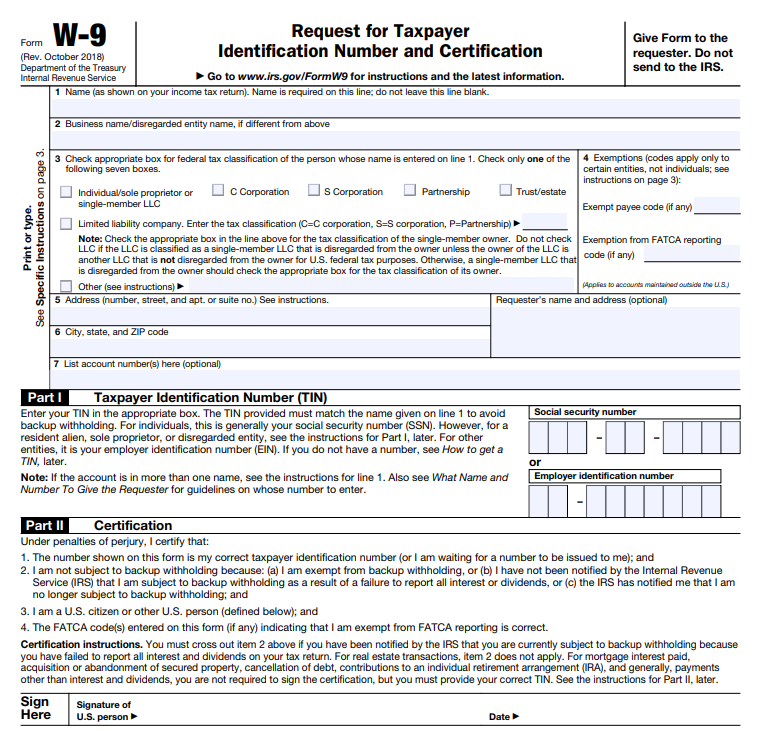

Filling out IRS form W-9 is a required part of most affiliate program sign up processes and is required by most businesses before they’ll hire you for freelancing or independent contractor work. In this article, I’ll explain what form W-9 is, how to fill it out, and what to do with it afterwards.

What is form W-9?

If you start a new job as an employee, your employer will ask you to complete a form W-4. At the end of the year, you’ll receive a form W-2.

If you start a new role as an independent contractor for a business, the business will ask you to complete a form W-9. At the end of the year, you’ll receive a form 1099.

The purpose of a form W-9 is for a business to collect basic info (e.g. name and tax number) about an independent contractor before they hire them. The business needs this information to be able to give you (and the IRS) a form 1099 for your work at the end of the year. Additionally, form W-9 requires the independent contractor to state (under penalty of perjury) that they are a U.S. person (either a U.S. corporation or a U.S. citizen or legal resident alien). If an independent contractor is NOT a U.S. person, they have to use form W-8 instead of form W-9.

NOTE: Some affiliate programs and other companies hiring you as an independent contractor might not actually use form W-9 but might instead ask for the same information through a form on their website. You’ll enter the information in exactly the same way though.

How do you fill out form W-9?

Whether you are an affiliate marketer, a freelancer, or any other type of independent contractor, the way to fill out form W-9 is the same.

Line 1

If you do your affiliate marketing or freelancing work without a business entity or through a single member LLC owned by you, then enter your (human) name on line 1.

If instead you work through a partnership (including an LLC with at least two members), an S corporation, or a C corporation, then enter the legal business name on line 1. Do not put a DBA name here — only the official name of the company as is shown in the company’s formation documents should be entered.

If you work through a single member LLC wholly owned by a partnership, S corporation, or C corporation, enter the name of that partnership or corporation on line 1 (this is extremely rare for small businesses).

NOTE: Line 1 should NEVER contain the name of a disregarded entity.

Line 2

If you have a disregarded entity name or DBA name which is different from whatever name you entered on line 1, then enter it on line 2. For example, if Jill Brown does freelancing through a single member LLC that she owns named “Brown Contracting LLC”, then she would enter “Jill Brown” on line 1 and “Brown Contracting LLC” on line 2.

If you do not have a disregarded entity name or DBA name different from what you entered on line 1, then just leave line 2 empty.

Line 3

Check exactly ONE box in section 3 (not two and not zero).

If the name you entered on line 1 is a corporation taxed as a C corporation, then check the box for C corporation.

If the name you entered on line 1 is an LLC taxed as a C corporation, then check the box for LLC and enter the letter “C” in the space next to it.

If the name you entered on line 1 is a corporation taxed as an S corporation, then check the box for S corporation.

If the name you entered on line 1 is an LLC taxed as an S corporation, then check the box for LLC and enter the letter “S” in the space next to it.

If the name you entered on line 1 is your own (human) name, then check the box labeled “individual/sole proprietor or single-member LLC”.

If the name you entered on line 1 is an LLC taxed as a partnership, then check the box for LLC and enter the letter “P” in the space next to it.

Line 4

Generally, you’ll leave this section blank. If your business is a C corporation, are doing freelance work that isn’t medical or health related, and only accept wire transfer, then you might be able to get an exemption. If your business is small and you want to minimize hassle though, I’d leave it blank.

Lines 5 & 6

Enter the mailing address you use for your business.

Part I

(I know — it’s not really part I since you already had “parts” before this).

If you entered the name of a human being on line 1, and if that human has a social security number, then enter the social security number where indicated and leave the EIN section blank.

If you entered the name of a human being on line 1 and that human does NOT have a social security number (e.g. because that human is a resident alien), then enter that human’s ITIN in the social security number section.

If you entered the name of a business on line 1, then enter the EIN of that business entity in the EIN section and leave the social security number section blank.

Part II

Read the three statements. Cross out item 2 if it is not true. Then sign and date where indicated. NOTE: DO NOT SIGN or use form W-9 if you are not a U.S. person or business. If you are unsure whether you are a U.S. person or business, ask a tax professional.

What do you do with form W-9 after filling it out?

You do not have to submit form W-9 to the IRS. If a company asks you for a W-9 in order to do independent contractor work, then fill out the form and send it back to them. That’s it.

If you are a U.S. based content creator, freelancer, or contractor and want some help with taxes, book-keeping, or managing money for your business, send me an email through the form below. Unlike many forms on the internet, you’ll get a reply from a real human with deep financial expertise.