Controversial articles and videos get more comments, and more comments means more virality for your content. So if you are a marketer or content creator in a finance or business niche, then it helps to make at least 5-30% of your posts on controversial topics related to finance or business. Those pieces of content help you to get in front of fresh people who haven’t seen your stuff before. In this article, I cover 21 examples of highly controversial business and finance topics for you to take inspiration from when making your own content.

NOTE: Just because you are covering a controversial topic doesn’t mean you necessarily need to take a controversial viewpoint (although you can if you want). For example, when the Trump Organization was convicted of fraud in December 2022, I posted a TikTok describing the structure of the Trump Organization, and it went viral. Sometimes objective, fact-based content about a controversial topic (especially when that controversial topic is already in the news) performs better than over-the-top, emotionally-charged content.

But without further ado, here are the topics:

1. Unions

Should people be forced to pay union dues in order to work, even if those dues are used to donate to political candidates they don’t like?

Should “right-to-work” laws actually be called “right to free ride” laws?

Do unions help workers by ensuring they are paid more, or do they hurt workers by making jobs more scarce?

Are unions good or bad for the economy?

2. Billionaires Avoiding Taxes

The very first article I ever shared on Hackernews went super viral, bringing in 100,000 visitors to my 6-month old blog in just 3 days. The article was about how almost anyone could use opportunity zones to avoid capital gains tax. However, on Hackernews I titled the post “How to have a billion dollar exit with zero capital gains tax“.

Billionaires are controversial in general, but billionaires avoiding taxes and “not paying their fair share” are even more controversial. That’s part of why that article went so viral.

Other examples of content that have gone viral based on this theme include:

- Trump’s tax returns

- Biden’s proposal for a new “billionaire minimum tax”

- Senator Warren’s proposal for a wealth tax

3. Inheritance

Is inheritance fair? Are any billionaires truly self-made? Should inheritance be taxed at a higher rate?

4. Crypto

Are any cryptocurrencies actually valuable or they all scams and pyramid schemes? Is crypto going to replace most of the traditional financial system? Are DAOs going to replace corporations?

5. ESG

Should investment fund managers consider environmental sustainability and employee diversity when deciding which companies to invest tens of millions of Americans’ retirement money into, or should they always just pick the companies that are expected to generate the highest returns?

6. Stakeholder Capitalism

Is stakeholder capitalism a fundamental violation of fiduciary duty or is it a necessary change that capitalism needs in order for our society to continue working for everyone?

7. DE&I

Should companies consider the color of someone’s skin when deciding whether or not to hire them?

Should someone who is gay be hired when there is a straight person with more experience who could be hired instead?

Just typing those questions raises my heart rate slightly, and that’s exactly what you want when you create content.

Some controversial keywords related to DE&I are:

- Affirmative action

- Racial equity

- Inclusive hiring

- Racial quotas

- Boardroom diversity

8. Woke Brands

Is it fair for a company to sponsor a trans-woman (biologically male) athlete instead of a biological woman athlete, given that biological women only get 1% of all sports sponsorship money?

Is it inappropriate to allow trans-women (biological men) to use the the same bathroom that small girls use?

Should brands like Disney be boycotted for glamorizing transgenderism in kids films? Do boycotts even work?

9. Living Wages

Imagine coming across YouTube videos with any of the following titles:

- “How to Replace Your American Employees with Cheap Columbians”

- “All My Employees Are Overseas, And I Pay Them $1.50/Hr”

- “Why I’ll Never Hire an American Again”

- “How to Legally Pay Your Employees Less Than Minimum Wage”

- “Amazon Saved $3 billion in 2021 by Paying Less Than $15/Hr”

Did any of those stir your emotions a bit?

Minimum wages and “living wages” are hot topics.

10. Fair Trade, Free Trade, and Trade Wars

Does free trade exploit less developed countries or does it help them develop economically?

Is fair trade actually more fair than free trade? Who benefits from fair trade anyway? Is fair trade even effective at helping the people in less developed countries?

Is free trade possible between the U.S. and China when China insists on stealing American IP?

11. Immigration

Is overpopulation or population decline a bigger risk?

Do immigrants make it harder for Americans to get jobs or do they help the American economy by taking jobs we don’t want for wages so low that Americans won’t accept them?

Is it fair that taxpayer money is being spent on housing immigrants in hotels for months?

Would allowing more immigrants into the U.S. help bring down inflation?

Do immigrants strain America’s welfare system?

12. Climate Change

Should pension fund managers consider climate change risk when making investment decisions?

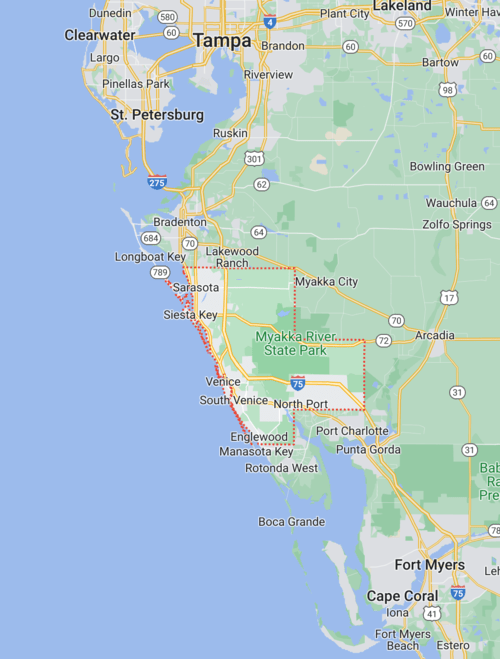

Is climate change an increasing risk to Florida real estate investors?

Is climate change at fault for increasing Florida insurance premiums?

Should insurance companies be allowed to raise prices faster in order to keep up with increasing climate risk?

Not everyone agrees that climate change is real, so any content you make which simply assumes it is real and discusses implications of it (e.g. “How Climate Change Is Causing an Insurance Crisis in Florida”) will naturally get some people commenting to tell you how wrong you are (yay engagement).

13. Nuclear Energy

Nuclear energy could replace fossil fuels, but is it safe? Physicists say yes, but the majority of the public doesn’t think so. Where would all that nuclear waste go? How dangerous is it to live next to a nuclear plant?

I made a basic listicle-style TikTok about nuclear power plants, and it got over 13,000 likes and hundreds of thousands of views.

14. Trump’s Business Activities

Is Donald Trump an amazing business man or a subpar business man who only generated subpar returns on the wealth he inherited?

Is he being unjustly attacked for political reasons or were his business dealings criminal?

15. Elon Musk

Elon is a billionaire (controversial) who makes electric vehicles to prevent climate change (controversial) and talks about spending billions to go to Mars (controversial to the people who say “we have enough problems to solve here on Earth”).

He bought Twitter (controversial both politically and financially), talks about free speech (controversial), and engages in juvenile behavior online (controversial).

16. Online Censorship

Are social media companies censoring Republicans? Are they doing enough to censor hate speech? Is it appropriate for kids to see transgender content online?

Should Section 230 be amended? Repealed entirely?

17. Student Loan Forgiveness

Should college be free? Should student loans be forgiven? Would that be fair to the majority of Americans who haven’t attended college but still pay taxes?

18. Retail Crime

Retail theft and organized retail crime have been on the rise for years. A California law restricting the ability to go after people stealing less than $1,000 of merchandise is controversial.

Are Democrats being too lenient on criminals?

Are immigrant “sanctuary cities” to blame?

Is inflation to blame? Inflation is certainly a consequence since retailers have to raise prices to cover the costs of more theft.

Do we need more police funding to solve this problem?

19. Big Oil

Are big oil companies ruining the planet, or are they essential to our civilization?

Does the U.S. government go to war over oil?

Should oil companies be taxed more?

20. AI Fear

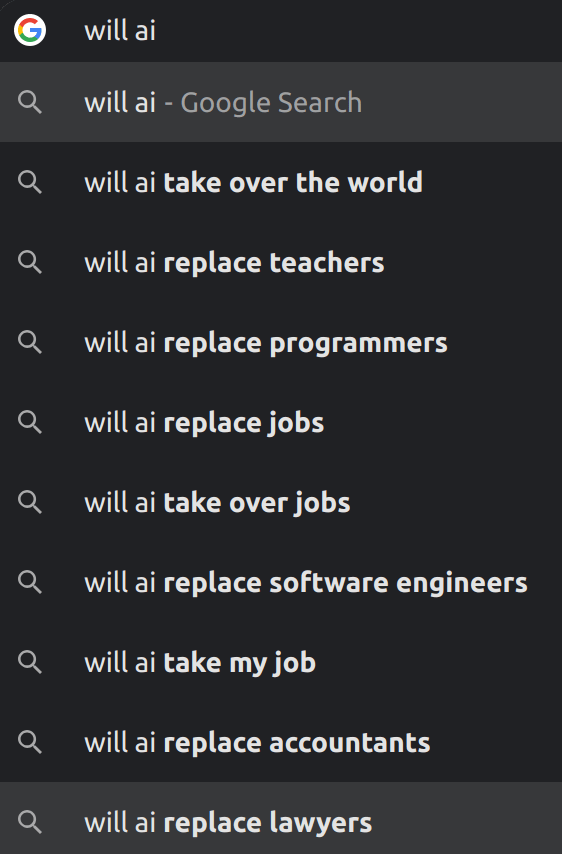

People are afraid that AI is either going to take over the world or replace their job.

21. U.S. Defense Industry

The U.S. Defense Industry (also known more ominously as the “military-industrial complex”) is controversial in several ways.

- Is it immoral to work at a company that makes missiles that sometimes kill innocent civilians but also help to keep America safe from terrorists?

- Does the U.S. spend too much money on defense when it should be putting some of that money towards universal healthcare or childcare?

- Is there collusion between certain members of the defense industry and certain politicians, at the expense of the taxpayer?

If you’re looking for even more specific inspiration, check out my list of 36 controversial money & business questions to ask on a podcast.