These are the six largest companies headquartered in Rhode Island, as ranked by 2021 annual revenue.

#1 CVS Health ($292 Billion)

CVS Health (NYSE: CVS) is a Woonsocket-based health conglomerate that sells medical insurance, provides behind-the-counter services to pharmacies, and operates almost 10,000 retail stores. Total revenue was $292 billion.

| Official Company Name | CVS HEALTH CORPORATION |

| State of Incorporation | Delaware |

| Address of Principal Executive Offices | 1 CVS Drive Woonsocket, RI 02895 |

| 2021 Annual Report | 10-K |

| Investor Relations Website | Investor Relations |

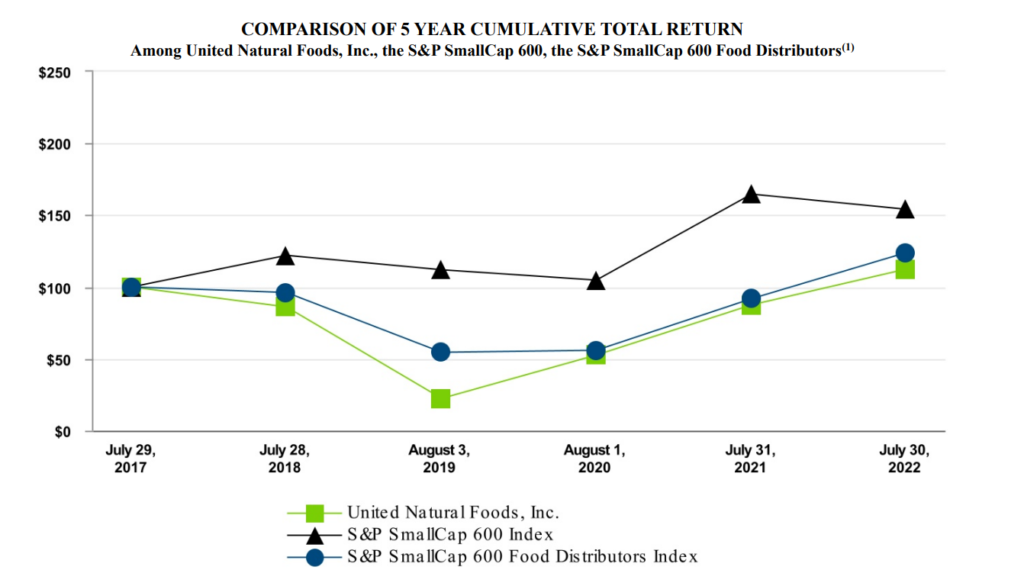

#2 United Natural Foods ($29 Billion)

United Natural Foods (NYSE: UNFI) is a wholesale food distributor. That means they buy food from farmers and other suppliers, transport that food to warehouses, and then sell and transport the food to retail grocery stores like Whole Foods, Kroger, and Publix.

The company has a strong focus on organic food, but it also sells non-organic food and even some non-food products. In addition, the company operates a few retail stores, although retail revenue is significantly smaller than wholesale revenue for the company. Total 2021 revenue was $28.9 billion, but net income attributable to shareholders was only $248 million.

| Official Company Name | UNITED NATURAL FOODS, INC. |

| State of Incorporation | Delaware |

| Address of Principal Executive Offices | 313 Iron Horse Way Providence, RI 02908 |

| 2021 Annual Report | 10-K |

| Investor Relations Website | Investor Relations |

#3 Textron ($12 Billion)

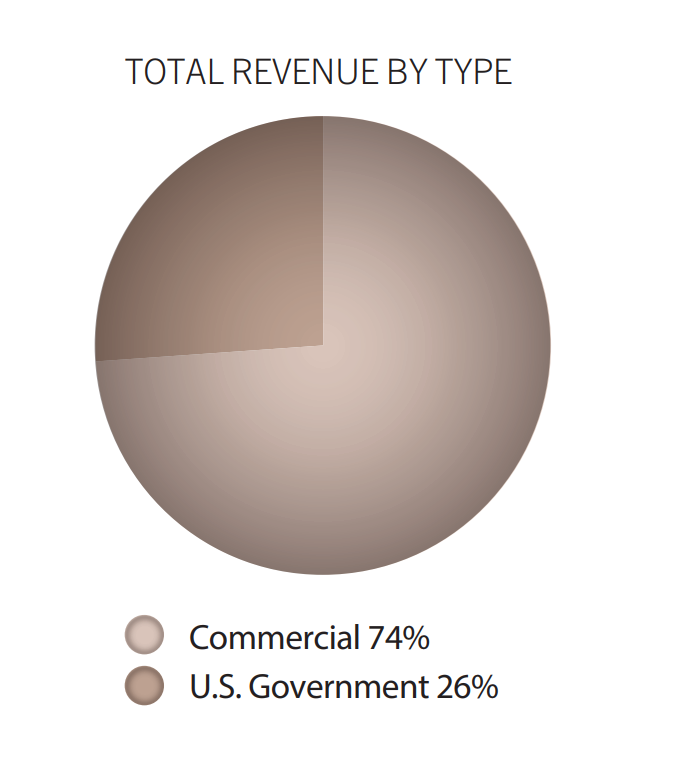

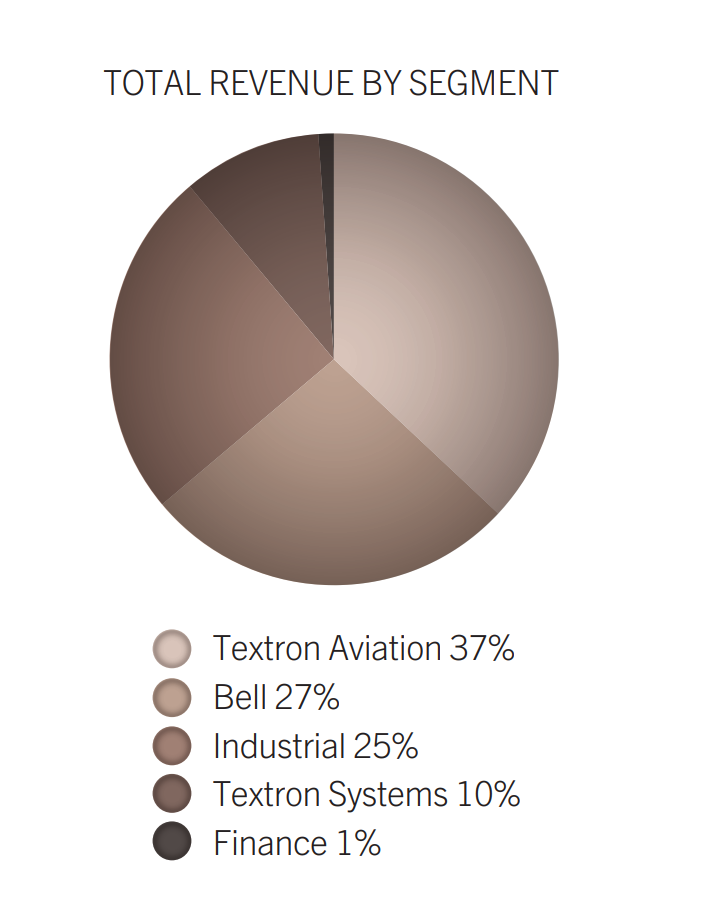

Textron (NYSE: TXT) is an defense contractor and aerospace company whose products include Cessna and Beechcraft airplanes, the V-22, and H-1 helicopters. Total revenue was $12.4 billion.

The company conducts business through five operating segments:

- Textron Aviation — Manufactures, sells, and services Beechcraft and Cessna aircraft. Services the Hawker brand of business jets. The two principal product lines are aircraft and aftermarket parts and services. Aircraft sales include business jets, turboprop aircraft, military trainer and defense aircraft, and piston engine aircraft. Aftermarket parts and services include commercial parts sales as well as maintenance, inspection, and repair services.

- Bell — Supplies military helicopters and provides support services to the U.S. government and other military customers outside the U.S. Bell’s primary lines of U.S. government business are the production and support of the V-22 tiltrotor aircraft and the H-1 helicopters.

- Textron Systems — Develops, produces, and sells aircraft, unmanned aircraft, aircraft piston engines, training systems, aircraft control computer systems, and miscellaneous other products and services related to aviation and defense.

- Industrial — Primarily consists of the Kautex subsidiary headquartered in Germany. Kautex designs and manufactures plastic fuel systems (fuel tanks, nozzles, resevoirs, battery housings, etc) for automobiles and light trucks.

- Finance — Concists of Textron Financial Corporation (TFC) and its consolidated subsidiaries. This segment provides financing to purchasers of new or used aircraft and helicopters produced by Textron.

| Official Company Name | Textron Inc. |

| State of Incorporation | Delaware |

| Address of Principal Executive Offices | 40 Westminster Street Providence, RI 02903 |

| 2021 Annual Report | 10-K |

| Investor Relations Website | Investor Relations |

#4 FM Global ($8.2 Billion)

FM Global is a mutual property insurance company for large corporations. The company is unusual in that it uses first-principles engineering analysis rather than backward-looking actuarial analysis to estimate risk. Total revenue including ceded premiums earned (i.e. premiums earned that were reinsured by a third party) was $8.2 billion in 2021.

| Address of Corporate Headquarters | 270 Central Ave Johnston, RI 02919 |

| 2021 Annual Report | Annual Report |

| Investor Relations Website | Investor Relations |

#5 Citizens Financial Group ($7.4 Billion)

Citizens Financial Group (NYSE: CFG) is Providence-based bank that generated $7.4 billion in total revenue and $2.2 billion in net income available to common shareholders.

| Official Company Name | Citizens Financial Group, Inc. |

| State of Incorporation | Delaware |

| Address of Principal Executive Offices | One Citizens Plaza Providence, RI 02903 |

| 2021 Annual Report | 10-K |

| Investor Relations Website | Investor Relations |

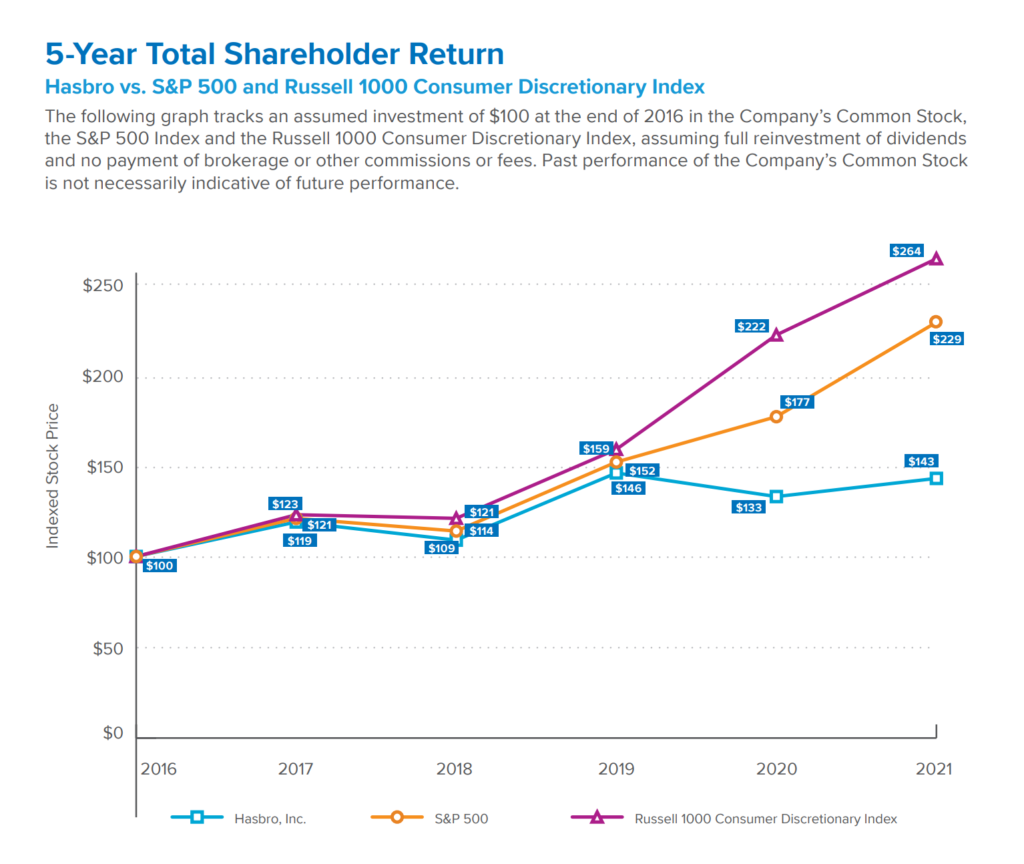

#6 Hasbro ($6.4 Billion)

Hasbro (NASDAQ: HAS) is a toy and game company that owns Monopoly, Play-Doh, Nerf, My Little Pony, Dungeons and Dragons, Power Rangers, and pretty much everything else you held dear as a child.

The company generated $6.4 billion in revenue and $429 million in net earnings attributable to Hasbro.

| Official Company Name | Hasbro, Inc. |

| State of Incorporation | Rhode Island |

| Address of Principal Executive Offices | 1027 Newport Ave Pawtucket, RI 02861 |

| 2021 Annual Report | 10-K |

| Investor Relations Website | Investor Relations |