These are the 5 largest companies headquartered in North Carolina by 2021 revenue.

#1 Lowe’s ($96 Billion)

Summary: Lowe’s is a Fortune 50 company and the world’s second largest home improvement retailer behind Home Depot.

Lowe’s (NYSE: LOW) operates 1971 home improvement and hardware stores spread across all 50 U.S. states (1737 stores) and Canada (234 stores). However it’s notable that while only 88% of Lowe’s stores are in the U.S., 94% of consolidated sales come from the U.S.

The company generated $96.25 billion of net sales and comprehensive income of $8.54 billion in 2021.

| Official Company Name | LOWE’S COMPANIES, INC. |

| State of Incorporation | North Carolina |

| Address of Principal Executive Offices | 1000 Lowes Blvd. Mooresville, NC 28117 |

| 2021 Annual Report | 10-K |

| Investor Relations Website | corporate.lowes.com/investors |

#2 Bank of America ($94 Billion)

Summary: This bank holding company owns subsidiaries that offer banking, asset management, and other financial & risk management services.

Bank of America (NYSE: BAC) operates through various bank and non-bank subsidiaries throughout the U.S. and abroad. The company organizes its business into four segments:

- Consumer Banking

- Global Wealth & Investment Management (GWIM)

- Global Banking

- Global Markets

The company competes with many types of businesses including banks, credit unions, investment banking firms, investment advisory firms, brokerage firms, investment companies, insurance companies, mortgage banking companies, credit card issuers, mutual fund companies, hedge funds, private equity firms, and e-commerce companies (e.g. Amazon’s merchant financing is competitive with certain BOA products).

The company generated $93.85 billion of revenue and $30.56 billion of net income attributable to common shareholders in 2021.

| Official Company Name | Bank of America Corporation |

| State of Incorporation | Delaware |

| Address of Principal Executive Offices | Bank of America Corporate Center 100 North Tryon Street Charlotte, NC 28255 |

| 2021 Annual Report | 10-K |

| Investor Relations Website | investor.bankofamerica.com |

#3 Nucor ($36 Billion)

Summary: This company manufactures steel and steel products.

Nucor (NYSE: NUE) is a steel manufacturing & metal industry business that self-organizes into three business segments:

- Steel Mills — Producing sheet steel, plate steel, structural steel (I-beams, etc), and bar steel. This is Nucor’s largest segment and generated 66% of the company’s sales (excluding intra-organization sales). Customers include steel service centers, fabricators, and manufacturers throughout the U.S., Canada, and Mexico. The steel mill segment sold 20.3 million tons of steel to outside customers in 2021.

- Steel Products — Producing various types of steel tubing, steel racking, steel joists, steel deck, concrete reinforcing steel, cold finished steel, steel fasteners, metal building systems, insulated metal panels, steel grating, and steel wire and wire mesh. This segment also includes a piling distributor division.

- Raw Materials — Producing direct reduced iron (DRI) for use in steel mills, brokering metals, selling alloys, and processing scrap metal. The raw materials segment also includes natural gas drilling operations.

Nucor generated $36.48 billion in net revenue and $6.83 billion of net earnings attributable to stockholders in 2021.

| Official Company Name | NUCOR CORPORATION |

| State of Incorporation | Delaware |

| Address of Principal Executive Offices | 1915 Rexford Road Charlotte, NC 28211 |

| 2021 Annual Report | 10-K |

| Investor Relations Website | Investor Relations |

#4 Honeywell ($34 Billion)

Summary: Honeywell is an aerospace, materials, and building technology company headquartered in Charlotte, North Carolina.

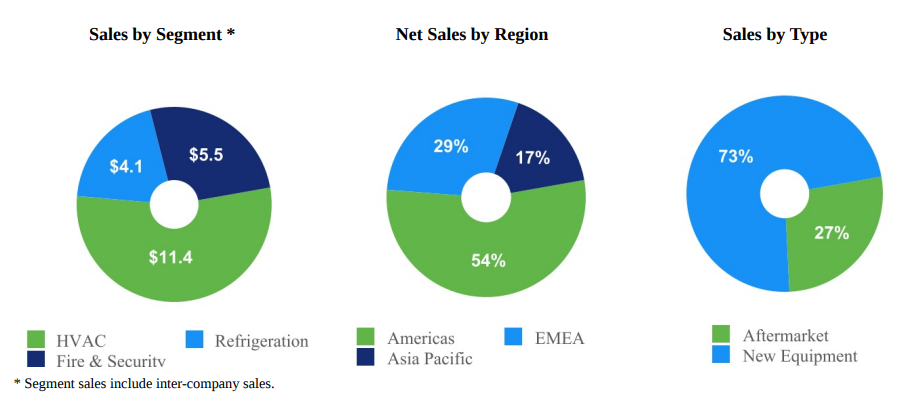

Honeywell (NASDAQ: HON) organizes its business into four segments:

- Aerospace — Selling software and services to aircraft OEMs (original equipment manufacturers) and other customers

- Honeywell Building Technologies — Selling building control & optimization software, sensors, switches, surveillance cameras, control systems, fire products, and installation and maintenance services

- Performance Materials and Technologies — Developing & manufacturing high-performance chemicals and materials (for applications such as armor and drug packaging), providing instruments and software for various materials industries (e.g. oil and gas, refining, pulp and paper, industrial power generation, chemicals, biofuels, life sciences, mining, etc), and providing chemical process aids (e.g. catalysts, adsorbents, and equipment) to to different chemical and material industry customers.

- Safety and Productivity Solutions — Providing PPE (personal protective equipment), workplace safety equipment, gas detection technology, emergency messaging services, supply chain and warehouse automation equipment and software, custom sensors and switches, and similar products and services.

Operations that don’t fall into any of those four segments are classified as “Corporate and All Other”, but that category is not reported as a business segment in Honeywell’s SEC filings.

The company generated $34.39 billion in revenue ($25.64B from product sales and $8.75B from service sales) and $5.54 billion in net income attributable to stockholders in 2021.

| Official Company Name | Honeywell International Inc. |

| State of Incorporation | Delaware |

| Address of Principal Executive Offices | 855 South Mint Street Charlotte, NC 28202 |

| 2021 Annual Report | 10-K |

| Investor Relations Website | honeywell.gcs-web.com |

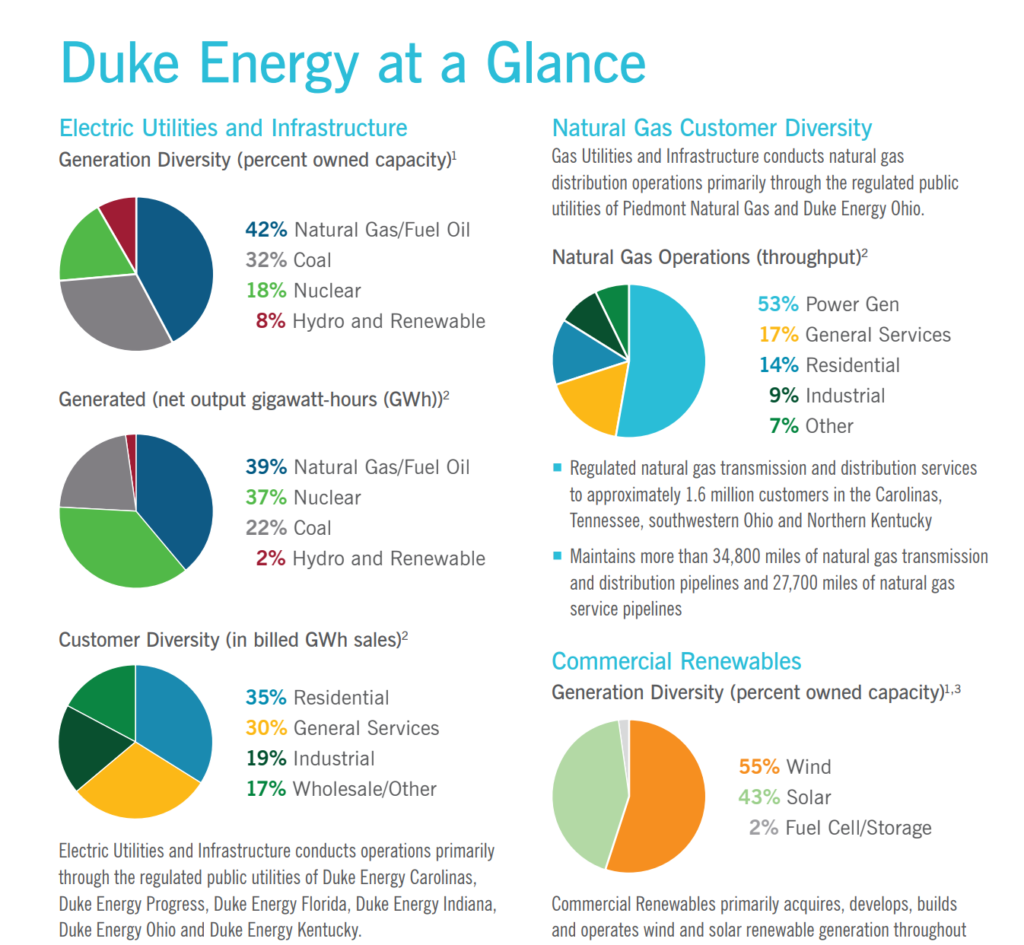

#5 Duke Energy ($25 Billion)

Summary: Duke Energy is an energy utility company that operates through various subsidiaries along the east coast and in the midwest.

Duke Energy (NYSE: DUK) is an FERC-regulated energy company operating in the U.S. primarily through its tree of subsidiaries which include Duke Energy Carolinas, Progress Energy, Duke Energy Progress, Duke Energy Florida, Duke Energy Ohio, Duke Energy Indiana, and Piedmont Natural Gas Company.

The company generated $25.1 billion in operating revenue ($22.3 billion of that from regulated electric utility operations) and $3.7 billion in comprehensive income available to common stockholders in 2021.

| Official Company Name | DUKE ENERGY CORPORATION |

| State of Incorporation | Delaware |

| Address of Principal Executive Offices | 526 South Church Street Charlotte, NC 28202 |

| 2021 Annual Report | 10-K |

| Investor Relations Website | investors.duke-energy.com |