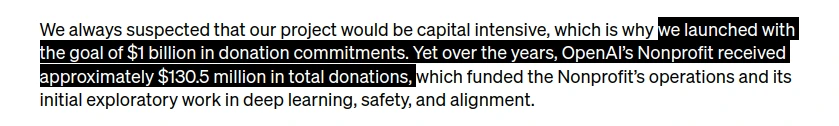

We all know that feeling of disappointment when you fail to hit your $1 billion nonprofit fundraising goal and only raise $130 million instead, but it’s how you deal with that disappointment that defines you as an entrepreneur.

Many people would take the easy route of just embezzling what they already had or asking their billionaire friends for more donations, but the team at OpenAI, well, they’re just built different. At a time when the hottest for-profit companies were losing money faster than nonprofits, the nonprofit OpenAI decided to become for-profit, and within a few months they were able to raise the $1 billion they needed.

And in fairness, they DID need it. Even back in 2017, long before anyone had heard of ChatGPT, the amount of computing power used by AI models was doubling every 3.4 months, so computing power was quickly using up all OpenAI’s donations.

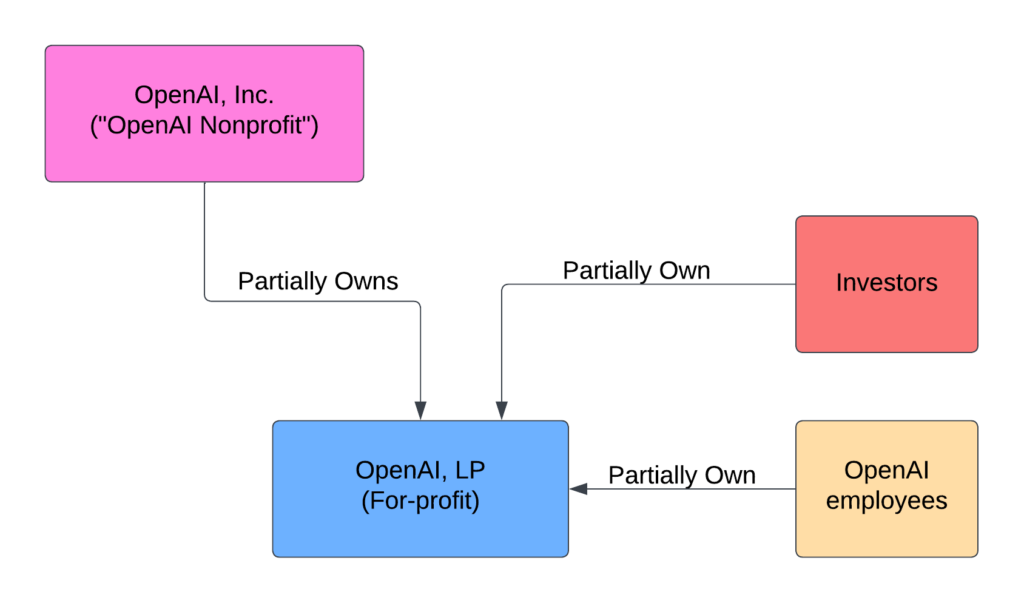

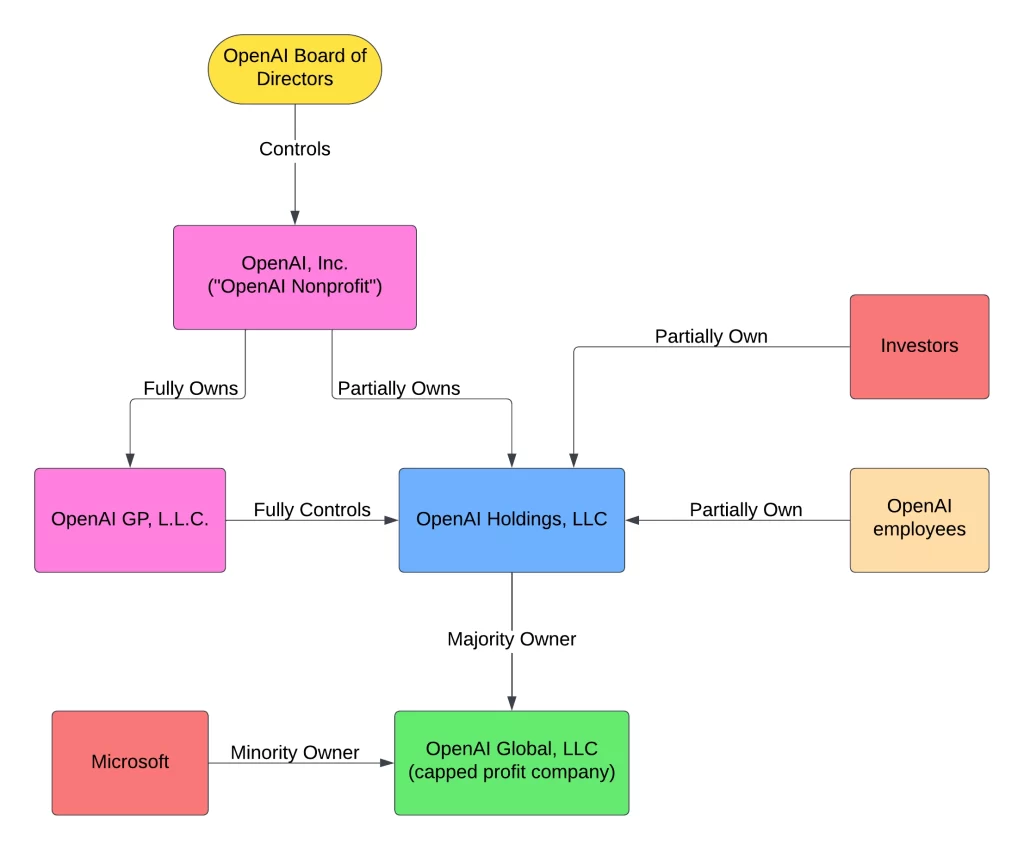

Of course, the IRS doesn’t actually allow nonprofits to simply convert themselves into for-profit companies since that would allow fraudsters to trick people into donating money to a good cause, only to declare the next day that the money would actually be used to build a new casino. OpenAI got around this by keeping the nonprofit company, called OpenAI, Inc., in place, and creating a new for-profit company, called OpenAI, LP, as a subsidiary.

OpenAI, Inc. still owns the OpenAI trademark and has complete control over OpenAI, LP, but OpenAI, LP does all the work, generates revenue, and provides equity compensation to OpenAI employees and investors. The structure was actually a little bit more complicated, and between 2019 and 2023, the structure was changed a couple times so that now it actually looks more like this:

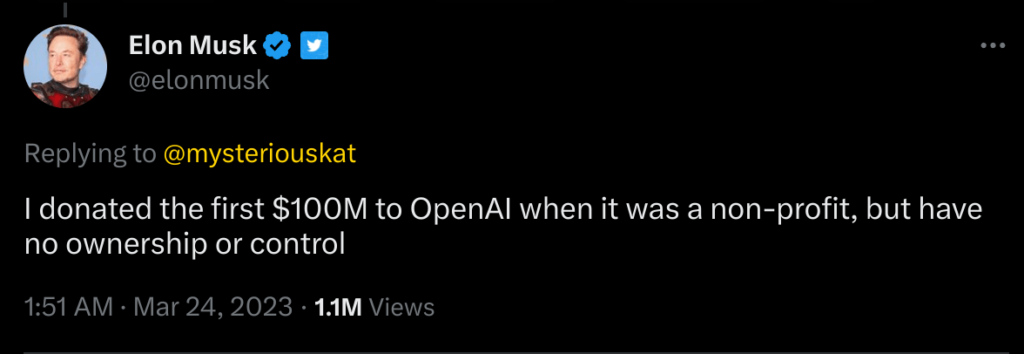

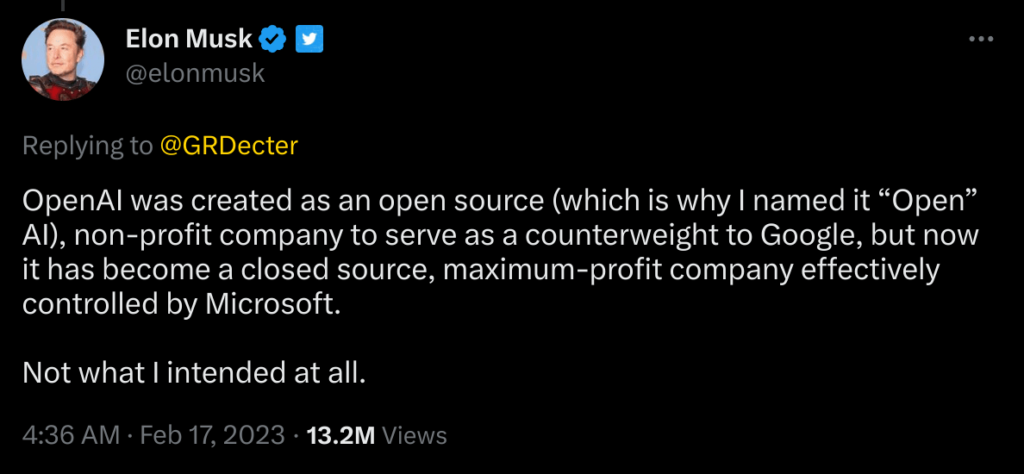

The restructuring process left OpenAI’s cofounder and largest donor, Elon Musk, to question the legitimacy of OpenAI’s actions.

So is what OpenAI did legal?

The simple answer is “probably”.

There are no laws that ban nonprofit companies from owning for-profit companies. In fact, it’s quite common for wealthy entrepreneurs to spend their careers building profitable companies and then donate their stock in those companies to one or more nonprofits.

For example, Henry Ford created the nonprofit Ford Foundation and donated over 90% of the non-voting shares of Ford to the Ford Foundation. Eli Lilly, the founder of the pharmaceutical company Eli Lilly & Co, created a nonprofit called Lilly Endowment Inc and donated almost $90 million (equivalent to over $1 billion in 2023 dollars) of Eli Lilly & Co stock to the nonprofit. And Howard Hughes donated the entire Hughes Aircraft Company to the nonprofit Howard Hughes Medical Institute, effectively turning a large defense contractor into a untaxed charity.

However, while there are no laws that outright ban nonprofit companies from owning for-profit companies, there are three major legal restrictions.

Firstly, the for-profit subsidiary can create what the IRS calls “Unrelated Business Income” or UBI. UBI is income that a nonprofit generates from something unrelated to its core mission, and it’s taxed at the corporate tax rate even if the nonprofit is tax-exempt in general. For example, if a nonprofit hospital opened a car dealership to help fund itself, then any income the car dealership generated would be considered unrelated business income since car dealerships are unrelated to hospitals. That means all income from the car dealership would be taxed as if the nonprofit was a normal for-profit company.

In the case of OpenAI, however, UBI is probably not an issue since both the nonprofit and its for-profit subsidiary are working exclusively on artificial intelligence.

The second legal issue that a nonprofit can run into when it owns a for-profit subsidiary is a violation of fiscal responsibility. State law dictates that nonprofits have a legal duty to manage the money they are endowed with in a financially responsible manner. Forty-nine states (Pennsylvania is the hold-out) and D.C. have adopted versions of the Uniform Prudent Management of Institutional Funds Act (UPMIFA). UPMIFA typically requires that nonprofits diversify their investments in order to reduce risk, and owning the majority of a large for-profit subsidiary can often violate that requirement.

However, UPMIFA only applies to nonprofit investments that are made primarily for financial return. If a nonprofit wants to make an investment primarily in an effort to further its mission rather than for financial return, then UPMIFA does not apply. That means when the nonprofit OpenAI, Inc created the for-profit OpenAI, LP, it likely could have invested the vast majority of its money into the for-profit company without triggering UPMIFA since the for-profit company investment is directly related to the nonprofit’s mission of creating safe AGI.

Finally, the last big issue that a nonprofit can run into when it owns a for-profit company is called provide private inurement. Private inurement is legal term for a concept that everyone understands intuitively, and it’s what makes most people feel like it’s unethical for a nonprofit to become a for-profit.

Essentially, private inurement is when a nonprofit board member or employee is able to gain unearned benefits from a nonprofit by abusing their position of power, at the expense of the nonprofit’s mission. For example, if a board member of a nonprofit youth athletics club owned the facility used by the club and rented the facility to the club at far above market rate, that would be private inurement. If a nonprofit art gallery allowed board members to exhibit their art for free but charged other artists a fee, that would be private inurement too.

In OpenAI’s situation, there are all sorts of things that might be private inurement. At a basic level, using non-public research, funded by a nonprofit, to then create a for-profit company which is majority owned by the nonprofit, but also partly owned by employees of the non-profit, is arguably an unfair benefit to those employees. It’s a somewhat gray area of law though because while many nonprofits have been gifted majority shares of large companies, relatively few nonprofits have used their own money to fund new subsidiary startups which employ some of the nonprofit’s own employees.

OpenAI’s lawyers did their research though because they have basically gone as close as they can to the legal line without overtly crossing it. For instance, there was a legal case in 1980 where the IRS challenged a nonprofit church which compensated its minister through a revenue-sharing agreement. Ultimately, the IRS ruled that since the arrangement provided potentially uncapped compensation, it was unreasonable and therefore constituted private inurement. OpenAI apparently took note of that case because when it created its for-profit subsidiary, it capped the potential return to 100-times the initial investment amount. In an OpenAI blog article at the time, they wrote:

“We want to increase our ability to raise capital… while still serving our mission [to ensure that artificial general intelligence (AGI) benefits all of humanity, primarily by attempting to build safe AGI and sharing the benefits with the world]… No pre-existing legal structure we know of strikes the right balance. Our solution is to create OpenAI LP as a hybrid of a for-profit and nonprofit–which we are calling a ‘capped-profit’ company.”

OpenAI blog article from 2019

OpenAI’s employees did such a fantastic job with PR that it would almost make you think the capped profit structure was motivated by an innovative mixture of altruism and practicality rather than the legal boundary of a 1980 tax court case.

But is a 100-x return on your money really that different from an unlimited revenue share, anyway?

Only the tax court can say for sure. If OpenAI is ever taken to court by the IRS though, one thing that will actually help their case is the fact that Sam Altman was fired. That’s because Sam Altman getting fired proves that no single employee had THAT much control over OpenAI. Before the nonprofit OpenAI created for-profit OpenAI, it set in place certain checks and balances. Only a minority of board members (of OpenAI Nonprofit) are allowed to own equity in the for-profit OpenAI company at the same time. Furthermore, only board members who don’t own equity can vote on decisions where the interests of shareholders might conflict with OpenAI Nonprofit’s mission. That’s exactly what happened when Sam got ousted last week: A majority of non-equity owning board members were concerned that Sam was shipping ChatGPT upgrades faster than was safe, so they voted him out.

Why did OpenAI need to become for-profit?

By March of 2017 (just 15 months after incorporation), OpenAI’s leadership realized that staying a purely nonprofit company would be financially untenable. The amount of compuational resources that other AI companies were using to achieve breakthrough results were doubling every 3.4 months, and OpenAI wasn’t able to attract as many donations as they had originally anticipated. Raising money from investors seemed like the best option.

Who invested in OpenAI when it was created?

Originally, OpenAI was created as a nonprofit which means it didn’t have investors. However, several wealthy people and companies collectively donated about $130.5 million to the company. Those initial donors included:

- Elon Musk

- Peter Thiel

- Greg Brockman

- Sam Altman

- Reid Hoffman

- Jessica Livingston

- Amazon Web Services (AWS)

- YC Research

- Infosys

Importantly, none of these donors gained any ownership in OpenAI through their donations since the company was a pure nonprofit at the time.

Who owns OpenAI now?

Once the for-profit OpenAI LP company was created, several people and companies invested.

OpenAI LP is owned by OpenAI, Inc (the original nonprofit OpenAI), Microsoft, Khosla Ventures, Tiger Global Management, Andreessen Horowitz, Bedrock, Reid Hoffman’s charitable foundation, and a holding company jointly owned by certain OpenAI employees.

OpenAI LP has since been restructured into OpenAI Holdings LLC, but the owners remain the same.

Meanwhile, OpenAI, Inc continues to be a nonprofit which means it is owned by nobody.

Is OpenAI a publicly traded company?

Neither OpenAI Inc nor OpenAI LP is a publicly traded company. OpenAI Inc is a non-profit which means it does not have stockholders, and OpenAI LP is a privately owned for-profit company owned by OpenAI Inc, the employees of OpenAI LP, and a few key strategic investors including Microsoft. However, since Microsoft is a publicly traded company, that that means you could indirectly invest in OpenAI by buying shares in Microsoft (NASDAQ: MSFT).

Does Microsoft own OpenAI?

Microsoft owns a significant equity stake in OpenAI Global, LLC. Between Microsoft’s 2019 investment of $1 billion into OpenAI and their secretive 2023 investment of up to $10 billion, Microsoft now reportedly owns 49% of OpenAI LP.

If Microsoft has invested $10 billion into OpenAI Global, LLC, then OpenAI’s “100x-capped-profit” structure means that Microsoft can profit by up to $1 trillion from its OpenAI investment.

Does Elon Musk own OpenAI?

No, Elon Musk does not own OpenAI. Elon Musk cofounded OpenAI Inc in 2015 with several other people. OpenAI Inc is a non-profit, and as part of his founding contribution, Musk donated $100 million to the company. Later, in 2019, OpenAI Inc formed a partially-owned subsidiary OpenAI LP (a for-profit company). However, Elon Musk did not receive any ownership stake in OpenAI LP.

What companies has OpenAI invested in?

OpenAI has invested in several startups including Descript (AI video editing software), Harvey (legal workflow software built on generative language models), Mem (an AI self-organizing workspace, starting with personal notes), and Speak (an AI language tutor).

Can nonprofits invest in for-profits?

Generally, nonprofits can own for-profit companies (e.g. as the result of a gift of stock) without restriction. However, nonprofits can only invest in for-profit companies under certain conditions.

Firstly, state laws apply. Forty-nine states (Pennsylvania is the hold-out) and D.C. have adopted versions of the Uniform Prudent Management of Institutional Funds Act (UPMIFA). However, UPMIFA only applies to nonprofit investments that are made primarily for financial return. If a nonprofit wants to make an investment primarily in an effort to further its mission rather than for financial return, then UPMIFA does not apply. For example, when the nonprofit OpenAI, Inc created the for-profit OpenAI, LP, it likely could have invested the vast majority of its money into the for-profit company without triggering UPMIFA since the for-profit company investment is arguably primarily for the furtherance of the nonprofit’s mission of creating safe AGI.

However, even if a contemplated investment is primarily motivated by a nonprofit’s mission rather than financial return so that UPMIFA does not apply, certain other laws still apply. Among these laws are:

- California Nonprofit Public Benefit Corporation Law, Section 5233: No Self-Dealing

- Federal Tax Law: No transaction to acquire a for-profit business may be performed if such transaction would constitute a “private benefit transaction”, “private inurement”, or “excess benefit transaction”.

- Treasury Regulations 1.501(c)(3)-1

- State laws that prohibit the diversion of charitable assets away from the purposes for which they were received or earned

References

[1] OpenAI creation & purpose announcement. December 11, 2015.

[2] OpenAI Blog: We’ve created OpenAI LP, a new capped-profit company. March 11, 2019.

[3] Tech Crunch: OpenAI shifts from nonprofit to ‘capped-profit’ to attract capital. March 11, 2019.

[4] MIT Technology Review: The messy, secretive reality behind OpenAI’s bid to save the world. February 17, 2020.

[5] OpenAI Startup Fund I, L.P. – SEC form D filing. October 28, 2021.

[6] CNBC: Microsoft announces new multibilion-dollar investment in ChatGPT-maker OpenAI. January 23, 2023.

[7] Microsoft Blog: Microsoft and OpenAI extend partnership. January 23, 2023.

[8] OpenAI VC Fund

[9] Nonprofit Law Prof Blog: Should OpenAI be tax exempt?

[10] Nonprofit Law Blog: Can a nonprofit own a for-profit? Can a for-profit own a nonprofit?

[11] Private benefit under IRC 501(c)(3)

[12] IRS Overview of Inurement/Private Benefit Issues in IRC 501(c)(3)

[13] IRS: How to lose your 501(c)(3) tax-exempt status (without really trying)

[14] OpenAI: Our Structure. June 28, 2023.

Appendix A: OpenAI Facts & History

OpenAI was founded in December of 2015 by a group of Silicon Valley legends including:

- Elon Musk (cofounder of PayPal, SpaceX, Tesla, Neuralink, and The Boring Company)

- Peter Thiel (cofounder of PayPal, seed investor in Facebook)

- Reid Hoffman (cofounder of LinkedIn)

- Jessica Livingston (founding partner of Y Combinator)

- Sam Altman (a then-mostly-unknown wunderkid)

and others, with additional institutional funding from:

- Amazon Web Services

- YC Research

- Infosys (an Indian multinational IT and consulting services company that publicly trades on the NYSE)

In 2018, Elon Musk resigned from his OpenAI board seat, citing a potential future conflict of interest with Tesla’s self-driving AI program.

In 2019, the nonprofit OpenAI company (OpenAI, Inc.) created a for-profit subsidiary (OpenAI, LP). The stated reason for doing this was to attract investors since the nonprofit OpenAI was finding it difficult to raise as much money as they needed (of the original $1 billion fundraising goal, OpenAI was only able to raise about $130 million).

Appendix B: Business Entity Records

As far as I can tell, all OpenAI business entities (both nonprofit and for-profit) are incorporated in Delaware and registered to do business in California. However, the exact structure seems to have changed more than once. Various for-profit subsidiaries seem to have been formed and then later restructured. The table below summarizes key publicly available business entity records for OpenAI.

| Business Entity | Record Location (State) | Record Date | Record Summary |

| OpenAI SPV I, LLC | Delaware | 11/15/2023 | Incorporation / Formation |

| OpenAI OpCo, LLC | California | 05/08/2023 | Registered to do business in CA |

| OpenAI Holdings, LLC | California | 05/01/2023 | Registered to do business in CA |

| OpenAI Global, LLC | California | 05/01/2023 | Registered to do business in CA |

| OpenAI Holdings, LLC | Delaware | 03/17/2023 | Incorporation / Formation |

| OpenAI Investment LLC | Delaware | 02/06/2023 | Incorporation / Formation |

| OpenAI Global, LLC | Delaware | 12/28/2022 | Incorporation / Formation |

| OpenAI Holdco, LLC | Delaware | 12/28/2022 | Incorporation / Formation |

| OpenAI Startup Fund I, L.P. | California | 01/27/2022 | Registered to do business in CA |

| OpenAI Startup Fund GP I, L.L.C. | California | 08/07/2021 | Registered to do business in CA |

| OpenAI Startup Fund GP I, L.L.C. | Delaware | 07/28/2021 | Incorporation / Formation |

| OpenAI Startup Fund I, L.P. | Delaware | 07/28/2021 | Incorporation / Formation |

| OpenAI Startup Fund Management, LLC | California | 07/22/2021 | Registered to do business in CA |

| OpenAI Startup Fund Management, LLC | Delaware | 07/16/2021 | Incorporation / Formation |

| OpenAI, L.L.C. | Delaware | 09/17/2020 | Incorporation / Formation |

| OpenAI GP, L.L.C. | California | 10/10/2018 | Registered to do business in CA |

| OpenAI, L.P. | California | 10/10/2018 | Registered to do business in CA |

| OpenAI OpCo, LLC | Delaware | 09/19/2018 | Incorporation / Formation |

| OpenAI GP, L.L.C. | Delaware | 09/19/2018 | Incorporation / Formation |

| OpenAI, Inc. (Nonprofit) | California | 01/07/2016 | Registered to do business in CA |

| OpenAI, Inc. | Delaware | 12/08/2015 | Incorporation / Formation |

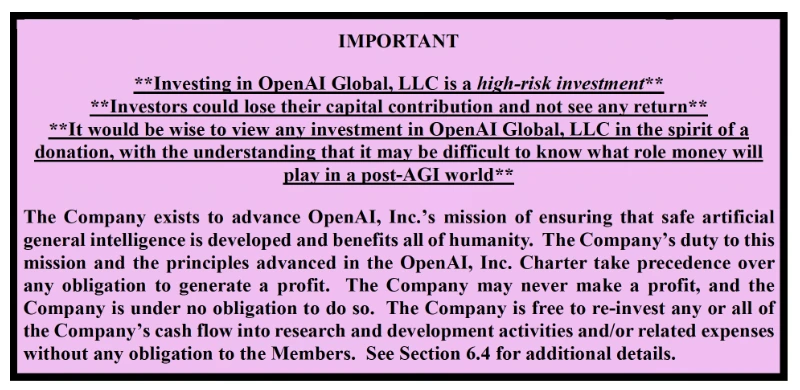

Additionally, OpenAI has published limited additional information on their blog. For example, in an article from June 28, 2023, the OpenAI team published the following snippet from the operating agreement of one of their for-profit companies, OpenAI Global, LLC:

The same article goes on to say that “the for-profit [OpenAI Global, LLC] is fully controlled by the OpenAI Nonprofit.” That control is implemented through OpenAI GP LLC, which is wholly owned by the nonprofit.