Primary Business:

- Advertising / lead gen for real estate buyers’ agents

Secondary Businesses:

- Rental unit advertising

- Property management software

- Mortgage origination

- Escrow & title closing services

Annual Financial Stats (2022):

- Revenue: $1.958 billion (66% from buyer agent advertising)

- Gross Profit: $1.591 billion

- Operating Expenses: $1.684 billion

- Net Loss: $101 million

Primary Moats:

- Network Effect

- Brand

Primary Weaknesses

- Stale data

- Low quality leads

Summary

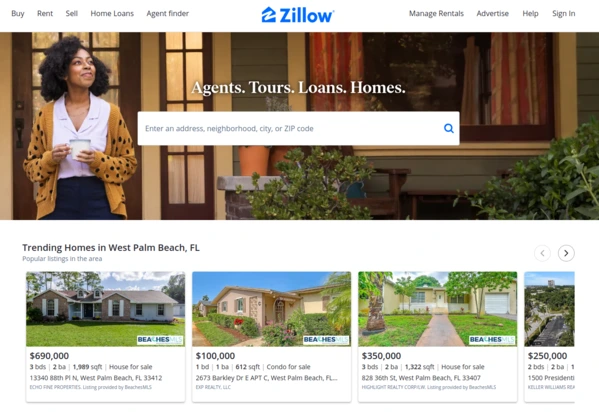

Zillow is an advertising company that makes the majority of its money from real estate buyers’ agents who pay for leads.

Zillow pulls listings from the MLS, publishes them on Zillow’s consumer-facing website, and then charges real estate agents for incoming phone calls from Zillow users who are interested in a particular listing.

Zillow refers to the agents who pay for leads as “Zillow Premier Agents”. In 2022, the company generated $2.0 billion in total revenue, and $1.3 billion of that was from Premier Agents.

How Zillow Leads work

Zillow Premier Agents bid on one or more zip codes where they would like to receive leads. Typically, these agents will spend at least $500 per month. In exchange, they will receive two types of leads:

- Connections. Bob is browsing a listing on Zillow and wants to request more information about a property or a property showing. He can do so by entering his contact info into a Zillow form. A Zillow employee will then call Bob, and then he’ll be connected to a Premier Agent. Bob is a “connection” (the most valuable type of lead on Zillow). When an agent buys connections, they don’t actually buy a specific number of connections. Rather, they bid on “share of voice” which means they are paying to receive a certain percentage of Zillow connection calls for a specific zip code. However, in some markets, Zillow has also rolled out “Flex” — a pay-for-performance marketing program where agents only pay for connections when they lead to a transaction.

- Nurture Leads. These are people who are looking at a property but aren’t very serious and might just be looking for a rental. Nurture Leads are sent to Zillow Premier Agents by email, and the agents then can follow up and nurture these leads until they are ready to buy or rent.

In late 2022, Zillow began rolling out no-call tour scheduling in Atlanta. The experience is like making a restaurant reservation online, similar to Redfin. This feature (called ShowingTime+) connects prospective home buyers directly with the listing agent of a property, so it will be interesting to see whether this reduces the number of Zillow connections and leads to a drop in Premier Agent revenue.

Zillow Revenue Streams

Zillow’s primary business is selling home buyer leads to real estate agents, but it also makes money in other ways. It’s biggest revenue streams are:

- Premier Agent ad spend ($1.291 billion)

- Rentals advertising ($274 million)

- Real estate agent software & other media ($274 million)

- Mortgage originations ($119 million)

In total, Zillow generated $1.958 billion of revenue in 2022, and 66% of Zillow’s revenue came from Premier Agents.

Zillow is trying to expand into adjacent markets as well, although those endeavors are still early. Zillow Closing Services offers title and escrow services, and Zillow Home Loans is a licensed mortgage originator (i.e. they lend and then resell the mortgages to banks and other lenders).

“In 2022, we turned our efforts toward building the foundation for a substantial direct-to-consumer purchase mortgage-origination business. We are working to… increase awareness of Zillow Home Loans, bolster loan officers’ capabilities so they can effectively handle our volume, and build integrated processes with Zillow Home Loans for our customers and Premier Agent partner base.”

Zillow 2022 Annual Report (Published April 2023)

However, Zillow Home Loans is still a tiny business. They originated less than 0.05% of all U.S. mortgage originations (i.e. fewer than 2,500 originations) in 2022.

Zillow also owns a portfolio of subsidiary brands, including:

- Trulia

- StreetEasy

- HotPads

- Out East

Zillow Total Addressable Market (TAM)

Zillow used to calculate its TAM as the residential real estate-related advertising market (about $19 billion). Now, it calculates TAM much more broadly, including all residential brokerage fees.

| Submarket | Total U.S. Market Revenue (2022) |

| Residential real estate industry transaction fees | $96 Billion |

| U.S. mortgage origination revenue | $76 Billion |

| Title & escrow services transaction fees | $20 Billion |

| Rentals advertising spend | $11 Billion |

| Property management software revenue | $7 Billion |

| Total Addressable Market | $210 Billion |

Zillow has also expressed potential interest in expanding into additional markets:

| Market | Total U.S. Market Revenue (2022) |

| Home insurance | $121 Billion |

| Home renovation services | $657 Billion |

| Moving services | $19 Billion |

| Home appraisal services | $10 Billion |

Zillow has grand ambitions.

“Our vision of a ‘housing super app‘ is to help customers across all their real estate needs, serving as one ecosystem of connected solutions for all the tasks and services related to moving… We also believe that the path to improving our growth metrics and ‘housing super app’ vision involves product initiatives within five key growth pillars:

Zillow 2022 Annual Report (Published April 2023)

- Touring — Make it easier for high-intent customers to take in-person tours and connect with our partner agents

- Financing — Prepare customers to be transaction-ready with financing early in their home buying journey

- Expanding sellers services — Continue to innovate on novel solutions to help sellers and seller agents

- Enhancing our partner network — Work with the best agents in real estate

- Integrating our services — Bring our engagement, products and services together to drive more transactions and more revenue per customer transaction”

And Zillow is already getting into auxiliary listing services:

“In early 2023, through ShowingTime+, we launched a photography service and comprehensive media package called Listing Media Services that enables listing agents to seamlessly deliver beautiful, immersive media for the homes they are selling. This service is a critical precursor to our upcoming Listing Showcase product, which we plan to launch in summer 2023.”

Zillow 2022 Annual Report (Published April 2023)

iBuying

Zillow had a disastrous time with their iBuying (instant buying) program. They operated the program from 2018 to 2022 and lost over $1 billion in the process. The program is now officially gone and wrapped up, but Zillow still offers sellers an instant cash offer via a partnership with iBuying company Opendoor.

“Customers who start their selling journey with Zillow can now simultaneously request a cash offer from our partner, Opendoor, and receive an estimate of their open-market home sale price with a local Premier Agent partner.”

Zillow 2022 Annual Report (Published April 2023)

Moats

- Network Effects

- Every additional prospective home buyer that uses Zillow makes the platform more valuable to real estate agents, and Zillow currently has about a 65% market share, as measured by the number of mobile real estate marketplace users.

- Every home seller who goes on Zillow to look at the Zestimate for their home is likely to also be a home buyer who will use Zillow to find a new home.

- Brand

- In 2022, more people searched Google for “Zillow” than for “real estate”.

- Ecosystem-Based Switching Costs

- Zillow offers software tools to real estate agent, such as IDX websites and a CRM. Those tools make Zillow sticky for real estate agents. However, this stickiness does not carry over to the consumers using Zillow. That means, for example, that this moat protects Zillow from other advertising portals such as Homes.com and Realtor.com but not from brokers like Redfin.

- Proprietary Data

- Zestimate (Zillow claims the Zestimate had a median error rate of 2.7% for homes listed for sale and 7.6% for off-market homes).

Weaknesses

- Stale data. Zillow data has a reputation for frequently being out of date.

- Zillow leads are low quality. This frustrates many real estate agents. If technology and/or regulations increase the perceived difficulty of the industry, it’s possible that the high churn of the real estate industry may decline, and that may hurt Zillow by reducing the stream of new, naive real estate agents who are ready to take a chance on Zillow leads.

- Zillow realtors are often low quality. The majority of times I have reached out to a real estate agent through Zillow, that agent has been unprofessional, unresponsive, uneducated about market nuances, or even “slimy”. I can’t say for sure whether this is a Zillow problem or an industry problem, but I do know that I have had MUCH better experiences with agents recommended by BiggerPockets.

- Zillow doesn’t control commissions. Zillow (unlike Redfin) does not actually provide real estate brokerage services. Instead, Zillow derives the majority of its revenue from real estate brokers around the country who advertise on Zillow. That means Zillow is vulnerable to competitors who offer a comparable consumer-facing data product but also directly provide services while charging much less than the industry average (e.g. 1% commissions instead of 3% commissions). Zillow could start offering brokerage services directly, but to do so it would have to bite the hand that feeds it 66% of its revenue (third-party agents paying for Zillow ads). This is a classic example of the innovator’s dilemma, and the faster a competitor could scale, the more likely it would be to successfully take market share from Zillow before Zillow would be willing to directly offer lower-cost brokerage services itself.

- Limited functionality. Zillow doesn’t have crime data, local air/water pollution data, or cost of living data. It does have limited school information but doesn’t have a good way to search by school quality. It also doesn’t give investors options to search for properties in special tax zones or explanations of what different zoning codes mean.

Company Culture

Mission:

“Zillow’s mission is to give people the power to unlock life’s next chapter so we can help make home a reality for more and more people.”

Company Values:

- Customers are our North Star. We’re here to help our customers in their journey to discover what’s next, and we strive to deliver an integrated experience that creates trust, delight, and joy (yes, joy!)

- Turn on the lights. We believe that information is power, and we’ve made it our business to increase transparency in real estate and within our company. Our purpose is to unlock information and empower people, customers, and partners to make better decisions.

- Do the right thing. We believe trust is earned, and we work to gain it every day. We act with integrity at every turn, speak up even when it’s difficult, and do what’s right even when no one is watching.

- Own it. We say what we’ll do and do what we say. We hold ourselves and each other accountable, and we treat Zillow resources like our own.

- Better together. We know we’re stronger when we work together as a team. We value what each and every person at Zillow brings to the table, and we strive to consistently treat each other with respect, empathy and appreciation to serve our customers, community and partners.

- Include and empower. We foster an environment where everyone feels included and empowered. We welcome new ways of thinking and are always looking at how we can create equitable opportunities for our people, customers and partners.

- Thing big, move fast. We’re a company of bold thinkers with the courage to try things that have never been done before. We reward and recognize pioneering spirit, even if ideas and first attempts fail.

- Deliver quality on time, every time. We work to deliver a seamless, convenient and consistent customer experience, from the initial search process through to closing. We balance quality, effort and speed, while learning from past mistakes, executing with discipline and high quality.