Barney Frank is a retired Democratic congressman who co-authored the Dodd-Frank Act (the set of new banking regulations that came in the wake of the Financial Crisis) and sat on the board of Signature Bank before it was shut down on Sunday.

“I think that if we’d been allowed to open tomorrow, that we could’ve continued. We have a solid loan book. We’re the biggest lender in New York City under the low-income housing tax credit… I think the bank could’ve been a going concern…[The regulators] wanted to send a message to get people away from crypto… We were singled out to be the poster child for that message.”

Barney Frank (speaking hours after Signature Bank was shut down)

In more detail, here is Barney’s explanation of exactly what happened to Signature Bank between Friday, March 10th and Sunday, March 12th:

“On Friday afternoon, we got hit by billions and billions of dollars of withdrawals […out of] reaction to what happened to Silicon Valley Bank. If [the Fed and FDIC statement] had been announced on Friday [instead of Sunday] we would have had no problem at all… we cater mostly to commercial lenders. We’re a big [low-income] housing developer, which is one of the things I liked about our role. So we had a lot of large depositors who were uninsured, and they panicked knowing we were involved in crypto.

We explained to them that it was crypto in a very responsible way that didn’t expose us, but they didn’t want to hear it. They just wanted to move to JP Morgan or Bank of America just in case. The way crypto hurt us was [just that] we were involved in crypto, although as I said, in a way different than SVB, and had large uninsured depositors. They panicked and fled.

What the Fed did, what the FDIC said, that they’d back up uninsured depositors and make a liquidity facility open at the Fed — THAT would’ve kept us from having a problem….[but regardless] I believe by Sunday we had resolved [our liquidity problem], finding more capital, and the deposit outflows stopped. I believe that the regulators stepped in even after we had managed to stabilize that because of a determination to get people to step away from crypto, and we were the posterchild for that decision.”

Those are big allegations. Are they true? Did regulators really shut down a solvent bank without liquidity issues just because they didn’t like crypto?

Let’s take a look at the public data.

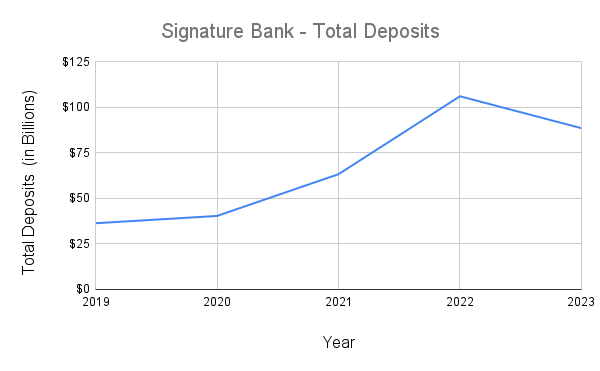

Both SVB and Signature Bank experienced a boom and bust of pandemic deposits

Government stimulus caused total bank deposits to grow 36.1% from the beginning of 2020 to the end of 2021. Over the same time period, SVB saw deposit growth of 206%. That massive surge in deposits put pressure on SVB’s management to invest in long-term, low-yielding, fixed-rate bonds and loans in an attempt to generate a return on all that deposit cash. Signature had similar pressure with deposit growth of 165% during that time period.

After the surge in deposit growth, both SVB and Signature Bank experienced more severe deposit shrinkage (as measured by percentage) than overall deposits in U.S. commercial banks. That put liquidity pressure on SVB which contributed to its collapse. By looking at the data below taken from Signature Bank’s annual reports, we can see that Signature also suffered a significant drop in liquidity from the end of 2021 to the end of 2022.

| 2021 | 2022 | YoY Change | |

| Cash | $29.55 Billion | $5.87 Billion | –80.1% |

| Securities (Investments) | $22.15 Billion | $26.37 Billion | +19.1% |

| Loans & leases, net | $64.39 Billion | $73.80 Billion | +14.6% |

| Total assets | $118.45 Billion | $110.36 Billion | –6.8% |

| Total deposits | $106.13 Billion | $88.59 Billion | –16.5% |

| Cash-to-Deposit Ratio | 27.84% | 6.63% |

Illiquid securities and loans were UP over 15%, total assets were DOWN almost 7%, and liquid cash and short term securities were DOWN over 80%! Signature’s overall liquidity at the end of 2022 was WAY DOWN from what it was at the end of 2021, and that’s despite the bank raising more than $730 million from selling stock in 2022.

Cash alone fell by almost $24 billion at the same time that illiquid loans increased over $10 billion. Cash was being both withdrawn and converted to illiquid assets in huge volumes at the same time.

Signature Bank was more illiquid than its balance sheet disclosed

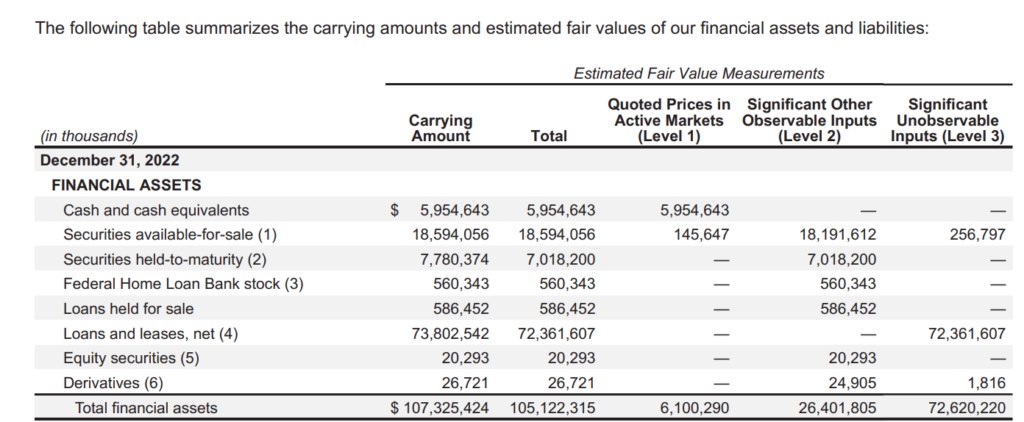

According to Signature’s latest 10-K, the bank had $110.36 billion of assets, $102.35 billion of liabilities, and $8.01 billion of shareholders’ equity. That’s $8 billion to cover any losses on $102 billion of leverage. Except buried deep in the pages of that same 10-K, you’ll find a disclosure that the assets on the balance sheet are overvalued by more than $2.2 billion:

Look at the bottom row of the table from the screenshot. “Carrying amount” is the value of financial assets on the balance sheet. “Total” is the value of those same assets when valued “fairly” rather than with the accounting tricks that banks use as standard procedure on their balance sheets. That missing $2.2 billion means the true shareholders’ equity is actually less than 73% of the reported shareholders’ equity. That’s a much smaller cushion to absorb losses, AND it gets worse.

Notice how the row labeled “Loans and leases, net” has the fair value reported in the last column labeled “Significant Unobservable Inputs (Level 3)”? That means the “fair value” of the bank’s loans is actually calculated by the banks managers because there isn’t an actively traded market of similar loans to compare to. When bank managers have that opportunity, they are often tempted to overestimate what is actually “fair”. That means the market value of those loans, should they need to be unloaded to cover deposit withdrawals, may be even less than the reported “fair value”.

In fact, it is INCREDIBLY likely that the true value of those loans is less than the reported “fair value” because the average yield on the bank’s interest-earning assets at the end of 2022 was only 3.10%, but even 3-month Treasury bills currently yield 4.70%. Based on the breakdown of loan maturities disclosed by Signature, it seems likely that their actual loan portfolio is worth at least $1 billion less than their estimated “fair value”. And that’s assuming an orderly sale. In a real bank run, it seems very likely that the loans would sell for even less. That doesn’t seem quite as optimistic a situation as former congressman and board member Barney Frank suggested.

Signature Bank played stupid games

In 2022, Signature Bank issued over $167 million in dividends, and it also raised over $730 million by selling additional stock. Issuing dividends is a way of returning money to shareholders. Selling stock is a way of taking money from shareholders. Doing both at the same time is like asking your mom for a $100 gift just so that you can spend that $100 at her boutique store, paying taxes along the way. Effectively, you turn $100 in her pocket into $70 in her pocket. A company that issues dividends and sells more stock at the same time is a company with illogical managers. Illogical managers create unstable banks.

Takeaway: There are clear signs that Signature Bank may have not been as well-run or as well capitalized as its managers and board members claimed. It seems likely that New York’s bank regulators were accurate in their assessment of the bank’s solvency and liquidity problems.

Appendix A: What was Signature Bank’s business model?

In the words of Signature Bank’s management:

“We distinguish ourselves by focusing on our target market: privately owned businesses, their owners, and their senior managers, as well as private equity firms and their general partners.”

Almost 90% of the bank’s deposits (88.17% to be exact) were business deposits as of December 31, 2022. Deposits from digital asset businesses alone totaled $17.79 billion (20% of total deposits). Unfortunately, about 90% of the deposits were also uninsured.

During 2022, deposits declined by $17.54 billion (16.5%) to $88.59 billion. That was largely due to a decline in digital asset banking deposits which decreased $12.39 billion.

The average cost for total deposits in 2022 was 0.88%.

Appendix B: Additional quotes from Barney Frank

BARNEY FRANK: “What you also had was, it wasn’t just Silicon Valley[ Bank]. It was a punishment for anybody involved in crypto… And I think in fact what happened was, we had gotten into crypto, although in a way that in no way put us at risk. We facilitated our customers who wanted to deal with each other in crypto, but we were known as someone that was doing crypto… and there was this fleeing [from] banks that were seen as crypto… now it was a liquidity issue not a solvency issue, and we had by Sunday actually gotten back to a point where we had the liquidity, but I believe the regulators wanted to send a message that crypto is toxic, frankly, and they wanted to tell everybody to get as far away from crypto as they could, and we were singled out to be the poster child for that message.”

BARNEY FRANK: “I think some of the regulators were a little nervous they had been a little too accommodating to crypto.”

BARNEY FRANK: “On Friday afternoon, we got hit with billions and billions of dollars of withdrawals of deposits… I believe by Sunday we had resolved that, finding more capital, and the deposit outflows stopped. I believe that the regulators stepped in even after we had managed to stabilize that because of a determination to get people to step away from crypto, and we were the posterchild for that decision.”