Americans spend roughly $10 billion on payday loan fees each year because it takes banks 2-5 business days to actually deposit paycheck money into your account after you earn it. That’s changing in less than 3 weeks though because the Federal Reserve is launching their new 24/7/365 payment service, FedNow, before the end of the month.

FedNow has been called a blockchain, a government version of CashApp, and a central bank digital currency (CBDC). In reality, it’s none of those things.

What FedNow actually is is an instant payment network for banks to send money to other banks, 24/7, even on weekends and Christmas. Unlike a public blockchain like Bitcoin, FedNow is neither decentralized nor available to the general public. Only banks and credit unions which already have master accounts at the Fed can directly use the FedNow network.

Despite the deceptive photoshopped images published by many media outlets (see the example below), there is no government app that consumers can use to send payments over the FedNow network. Instead, each bank that wants to make FedNow available to their customers has to modify their own app or website to provide an interface for their customers to the FedNow network. That means FedNow instant payments will only be available to customers at certain banks in the beginning, but more banks will gradually join the network over time as part of FedNow’s phased roll-out strategy.

Faster payments help people, especially poor people, but some consumer advocates have raised concerns about how FedNow handles these payments. For starters, FedNow transactions are routed through the Fed which means the government can see the details of every payment that anyone sends on FedNow, not just payment amounts over $600 as will be the case for Venmo starting next year.

Additionally, some people are concerned that since FedNow is operated by the Fed, the Fed could abuse its power over the network to block transactions on political grounds. For example, the Fed could in theory refuse to process FedNow payments to certain political protesters or to firearm stores.

Currently, Fed officials claim the Fed will not censor any transactions, but Fed governor Lael Brainard also said that after phase 1 of the network’s roll-out, the Fed may start censoring transactions suspected of being fraudulent.

Several years ago, Facebook admitted to incorrectly censoring Trump supporters who were misflagged as Russian bots, so it’s not unreasonable to worry that automated Fed censoring of financial transactions may end up harming certain political groups. It’s also not unreasonable to assume that the Fed may provide some of this information to the IRS to help them target Americans suspected of under reporting their income. FedNow transactions even include metadata related to tax.

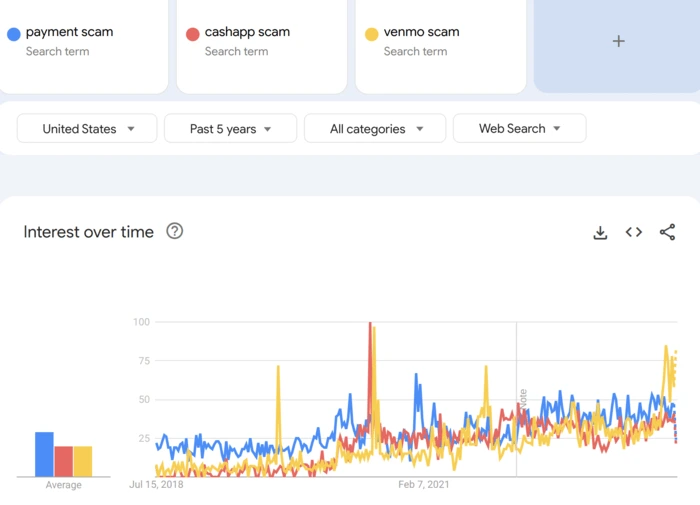

Instant payments in general also increase the risk of bank runs like we saw at Silicon Valley Bank earlier this year, and the risk of payment scams like we already have on CashApp and Zelle.

FedNow also poses an existential risk to some businesses, including payday loan companies and crypto companies.

One of the primary selling points of cryptocurrencies is that they enable nearly instantaneous 24/7/365 payments. If you can now accomplish the same thing directly from a U.S. bank account you already have, then what’s the benefit of paying via cryptocurrency? In fact, many cryptocurrencies are slower than FedNow.

FedNow transactions take a maximum of 20 seconds to complete, with a typical transaction only taking 2-5 seconds. In contrast, a Dogecoin transaction takes 2-5 minutes to finalize, and a Bitcoin transaction takes about an hour to finalize.

However, three crypto companies are embracing the FedNow roll-out as an opportunity to be a service provider to banks in a brand new market:

If the name “Nuvei” sounds somewhat familiar, it’s probably because Ryan Reynolds recently invested in and became a spokesperson for the company.

Nuvei is actually not a crypto-native company though. It’s just a regular payments company that happens to provide a way for businesses to pay in cash and pay out in crypto, or vice versa, and it allows traditional payments to also occur via FedNow.

Fluency and Tassat on the other hand both offer private blockchain platforms for banks to build upon.

Sadly, but not surprisingly, there are no Ethereum or other public blockchain based companies that are currently connecting to FedNow. However, one thing that does bring FedNow and many crypto companies together is a tendency to create expensive animated web pages for questionable projects:

A quick comparison of existing payment methods in the U.S.

| Payment Method | Transaction Limits | Typical Transaction Cost to User | Typical Time | Availability |

| Wire Transfer | None (or bank specific) | $20 | 1 Hour | Monday to Friday, 9am to 4pm Available at all banks |

| ACH | $10,000 or less per tx for consumer accounts $25,000 or less per day for consumer accounts *Chase offers the highest limits for consumers | Free for consumers Free or <$1 for businesses | 2 Business Days | Monday to Friday |

| RTP | $1 million per tx | Not directly available to end users 4.5 cents per tx for banks | Seconds | 24/7/365 Available at ~300 financial institutions |

| Zelle *Uses RTP, ACH, batching, and virtual transfers on the back end | $5,000 or less per day | Free | 3 Minutes | 10am to 10pm, 7 days a week, excluding certain holidays *Not available for users of every bank |

| FedNOW | $500,000 per tx | Not directly available to end users 4.5 cents per tx for banks | <20 seconds | 24/7/365 |

What IS FedNow, from an engineering perspective?

FedNow is a new software protocol operated by the Federal Reserve and made available to banks and other financial institutions. The purpose of FedNow is to allow banks to instantly (within 20 seconds) send payments back and forth.

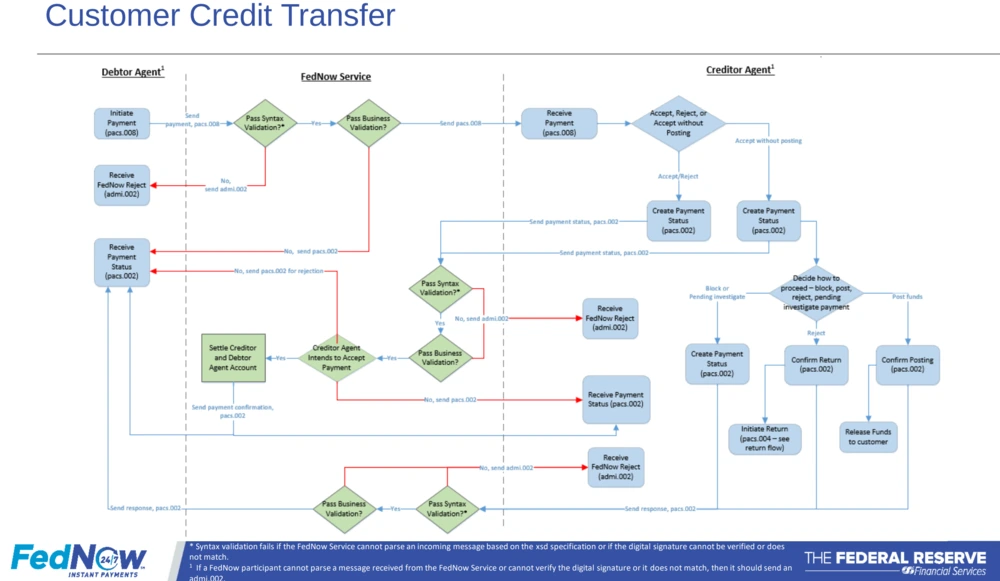

In nerdier terms, FedNow is a messaging protocol where certain messages have the side effect of changing the values of participating master accounts at the Federal Reserve.

Will FedNow replace stablecoins?

FedNow provides instant payments that are as fast or faster than most stablecoins, are backed by FDIC-insured deposits, and are fully regulated and compliant with U.S. laws. In that sense, FedNow replaces one of the biggest use cases for stablecoins. However, FedNow does not directly interact with any blockchain which means it does not provide a solution for fiat-to-crypto trading via decentralized exchanges (DEX’s).

How does FedNow prevent fraud?

Faster payments enable faster fraud. If you send money to a scammer via a blockchain, via Zelle, or via FedNow, you have very little time to discover your mistake before the payment becomes irreversible. To combat the increased risk of fraud created by the introduction of FedNow, FedNow has built-in features to help banks limit their fraud risk. Those features are summarized in the table below.

| Feature | Description |

| Network-level transaction limit | The maximum amount per transaction that a financial institution can send over the FedNow network. This limit is set by the Federal Reserve. |

| Participant-level transaction limit | Participants (i.e. banks and credit unions on the FedNow network) can set a lower transaction limit for credit transfers they initiate based on their organization’s risk policies. Why would they want to do that? Are sending orgs responsible for fraud? |

| Participant-defined blacklists | Financial institutions can specify a list of suspicious accounts that their organization cannot send to or receive from. |

What is ISO 20022?

ISO 20022 is a messaging standard for financial institutions developed by the Geneva-based International Organization for Standardization (ISO) in 2004. The ISO 20022 standard is used in various aspects of finance, including:

- Payments

- Securities

- Trade services

- Cards

- Foreign exchange

Here is an example of the ISO 20022 message flow for a consumer credit transfer via FedNow:

What features differentiate different payment networks?

- Does the network support request-for-payment-initiated payments or only payer-initiated payments?

- Does the network support computational rules to compute whether or not a payment should take place based on the state of the network?

- Example: Each day, check if Bob’s account is below $100. If so, check if Alice’s account is above $500. If so, send $100 from Alice to Bob.

- How much does it cost to be a participant of the network?

- Example: Creating and owning a Bitcoin wallet is free, but there is a monthly membership fee for financial institutions to be a member of FedNOW.

- What is the cost per transaction? Is the cost charged for transaction submission, transaction settlement, or both?

- Is the network directly available to end users (e.g. Bitcoin) or is it only available to financial institutions (e.g. FedNOW)?

- How long does it take for a payment to reach finality?

- *Finality means that the funds transferred officially become the legal property of the receiving party.

- **All other things being equal, a faster payment network will reduce false claims fraud perpetrated by payers, whereas it will increase fraudulent charges fraud perpetrated by payees.

- ***Finality is correlated with the time it takes for money to show up in a payee’s account, but the two events are not actually the same. True finality is mostly a concern for financial institutions concerned with counterparty risk. Most consumers are satisfied when money hits their account and aren’t concerned with whether or not the money is actually theirs or is simply being credited to them a day early by their bank.

- Who is responsible for operating the network and finalizing transactions? There are several reasons why this is important:

- If a single company or small group of companies is responsible for operating the network, they could commit fraud, be hacked, or lose data in a power outage.

- If a government agency operates the network, then the government may have access to a lot of sensitive information that could be abused for political purposes, such as spying on the financial activities of a political adversary (unless the network has strong cryptographic privacy protections in place).

- What types of cryptographic, legal, contractual, and/or company policy based privacy protections are there for users of the network? Who can see (and under what conditions) the information about who sent money to who and what that money was for?

- *If a payment network has no privacy features preventing a government entity (such as the Fed) from seeing all details about all transactions, then it is easier for the government to abuse any control it may have over transactions (e.g. by blocking payments to a group of political protesters).

- What information is (mandatorily or optionally) sent with each payment?

- Example: If a payment network supports request-for-payment-initiated transactions, then it is valuable to businesses (from a bookkeeping perspective) to have such transactions accompanied by text or other data which identifies what the payment was for. That’s so that the business has proof to show the IRS in the event they are audited. However, if the same payment network also makes all transaction directly to a government entity such as the Fed, then there is a concern that such additional data could be abused to selectively control how people can spend their data (e.g. by disallowing people to spend more than $100 per month on gasoline as a way to accelerate transition towards a green economy).

- Can network participants choose whether to only receive payments, only send payments, or both?

- Can network participants blacklist certain payment senders, recipients, or transaction types to limit its own risk (e.g. fraud risk, counterparty risk, or sanction risk)?

- Example 1: My bank won’t accept any payments from Bob because Bob is suspected to be a terrorist, and I don’t want my bank to be fined for helping to fund terrorism.

- Example 2: My bank won’t send any payments over $100,000 to limit our risk of being defrauded by scam businesses.

- Example 3: Don’t accept more than 3 request-for-payment-initiated transactions from the same requester in any 2-hour period.

- What type(s) of value can be transferred over the payment network?

- Example 1: Federal Reserve master account dollars

- Example 2: Bitcoins

- Example 3: Title to a real estate property

What’s the difference between RTP and FedNow?

RTP is a real-time payment network operated by a consortium of large U.S. banks via The Clearing House organization. RTP was launched in November 2017 and is currently used on the backend of some consumer services like Zelle.

FedNow is also a real-time payment network, but it is operated by the Fed rather than by private banks. FedNow is set to launch before the end of this month (July 2023).

What is FedLine?

FedLine is essentially a computer system that banks use in order to complete bank-to-bank wire transfers and FedNow payments.

What is Fedwire?

Fedwire is the protocol (accessed via FedLine) that banks use to complete domestic wire transfers. As of 2023, the fee charged by the Fed for a bank to transfer funds via Fedwire ranges from 3.6 cents to 92 cents per transaction.

References

[1] About the FedNow Service. The Federal Reserve Board Financial Services.

[2] Explore FedNow. The Federal Reserve Board Financial Services.

[3] FedLine Solutions. The Federal Reserve Board Financial Services.

[4] Federal Reserve Financial Service Fees. FRB Financial Services.

[5] FedNow Fraud Prevention. FRB Financial Services.

[6] RTP (Real Time Payment Network) FAQs. The Clearing House.

[7] FedNow(SM) Service Illustration. Youtube – Federal Reserve Bank Services channel.

[8] Metal Blockchain

[9] FedNow ISO 20022 Message Flows (v1.3, December 2022)

[10] Fluency Technologies – Service Provider Showcase for FedNow