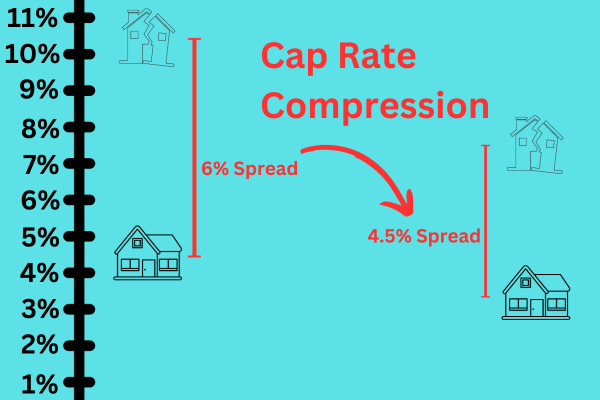

Cap rate compression is just the process of cap rates going down. It’s called “compression” because when cap rates are declining, the cap rates of high cap rate properties typically go down more than the cap rates of lower cap rate properties, which “compresses” the range of cap rates for various properties. This is illustrated visually below.

Why does cap rate compression happen?

Cap rate compression can happen for many reasons, including increased competition within a market. However, on a macro scale, the most important cause of cap rate compression is falling interest rates. Interest rates affect how every other asset class in an economy gets priced.

Cap rates tend to lag interest rates by 1-5 years because most lease agreements last 1-5 years. That means if interest rates are dropped but then raised back up within a few months, it probably won’t have much effect on cap rates. However, from 1981 to 2022, interest rates in the U.S. trended down overall. That multi-decade trend of falling interest rates led to a multi-decade trend of falling cap rates which was only interrupted in a substantial way one time, by the financial crisis in 2007-2009 when asset prices plummeted. Now that interest rates are going up again, cap rates should eventually start trending up again as well. However, this will only occur if interest rates stay high for some time.