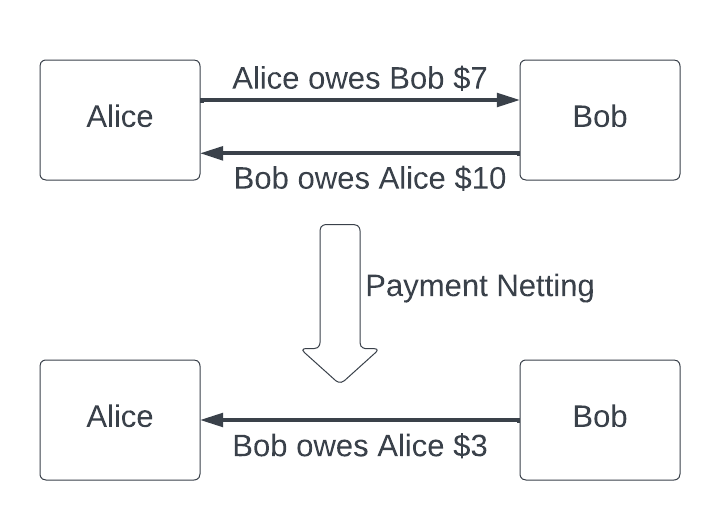

Conceptually, a master netting agreement is very simple. It just says that if Alice owes Bob $7 for ice cream last week and Bob owes Alice $10 for lunch yesterday, then Alice and Bob can settle both debts at once with only one payment of $3 from Bob to Alice.

Stated more formally, a master netting agreement is a single agreement that a company (usually a financial institution such as a bank, broker, or dealer) makes with a counterparty that permits multiple obligations between the two parties to be settled through a single payment in a single currency. A master netting agreement might apply to all transactions and obligations made between the two parties or, more commonly, a specific subset of them.

Sometimes the term “master netting agreement” is meant to include agreements where two parties with ongoing business dealings are settled in net on a periodic basis. However, more commonly, the term specifically refers to an agreement where the “netting” is only triggered when one of the party’s defaults on some obligation.

Example

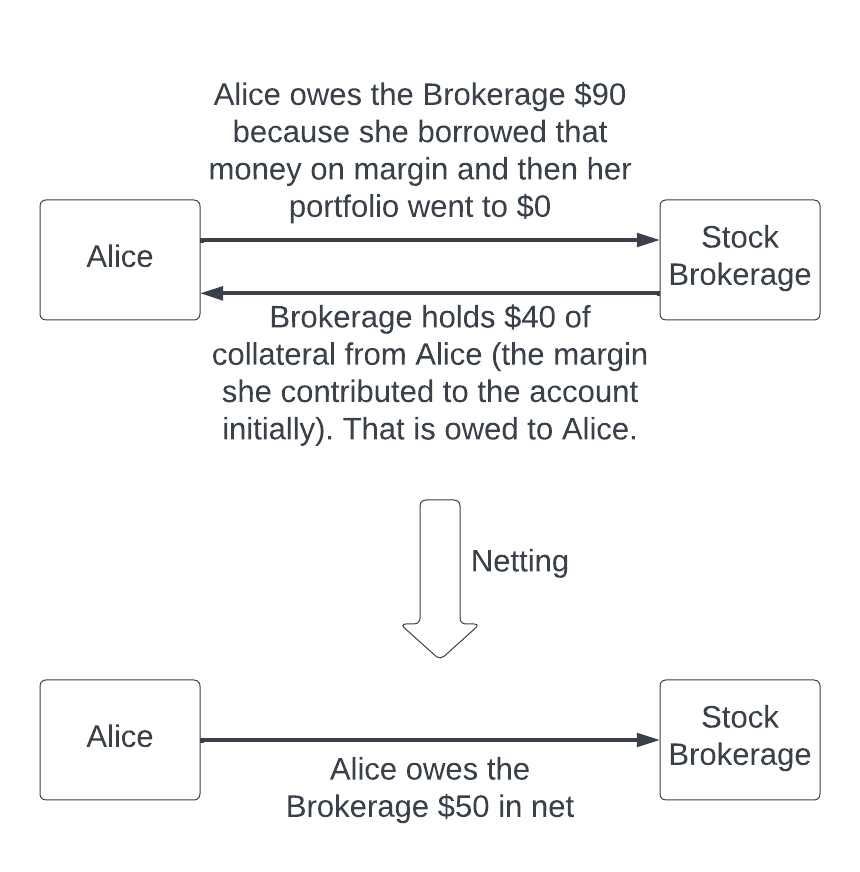

Alice creates a margin trading account with a stock brokerage and funds her account with $40 of initial margin. To create that account, the brokerage makes Alice sign a master netting agreement.

Alice then uses margin account debt to buy a share of a company X for $90. The next day, company X files for bankruptcy and releases a statement that they have no money left in the bank account. The stock plummets to zero before Alice or the stock brokerage can sell the share.

Because Alice bought $90 of sock in a margin account which is now worth zero, she owes the brokerage $90. Alice defaults on that obligation by not reimbursing the brokerage for a decline in her portfolio’s value quickly enough.

However, the stock brokerage also holds $40 of cash collateral (the initial margin that Alice provided to the brokerage when she set up her margin account). Holding collateral means the stock brokerage has a debt to eventually pay that collateral back when Alice closes her account.

To summarize, Alice owes the brokerage $90, and the brokerage owes Alice $40. However, because the two parties have a master netting agreement in place, those two debts can be eliminated and replaced by a single debt for Alice to pay the brokerage $50 (=$90 – $40). This whole process is illustrated succinctly in the diagram below.

Why do master netting agreements matter?

Master netting agreements matter because they reduce counterparty risk. For example, in the example above, suppose the obligations could not be “netted”. Then the stock brokerage would have to pay back Alice’s $40 of initial margin even if Alice never paid any of her $90 debt. The brokerage might end up losing $90 instead of only $50 if Alice goes bankrupt and can’t pay back anything.

In fact, bankruptcy is the most important scenario to consider when contemplating the value of a master netting agreement. During bankruptcy, not every creditor is likely to get paid the full amount they are due. That means if Alice goes bankrupt and creditors get paid 50 cents on the dollar, then the brokerage would much rather be owed only $50 than the full $90. Giving Alice’s bankruptcy estate the $40 that the brokerage owes Alice in the absence of netting would just be subsidizing Alice’s other creditors at the cost of the brokerage taking a larger loss.

Because master netting agreements DO have such a large impact on creditors during bankruptcy, they are legally regulated. Not every contract which purports to control netting is actually legally enforceable. The chapter 11 bankruptcy code and its corresponding regulations define the boundaries of when and what type of master netting agreements are legally enforceable.

Additionally, banks care about master netting agreements because they affect a bank’s liquidity. For that reason, the FDIC, OCC, and Federal Reserve all specify their own definitions of what constitutes a legal master netting agreement for purposes of fulfilling capital adequacy and other banking regulations.

What is a bilateral master netting agreement?

A bilateral master netting agreement is just a master netting agreement where either party can net outstanding obligations if the other defaults. This is in contrast to a master netting agreement where only one party can demand netting if the other defaults.

What is a qualifying master netting agreement?

FDIC definition

According to the FDIC, a qualifying master netting agreement is a written agreement that meets 4 conditions:

- The agreement creates a single legal obligation for all individual transactions covered by the agreement upon an event of default following any stay permitted by paragraph (2) of this definition, including upon an event of receivorship, conservatorship, insolvency, liquidation, or similar proceeding, of the counterparty.

- The agreement provides the FDIC-supervised institution the right to accelerate, terminate, and close-out on a net basis all transactions under the agreement and to liquidate or set-off collateral promptly upon an event of default, including upon an event of receivorship, conservatorship, insolvency, liquidation, or similar proceeding, of the counterparty, provided that, in any such case, two conditions are met:

- (i) Any exercise of rights under the agreement will not be stayed or avoided under applicable law in the relevant jurisdictions, other than:

- (A) In receivorship, conservatorship, or resolution under the Federal Deposit Insurance Act, Title II of the Dodd-Frank Act, or under any similar insolvency law applicable to GSEs, or laws of foreign jurisdictions that are substantially similar to those, in order to facilitate the orderly resolution of the defaulting counterparty, or

- (B) Where the agreement is subject by its terms to, or incorporates, any of the laws referenced in (A).

- (ii) The agreement may limit the right to accelerate, terminate, and close-out on a net basis all transactions under the agreement and to liquidate or set-off collateral promptly upon an event of default of the counterparty to the extent necessary for the counterparty to comply with the requirements of 12 CFR part 382, 12 CFR subpart I of part 252, or 12 CFR part 47, as applicable.

- (i) Any exercise of rights under the agreement will not be stayed or avoided under applicable law in the relevant jurisdictions, other than:

- The agreement does not contain a walkaway clause (that is, a provision that permits a non-defaulting counterparty to make a lower payment than it otherwise would make under the agreement, or no payment at all, to a defaulter or the estate of a defaulter, even if the defaulter or the estate of the defaulter is a net creditor under the agreement); and

- In order to recognize an agreement as a qualifying master netting agreement for purposes of 12 CFR part 329, subpart A, an FDIC-supervised institution must comply with the following requirements from 12 CFR 239.4(a) with respect to that agreement:

- (1) The FDIC-supervised institution must conduct a sufficient legal review to conclude with a well-founded basis (and maintain sufficient written documentation of that legal review) that:

- (i) The agreement meets the other requirements for the definition of “qualifying master netting agreement” that we have already stated.

- (ii) In the event of a legal challenge (including one resulting from a default or from receivorship, bankruptcy, insolvency, liquidation, resolution, or similar proceeding) the relevant judicial and administrative authorities would find the agreement to be legal, valid, binding, and enforceable under the law of the relevant jurisdictions; and

- (2) The FDIC-supervised institution must establish and maintain written procedures to monitor possible changes in relevant law and to ensure that the agreement continues to satisfy the requirements of the definition of qualifying master netting agreement previously mentioned.

- (1) The FDIC-supervised institution must conduct a sufficient legal review to conclude with a well-founded basis (and maintain sufficient written documentation of that legal review) that:

Federal Reserve definition

According to the Federal Reserve, a qualifying master netting agreement is defined as an agreement that just meets the first two of the four FDIC conditions, with two changes:

- The phrase “FDIC-supervised institution” is replaced with “Board-regulated institution”

- In condition part (2)(ii) of the FDIC definition, “12 CFR subpart 1 of part 252” is replaced with “the Board’s Regulation YY (12 CFR part 252)”

OCC definition

According to the OCC, a qualifying master netting agreement is defined as an agreement meeting just the first two of the four FDIC conditions, with one change:

- All instances of the phrase “FDIC-supervised institution” are changed to “national bank or Federal savings association”

Basel iii definition

A master netting agreement is considered legally enforceable under the Basel iii leverage ratio framework if it satisfies the conditions in paragraphs 8(c) and 9 of the Annex to the Basel III leverage ratio framework and disclosure requirements.

ISDA master netting agreement

The International Swaps and Derivatives Association (ISDA) has published template “master netting agreements”, although in some areas (such as energy transactions) such templates are rarely used, with dealers instead typically using bespoke master netting agreements.

Here is an example of an ISDA master netting agreement between Bank of America and Katy Industries: ISDA Master Agreement Example

Here is another example of an ISDA master netting agreement between Bank of America and Natural Alternatives International: ISDA Master Agreement Example 2

Glossary

GMRA = Global Master Repurchase Agreement

ICMA = International Capital Market Association

ISDA = International Swaps and Derivatives Association

MNA = Master Netting Agreement

MSFTA = Master Securities Forward Transaction Agreement

MRA = Master Repurchase Agreement

MSLA = Master Securities Loan Agreement

QMNA = Qualifying Master Netting Agreement

References

[1] 11 U.S.C. 362 — Automatic stay

[2] 11 U.S.C. 561 — Contractual right to terminate, liquidate, accelerate, or offset under a master netting agreement and across contracts; proceedings under chapter 15

[3] 11 U.S.C. 101 — Definitions

[4] 11 U.S.C. 741 — Definitions for the bankruptcy rules related to liquidating stock brokers

[5] 11 U.S.C. 761 — Definitions for the bankruptcy rules related to liquidating commodity brokers

[6] ISDA: 2002 Model Netting Act

[7] 12 CFR 3.2 — OCC Bank Capital Adequacy Standards

[8] 12 CFR 217.2 — Federal Reserve Capital Adequacy for Bank Holding Companies

[9] 12 CFR part 329 — FDIC Liquidity Risk Measurement Standards

[12] User’s Guide to the 2001 ISDA Margin Provisions

Appendix: How does JP Morgan use Master Netting Agreements?

JP Morgan’s 2022 annual report defines a master netting agreement as follows.

“A master netting agreement is a single agreement that a bank, broker, or dealer makes with a counterparty that permits multiple transactions governed by that master netting agreement to be terminated or accelerated and settled through a single payment in a single currency in the event of a default (e.g. bankruptcy, failure to make a required payment or securities transfer, or failure to deliver collateral or margin when due).”

Throughout the bank’s 2022 annual report, the company describes how it uses master netting agreements to reduce credit / counterparty / settlement risk as well as how its reported financials are affected by netting agreements. The following excerpts capture the key disclosures and explanations from the bank about how it uses and accounts for netting agreements:

Excerpt 1

“The fair value of derivative receivables reported on the Consolidated balance sheets were $70.9 billion adn $57.1 billion at December 31, 2022 and 2021, respectively… Derivative receivables represent the fair value of the derivative contracts after giving effect to legally enforceable master netting agreements and the related cash collateral held by the Firm.

In addition, the Firm held liquid securities and cash collateral that may be used as security when the fair value of the client’s exposure is in the Firm’s favor. For these purposes, the definition of liquid securities is consistent with the definition of high quality liquid assets as defined in the LCR rule.

In management’s view, the appropriate measure of current credit risk should also take into consideration other collateral, which generally represents securities that do not qualify as high quality liquid assets under the LCR rule. The benefits of these additional collateral amounts for each counterparty are subject to legally enforceable master netting agreement and limited to the net amount of the derivative receivables for each counterparty.”

JPM 2022 form 10-K, page 124

Excerpt 2

“As permitted under U.S. GAAP, the Firm has elected to net derivative receivables and derivative payables and the related cash collateral received and paid when a legally enforceable master netting agreement exists. The level 3 balances would be reduced if netting were applied, including the netting benefit associated with cash collateral.

The Firm also holds additional collateral (primarily cash, G7 government securities, other liquid government agency and guaranteed securities, and corporate debt and equity securities) delivered by clients at the initiation of transactions, as well as collateral related to contracts that have a non-daily call frequency and collateral that the Firm has agreed to return but has not yet settled as of the reporting date. Although this collateral does not reduce the balances and is not included in the tables below, it is available as security against potential exposure that could arise should the fair value of the client’s derivative contracts move in the Firm’s favor.”

JPM 2022 form 10-K, page 174, footnote (f)

The level 3 balances referred to by the above excerpt are JP Morgan’s “level 3 assets” in the fair value hierarchy. These are the assets whose fair value measurements have the highest degree of uncertainty because no identical or similar assets are actively traded and unobservable variables significantly impact the final fair values calculated.

Excerpt 3

“The Firm’s wholesale exposure is managed through loan syndications and participations, loan sales, securitizations, credit derivatives, master netting agreements, collateral and other risk-reduction techniques.”

JPM 2022 form 10-K, page 192

Excerpt 4

“The following tables present, as of December 31, 2022 and 2021, gross and net derivative receivables and payables by contract and settlement type. Derivative receivables and payables, as well as the related cash collateral from the same counterparty, have been netted on the Consolidated balance sheets where the Firm has obtained an appropriate legal opinion with respect to the master netting agreement. Where such a legal opinion has not been either sought or obtained, amounts are not eligible for netting on the Consolidated balance sheets, and those derivative receivables and payables are shown separately in the tables below.

In addition to the cash collateral received and transferred that is presented on a net basis with derivative receivables and payables, the Firm receives and transfers additional collateral (financial instruments and cash). These amounts mitigate counterparty credit risk associated with the Firm’s derivative instruments, but are not eligible for net presentation:

JPM 2022 form 10-K, page 199

- Collateral that consists of liquid securities and other cash collateral held at third-party custodians, which are shown separately as “Collateral not nettable on the Consolidated balance sheets” in the tables below, up to the fair value exposure amount. For the purpose of this disclosure, the definition of liquid securities is consistent with the definition of high quality liquid assets as defined in the LCR rule.

- The amount of collateral held or transferred that exceeds the fair value exposure at the individual counterparty level, as of the date presented, which is excluded from the tables below.

- Collateral held or transferred that relates to derivative receivables or payables where an appropriate legal opinion has not been either sought or obtained with respect to the master netting agreement, which is excluded from the tables below.”

Excerpt 5

“[The] Firm typically enters into master netting agreements and other similar arrangements with its counterparties, which provide for the right to liquidate the underlying securities and any collateral amounts exchanged in the event of a counterparty default.”

JPM 2022 form 10-K, page 222 (on credit risk mitigation practices)