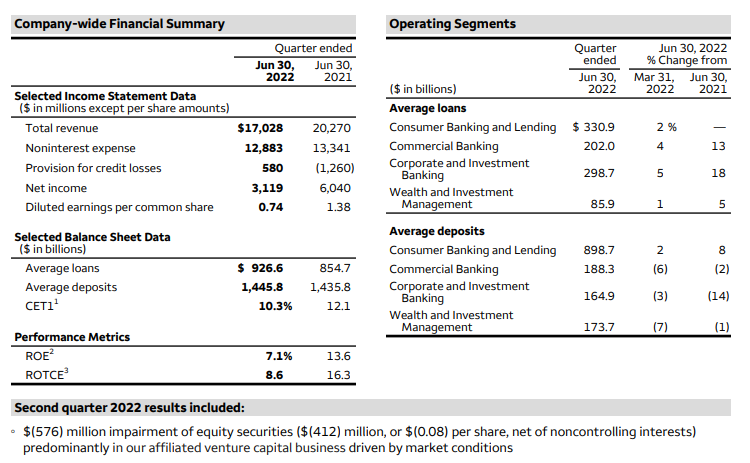

Wells Fargo reported Q2 non-GAAP EPS of 74 cents on $17 billion in revenue versus the 80 cents on $17.5 billion expected by Barron’s. This continues the trend of financial companies consistently missing analyst estimates this quarter. However, Wells Fargo still plans to increase its dividend by 20% in Q3.

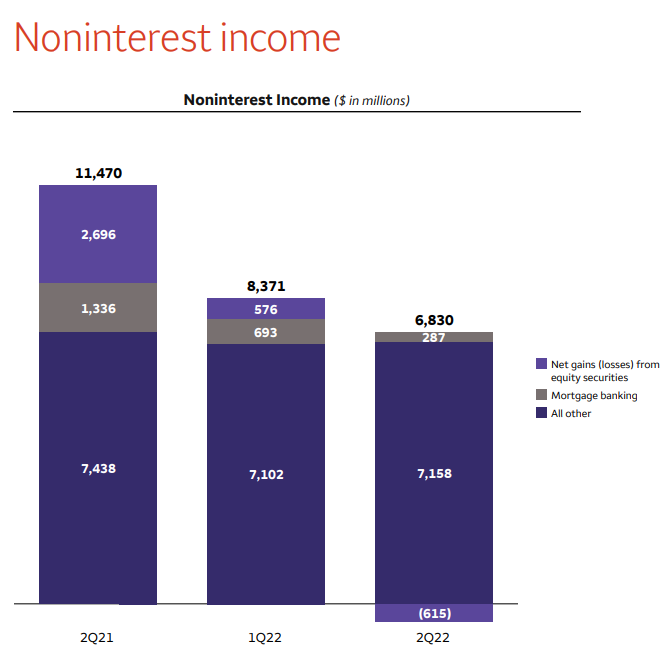

Noninterest income was down 40% from 2Q21. This was mostly due to massive gains on equity securities in 2Q21 versus moderate losses in 2Q22. Wells Fargo’s affiliated venture capital business accounts for most of that change.

Wells Fargo CEO Charlie Scharf had this to say about the change in income:

“Looking ahead, our results should continue to benefit from the rising interest rate environment with growth in net interest income expected to more than offset any further near-term pressure on non-interest income. We do expect credit losses to increase from these incredibly low levels, but we have yet to see any meaningful deterioration in either our consumer or commercial portfolios.”

Importantly, Scharf seems to mean “deterioration to below pre-pandemic levels” rather than “deterioration from Q1 2022” or “deterioration over the past year”. During the earnings call, Scharf did say that consumer deposits declined to pre-pandemic levels (but didn’t say below pre-pandemic levels). Scharf, like many other finance company executives, seems to be uncertain whether this decline is only a return to baseline or whether it will continue and eventually trend below baseline.

Consumer & Real Estate Trends Mentioned by Wells Fargo

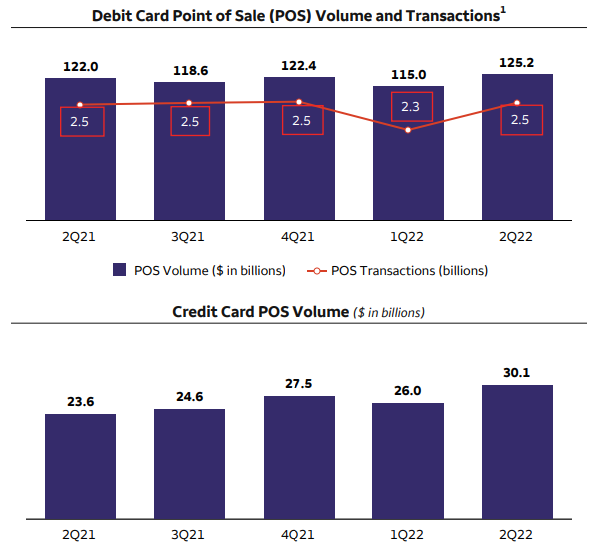

- Consumer spending slowing in May & June 2022

- Consumer spending on apparel and home improvement is down double digits versus last year, but travel spending (including fuel) is up

- Consumer credit & small business credit remain strong (no signs yet of stress, but some decline back towards pre-stimulus levels)

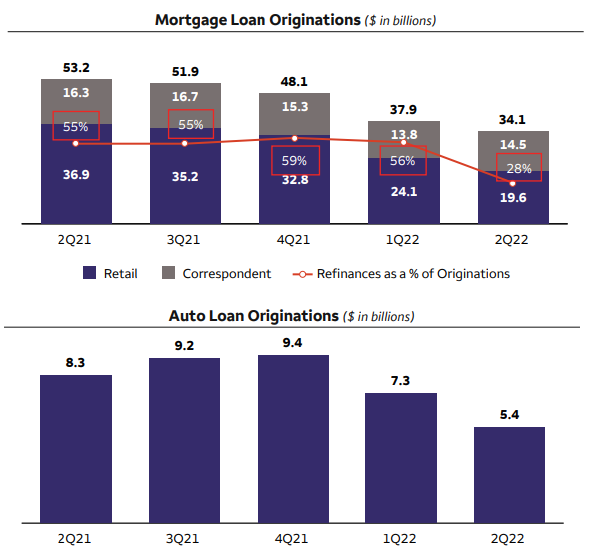

- Total mortgage originations (inlcuding refinances) declined 10% from Q1 (that’s a big quarterly decline!). Wells Fargo expects further decline in mortgage originations in Q3.

- Auto loan originations down significantly

Below are 4 charts on consumer spending & loan demand (corporate card spending not included for example).

Commercial Banking Trends Mentioned by Wells Fargo

- Higher rates & loan balances

- Credit utilization rates increasing but still not back to pre-pandemic levels

- Loan growth driven by larger clients

- Deposit betas expected to continue to increase this year