The exponential price curves of many cryptocurrency projects mean that investing in projects even a little earlier can result in a disproportionately larger payoff, but how can you discover new crypto projects when they are still pre-mainstream? In this article, I’ll share 6 strategies to source these early-stage prospects.

1. Follow Crypto Early Adopters on Twitter

The only way to find the earliest of early projects is to hear someone talking about them. Unfortunately, very few people know about such an early stage project (by definition of being so early stage). This means the person talking about that project will most likely be either a founder of the project, an early engineer working on building the project, or someone in the social circles of the project founders or engineers who happens to be a very early adopter of new things.

Fortunately, online communities make it easier to find such people than it used to be.

Twitter is the social media platform of choice for many software developers, startup founders, investors, and technology early adopters. Curate a list of such people who are deeply into the crypto space and follow them. Pay attention to any new crypto projects they mention. You can start with my Twitter list of over 500 crypto early adopters.

Do note that this is not a list of amazing investors or unbiased individuals, so always perform your own due diligence on a crypto project after someone mentions it on Twitter. This list merely represents the “pulse” of the cryptocurrency ecosystem with a wide variety of individuals who are deeply nerdy about crypto and have a history of being very very early in the adoption curve of crypto projects.

2. Use Coinmarketcap Rankings

Coinmarketcap is a fantastic tool for discovering new cryptocurrencies and tokens, and although it won’t necessarily be able to help you find projects quite as early as Twitter, it can still help you discover projects that are quite early stage. In addition, Coinmarketcap is a more predictable research tool than just waiting for someone on Twitter to mention a new token, dapp, or blockchain.

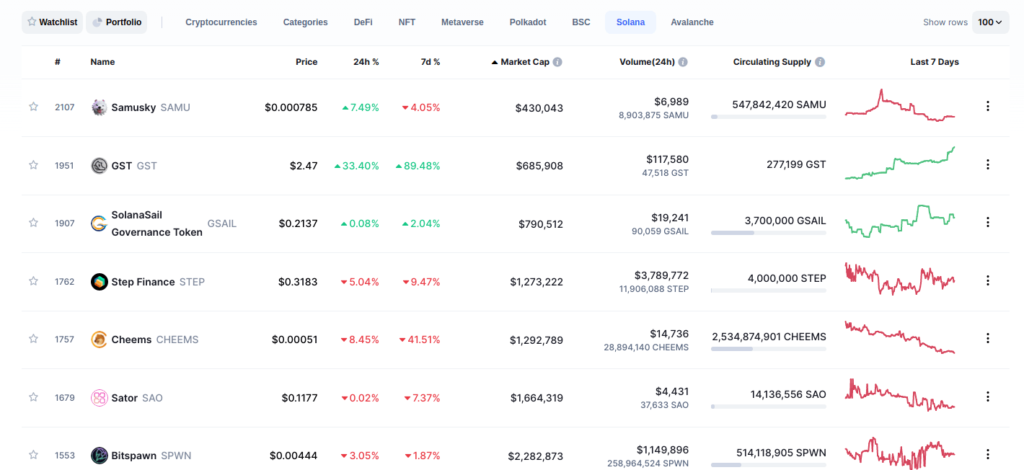

The key to doing good research on Coinmarketcap is to use filters and ranking criteria. For example, in the screenshot below, I have filtered for only tokens issued on the “Solana” blockchain and then ranked from smallest to largest market cap.

Filtering by market cap is a pretty good way to find crypto projects that are still mostly unrecognized. However, the vast majority of these tokens will be either junk or outright scams, so do extremely careful due diligence on such young projects (this warning really applies to new projects no matter where you source them).

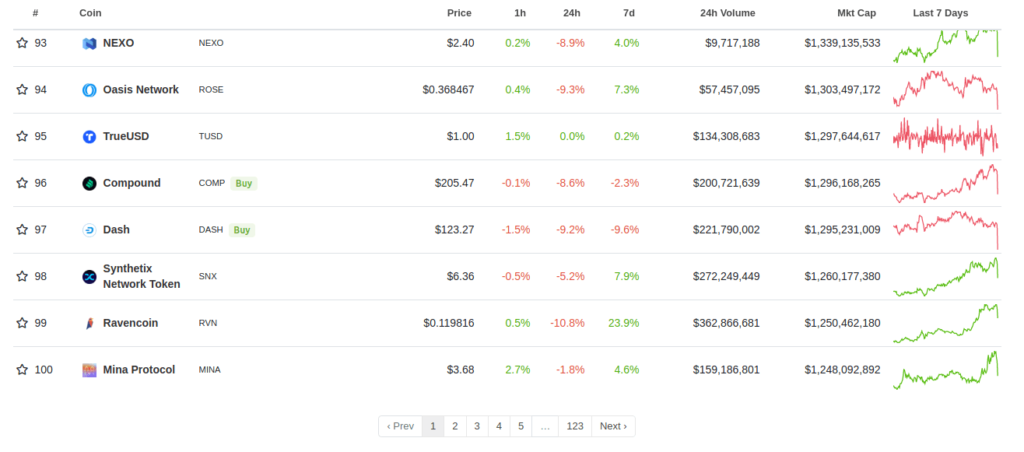

3. Go to the Last Page of Coingecko

Coingecko is a competitor of Coinmarketcap, but they don’t list exactly the same tokens so it’s useful to check both. The user interface of Coingecko isn’t quite as refined as that of Coinmarketcap, but I’ve found that a useful way to find new projects is to scroll to the bottom of the list of 100 tokens shown on the first page. At the bottom of that list, there is a selector to go to the next, previous, or last page (as shown in the screenshot below). Click on the last page button (number 123 as of the time the screenshot below was taken). That will take you to very new listings, many of which probably don’t even have available price or markcap data shown. These are your potential gems (or duds) to explore.

4. Use DappRadar Rankings

DappRadar is a site that provides ranked lists of crypto dapps (decentralized applications) rather than tokens as Coinmarketcap and Coingecko do. However, many dapps have one or more tokens that can be used with them (e.g the Uniswap dapp has the UNI token).

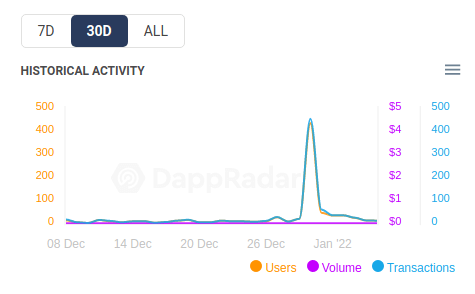

DappRadar allows you to filter dapps by what blockchain they are on and to rank them by the number of dapp users or the total transaction volume of transactions interacting with each dapp over a 24-hour, 7-day, or 30-day window.

One way to use this tool to identify promising crypto projects is to rank projects in terms of number of users over a 30 day period and then investigating dapps that have enough users to show some traction (e.g. at least 100) but not so many as to signal larger adoption has already taken place (e.g. less than 50k monthly users). Within this subset of dapps, you’ll want to look for dapps where the number of users is relatively steady and/or growing rather than super spiky with most days having few users (see the chart below from a real crypto project for an example of “spiky” user interaction that indicates a lack of sustainable adoption).

5. Monitor Early Adopter Discord Servers

Discord can be a good place to hear discussions about up-and-coming new crypto projects. The key is to join the right Discord servers. Below, I’ve put together a starter list of servers with invites to each

- Solidity developer server invite

- Dumb money server invite

- Solana server invite

- Avalanche server invite

- Polkadot server invite

- Cardano fans server invite (make sure to check out the “folder-servers” section which links to other discord servers of certain projects building on Cardano)

- Cardano official community server invite

The point of joining e.g. the Solana discord is not to invest in Solana, but to catch discussions or mentions of still-young projects being built on Solana (and similarly for Avalanche, Polkadot, etc).

6. Monitor Crypto Reddit

Like Discord, Reddit can be a useful source of information if you can plug into the right communities. I’ve provided a starter list of crypto subreddits below.

Note that Reddit has significantly less barrier to participation when compared with Twitter or Discord so there are often correspondingly more scammers and bots that you’ll need to filter out to find true investment gems.