Walmart beat both revenue and Non-GAAP EPS estimates for the quarter. However, the company is under pressure from inflation and poor inventory planning last year.

Quick Numbers

Reporting Period: May 1, 2022 – July 31, 2022 (Q2 FY2023 — That’s not a typo. Walmart does consider this 2022 period a part of fiscal year 2023.)

Total Revenue: $152.9 Billion (up 8.4% YoY and above Wall Street estimates of $150.8 Billion)

Non-GAAP EPS: $1.77 (down 0.6% YoY but above Wall Street estimates of $1.62)

Operating Income: $6.9 Billion (down 6.8% YoY and would have been worse except Walmart International operating income was up 21.1% even while Walmart U.S. and Sams Club operating incomes were both down)

Operating Cash Flow: $9.2 Billion (down 25.8% YoY)

Free Cash Flow: $1.7 Billion (down 77% YoY, partly due to decreased operating cash flow and partly due to increased capital expenditures)

Cash & Cash Equivalents (Balance Sheet Asset): $13.9 Billion (down 39% YoY)

Inventories (Balance Sheet Asset): $59.9 Billion (up 25.5% YoY — That’s much more than inflation alone could account for).

Short-term Borrowings (Balance Sheet Liability): $10.6 Billion (up 1485% YoY — That’s not a typo.)

Working Capital (=Current Assets – Current Liabilities): – $15.7 Billion (Yes, that’s a negative number. Negative working capital is pretty common for retail businesses, but the number has grown somewhat concerning for Walmart. For the same quarter last year, working capital was only – $2.9 Billion.)

Overview

There are two primary factors affecting Walmart’s business: (1) Inflation and (2) the get-out-of-retail strategy.

First, record inflation is affecting Walmart’s business in numerous ways. On the one hand, it is bringing more middle and high income earners to shop at Walmart rather than more expensive stores. On the other (larger) hand, it is putting a lot of pressure on consumers so that they are spending more on groceries and less on other, higher-margin categories like apparel, electronics, and home goods. The overall result has been a reduction in margins which is why EPS is lower than last year even while revenue is higher.

In parallel to the inflation drama, Walmart is also trying to diversify its revenue in what I like to call the get-out-of-retail strategy. The company is launching and expanding numerous businesses to collect more B2B and subscription (both of which tend to be more stable revenue sources than retail). During the earnings call, Walmart’s executives talked about 3 of these ventures: Walmart+, Walmart Connect, and Walmart GoLocal.

Walmart+

Walmart+ is membership program that sounds suspiciously like Amazon Prime. For $98/year, you get discounts on fuel at Exxon, Mobil, Walmart, and Murphy gas stations. You also get free Walmart deliveries on orders of at least $35 (with some restrictions). And starting next month (September 2022), Walmart+ will also come with free access to Paramount+ streaming. They probably should have just called the program Walmart Prime.

Walmart Connect

Walmart Marketplace is an online marketplace for third party businesses and operates in a very similar way to Amazon Marketplace. Walmart has even started using its stores as fulfillment centers so that sellers have the option to pay Walmart to warehouse and ship their products just like they could do with Amazon FBA if they used Amazon Marketplace.

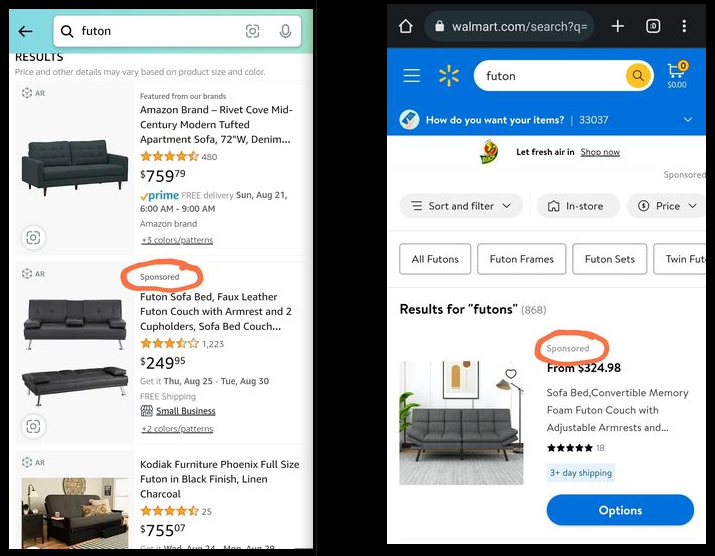

Walmart Connect is an omni-channel advertising marketplace. That means Walmart allows businesses to buy sponsored product positions on Walmart Marketplace, but also businesses can pay to place ads on the self-checkout machines or on the display TVs in Walmart stores.

The number of active Walmart Connect advertisers is up 121% year over year, and advertising is one of the main strategic priorities for Walmart going forward.

Walmart GoLocal

Walmart GoLocal is a white label delivery-as-a-service platform for businesses offered by Walmart. Currently, customers are mostly large companies, but Walmart is trying to convince smaller businesses to also use GoLocal to create their own on-brand delivery services.

Management and Strategy

Walmart has recently replaced some of their management team, and they are also trying to do a lot of things at once. That does make me a bit concerned that they may be spreading themselves a bit thin and/or investing into non-optimal businesses. “GoLocal” for example is basically a whitelabeled version of Instakart which means it should have even lower profit margins (as white labeled products almost always have lower margins than branded products). But gig economy companies have struggled to turn a profit even WITH branded products. Hmm…

I also question whether the Walmart management team might be a bit too optimistic in their future outlook. In May 2022, Walmart’s management said that Q2 was “off to a good start from a sales perspective”. Then mid summer, they revised down guidance and said that Q2 was going poorly. Now they say that Q3 is off to a better start than Q2, but should we believe them?

Appendix A: Walmart business segments

Walmart Inc. divides its business into three reporting segments: Walmart U.S., Walmart International, and Sam’s Club.

Appendix B: Walmart fiscal years

Walmart does not use the conventional calendar year for accounting purposes. Instead, the company uses a fiscal year which starts on February 1. The primary reason for this is that there are a lot of Holiday season returns in January so by including January in Q4 of the previous year, financial results more accurately reflect total net Holiday season earnings.

One additional oddity of Walmart accounting is that the fiscal year starting in February of a particular year will be labeled as the next year. For example, the fiscal year that began on February 1, 2020 was called FY2021, and the fiscal year that began on February 1, 2022 was called FY2023. That means the August 2022 earnings report discussed in this article which covered the period from May 1, 2022 to July 31, 2022 was technically covering Q2 of FY2023.