“There were at least 1,164 train derailments in the U.S. in 2022, but most occurred in rail yards and didn’t involve hazmat spills.”

On January 6, 2005, a malfunctioning railroad switch caused one Norfolk Southern train to smash into another in Graniteville, South Carolina — releasing diesel fuel and 60 tons of toxic chlorine into the water and air from a ruptured hazmat train car. The incident killed 10 people, injured somewhere between 250 and 600 people, and displaced 5,400 residents for nearly two weeks while hazmat teams cleaned up the town. The accident also damaged a textile mill significantly enough to put the company out of business, resulting in 4,000 workers losing their jobs the next year.

Over the next 5 years, the total remediation costs, personal injury claims, property damage claims, civil damages for economic losses suffered by other businesses, regulatory fines, and other direct costs associated with the train crash cost Norfolk Southern $260 million. In the same year as the crash, NS generated $232 million in free cash flow to equity. That means the liability generated from the Graniteville train crash would have wiped out an entire year’s free cash flow to Norfolk Southern stockholders if it hadn’t been for insurance.

Even with insurance, Norfolk Southern had to shell out a $25 million deductible, cover another $58 million in claims that were denied by insurance and insurance arbitrators, and $4 million in regulatory fines. And that doesn’t even include the cost of fronting over a hundred million dollars for claims that were only reimbursed by insurance carriers several years later.

The $87 million of uninsured and non-reimbursed derailment liabilities represent 38% of Norfolk Southern’s free cash flow to stockholders from 2005 — a heavy cost by any measure. Why does Norfolk Southern assume this risk at all? Why agree to transport highly toxic chemicals when they constitute only a small percentage of revenue but a HUGE percentage of total train crash liability?

The answer is that Norfolk Southern (and every common carrier railroad company) is legally required to offer to transport hazardous materials, regardless of the risk. And on February 3, 2023, Norfolk Southern felt the impact of that risk again when 50 train cars, including 11 carrying hazardous chemicals, derailed in East Palestine, Ohio. Several of the derailed train cars caught fire, releasing hundreds of thousands of pounds of toxic chemicals into the soil, water, and air:

- Butyl acrylate (a skin & respiratory irritant)

- Ethylene glycol (a respiratory irritant if inhaled, and a liver & heart toxin if ingested)

- Ethylhexyl acrylate (a suspected carcinogen in humans, and a known carcinogen in animals)

- Ethylene glycol monobutyl ether (another suspected carcinogen in humans, and known carcinogen in animals)

- Diesel, oil, and oil combustion byproducts including benzene (a known human carcinogen)

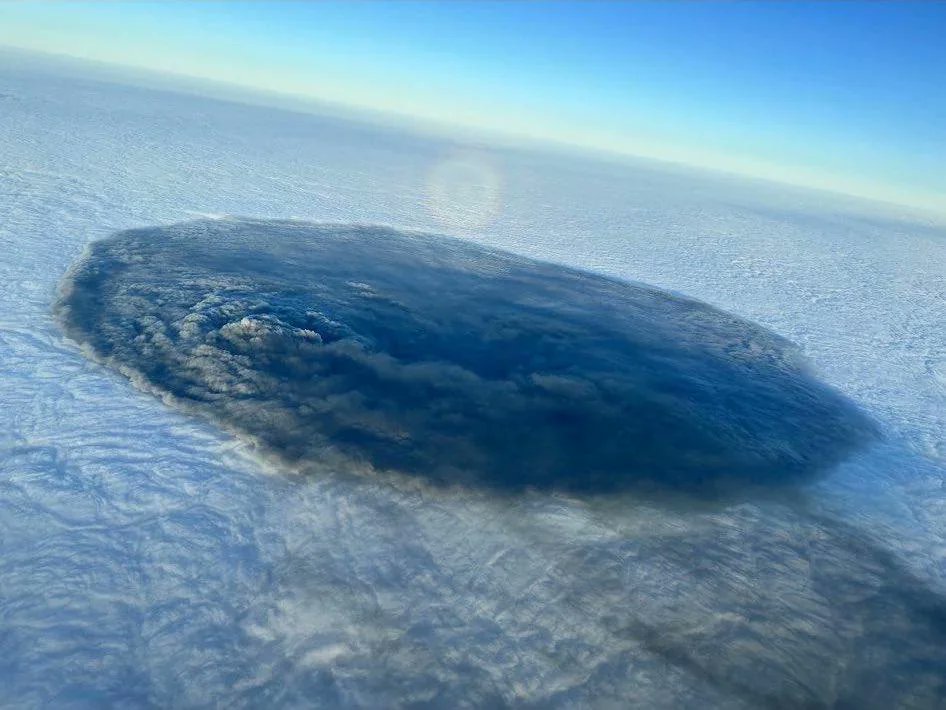

Nobody died in the crash, but after the crash site burned for 3 days, emergency responders were concerned that 5 additional train cars containing vinyl chloride were increasing in temperature and might explode. To avoid this, they preemptively blew holes in the tanker-cars to start a controlled burn that released over a million pounds of vinyl chloride (a human carcinogen), phosgene gas (used as a chemical weapon during World War 1), and hydrochloric acid. The fire created a toxic black cloud that was visible from space and left chemical residue on farms located miles away.

How much will the East Palestine derailment cost Norfolk Southern?

In Norfolk Southern’s 2021 annual report (the latest report available at the time of writing), the company stated that it had third-party liability and property damage insurance on claims between $75-800 million (or $75 million-$1.1 billion for certain scenarios) per occurrence. The company also stated it had first-party property insurance that covers 87% of claims between $75-275 million.

First Party Liability

As of December 31, 2021, the company had 37,228 freight cars with an average age of 25.7 years and about 6.5 years of expected useful life left. The reported net book value of all freight cars at the time was $1.692 billion. That means to replace the 62 destroyed cars (50 derailed plus 12 more were damaged in the subsequent fires) should cost at least $2.82 million. Together with the cost of repairing the tracks where derailment occurred, we can conservatively estimate a cost of at least $3 million. That’s well under Norfolk’s $75 million deductible which means it will come directly out of the company’s free cash flow. However, the much larger cost to the company will come from its third party liability.

Third Party Liability

Despite some environmentalists labeling the East Palestine derailment as a “modern day Chernobyl”, the two events differ in severity by orders of magnitude. The estimated death toll at Chernobyl is about 4,000. The death toll in East Palestine is zero. The number of residents within the immediate vicinity of Chernobyl who received the highest levels of radiation exposure was about 270,000. The number of residents of East Palestine is roughly 4,700. The total environmental and economic costs of Chernobyl have been estimated to be around $250 billion. It’s pretty safe to assume that is an upper limit far above what the total cost of any train crash liability would be.

A somewhat closer comparison is PG&E’s contamination of a city’s groundwater with hexavalent chromium in a case made famous by Erin Brockovich in 1996. After adjusting for inflation, the total money paid out for various lawsuits related to that situation was about $1.1 billion.

Below are the approximate total liabilities from several other industrial-environmental disasters for comparison:

| Examples of Catastrophic Industrial Liabilities | Approximate Total Liability (in 2023 Dollars) |

| Tobacco Master Settlement Agreement in 1998 | $379 Billion |

| BP oil spill in 2010 | $27 Billion |

| PG&E groundwater contamination | $1.1 Billion |

| Kingston fossil coal plant dam failure | $1-5 Billion (ongoing) |

| Graniteville train crash in 2005 | $359 Million |

| Perry, GA train crash in 2019 | >$5.1 Million |

In the BP oil spill, 11 workers died, 206 million gallons of oil spilled, and 225,000 tons of methane were released. In contrast, the volume of chemicals spilled in East Palestine is over 1,000-fold less, and no one has died yet. That means the total East Palestine crash liability should be much less than BP’s $27 billion.

The Graniteville crash is probably the most similar. The environmental liability from the Graniteville crash is probably less than that of the East Palestine crash (since only 1 hazmat car leaked in Graniteville versus 11 hazmat cars in East Palestine). However, the third-party business liability from Graniteville was probably higher than in East Palestine because the Graniteville crash damaged a textile mill that was necessary to keep a larger business (Avondale Mills) solvent. When Avondale collapsed the next year, Norfolk Southern ended up on the hook for hundreds of millions of dollars in damages. In the East Palestine crash, most businesses within the affected area are relatively small meaning that even if several do go out of business, the total liability to Norfolk would likely be smaller than it was for Avondale.

I estimate the final liability (including environmental remediation costs, third-party personal injury claims, and civil damages for third party business losses, not all of which will be measured or claimed for several years to come) for the East Palestine crash will be in the range of $50-500 million. That’s an 80% confidence interval based on the statistics I have available.

However, Norfolk Southern is unlikely to pay more than $100 million out of pocket due to insurance. For a company that generated $2.36 billion in free cash flow to stockholders in 2021, that isn’t too big of an expense (especially when spread out over the course of the next several years). If Norfolk Southern hadn’t started out at such a high P/E before the East Palestine crash, the resulting stock dip could have been quite the buying opportunity.

By the way, if you want more articles like this about interesting business topics (researched & written by a guy who worked at two national labs and spent 3 years in Duke’s math PhD program), subscribe to my free weekly newsletter. It’s like hiring me as a research analyst for free.

How much money do railroads invest in maintenance & infrastructure?

From 1980 to 2021, America’s freight railroads spent approximately $760 billion on capex and maintenance related to locomotives, freight cars, train tracks, bridges, tunnels, and other infrastructure and equipment. That’s more than 39 cents of every dollar of freight railroad revenue during that time. In recent years, annual spending has been over $25 billion.

How many people die in train accidents each year?

In 2022, the U.S. railroad industry (excluding Amtrak) caused 817 fatalities which included 10 on-duty employees, 569 trespassers, 2 passengers, and 236 bystanders (most of which were people on railroad crossings).

On a fatalities-per-mile basis, the U.S. railroad industry caused 1.49 deaths per million train-miles. That’s roughly 100-fold higher than the death rate per million car-miles, but a single train can carry substantially more cargo and passengers than a car or semi-truck. Additionally, transporting cargo by freight train is about 75% more carbon-efficient than transporting cargo by truck.

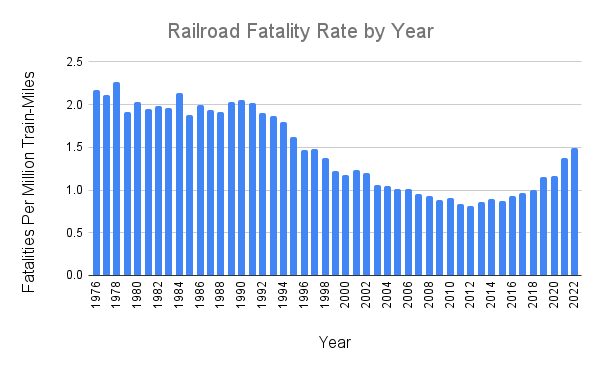

The chart below shows how the railroad fatality rate has changed from 1976 to 2022.

As you can see, safety improvements led to substantial decreases in railroad fatalities from 1976 to 2012, but then fatalities started increasing again. Some union advocates have attributed this to softening regulations & safety standards (e.g. allowing longer & heavier trains with fewer onboard employees), but let’s take a look at some data before we accept that conclusion.

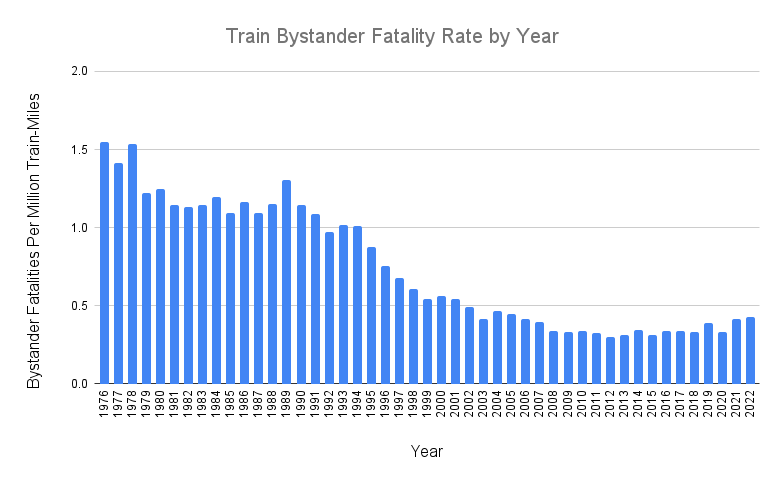

The chart below shows the fatality rate of bystanders by year.

Bystander fatalities did tick up slightly after 2012, but not nearly as much as overall fatalities. If we look at the same chart for employee fatalities, we would see that they have actually decreased since 2012. That shouldn’t be the case if the overall fatality rate uptick were being caused by weaker safety standards. So what’s going on?

The answer is trespassers.

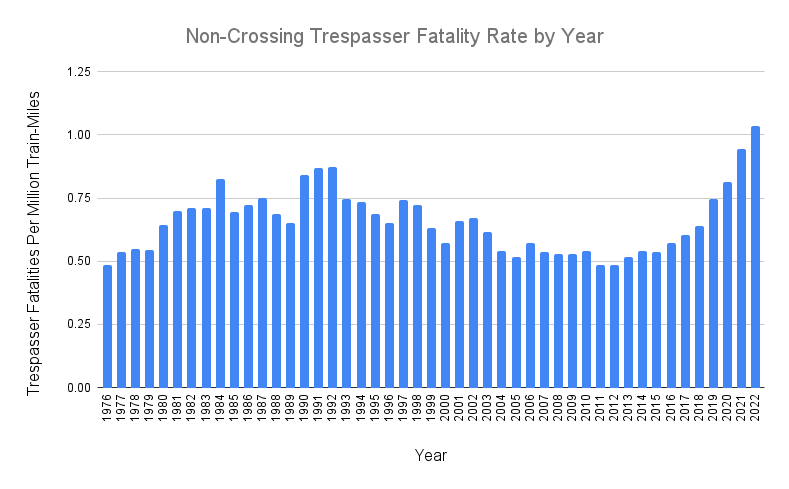

The chart below shows the rate of trespasser deaths at locations other than road-railroad crossings.

The rate of railroad trespasser deaths has more than doubled from 2012 to 2022. Typically, these trespassers are intoxicated males age 20-69 with low socioeconomic status.

Train Accident Prevention Business Ideas

Business Idea #1: Railroad trespasser patrol drones.

Create a system of drones and drone chargers that you can sell to local governments or train operators in urban areas where railroad trespassing is common. The drones would automatically patrol the railroad and whenever a trespasser was detected on or near the tracks, a notice would be sent to the police, train conductor, and/or other railroad personnel.

Alternatively, you can reduce the number of false positives by having any detections of trespassers first sent to a small team of humans working at your company. If the detected trespasser is real, then the human employee of your company can then notify police and/or the train conductor.

Business Idea #2: On-train inspection drone.

Create a drone system that can be mounted on a locomotive. The system would have a charger and at least two drones. Each drone would have an infrared camera that is live-streamed back to the charging hub on the locomotive. The hub would have a computer running image processing AI to detect any dangerous heat buildup along the axles or wheels of the train. While one drone was charging, the other would be going back and forth along the train as it was moving. Then the drones would swap roles. Since freight trains can often travel around 50 mph, you’d need to build drones that could travel around 70-90 mph.

References

[1] U.S. Department of Transportation FRA Safety Data Portal

[2] Pipeline and Hazardous Materials Safety Administration

[3] Association of American Railroads: Freight Rail Facts & Figures

[4] Union Pacific – Investor Relations

[5] Norfolk Southern (NYSE: NSC) – Investor Relations

[6] Strategies for Reducing Railroad Trespassing

Appendix: Historical Environmental Incidents

| Incident | Amount | Amount in 2023 dollars | Explanation |

| PG&E hexavalent chromium groundwater contamination | $648 Million | $1.09 Billion | From 1952-1966, Pacific Gas and Electric Company (PG&E) dumped ~370 million gallons of chromium 6 tainted water into unlined wastewater ponds near the town of Hinkley, CA about 120 miles form LA. PG&E settled the first case with over 600 plaintiffs (brought by Erin Brockovitch) in 1996 for $333 million (~$621 million in 2023). In 2006, PG&E agreed to pay $295 million ($437 million in 2023) to settle cases involving another 1,100 people statewide for hexavalent chromium-related claims. In 2008, PG&E settled another Hinkley claim for $20 million ($28 million in 2023). |

| Tobacco Master Settlement Agreement in 1998 | $206 Billion | $379 Billion | As of 2023, this is still the largest lawsuit settlement in history. The case mandated the 4 biggest tobacco companies pay out $206 billion over 25 years to cover medical-related costs due to illnesses linked to smoking tobacco. |

| Deepwater Horizon BP Oil Spill in 2010 | $20 Billion | $27.4 Billion | The Deepwater Horizon offshore oil rig exploded, killing 10 people and causing a massive oil spill in the Gulf of Mexico. BP settled a number of charges including manslaughter and various misdemeanors and also covered a compensation fund for the victims and economic losses that were experienced as a result of the oil spill (including future medical expenses). |

| Johnson & Johnson Baby Powder Cancer Case | >$61.5 Billion | >$62 Billion | J&J’s baby powder and shower-to-shower powder have been used by millions of women and babies. However, the talc used in the powder has been accused of being contaminated with asbestos, and lawsuits have claimed J&J knew about and hid that fact for years. J&J attempted to offload the nearly 40,000 talc powder lawsuits initiated so far into a subsidiary that it would fund with $61.5 billion and then put into bankruptcy, indicating that J&J believed the total liability when all was said and done would be at least that much. However, that tactic was blocked by a U.S. court which could mean the final damages are even higher. |

| Three Mile Island nuclear reactor meltdown | >$973 Million | >$4.01 Billion | On March 28, 1979, a nuclear power plant located on Three Mile Island near Harrisburg, PA suffered a malfunction and subsequent meltdown that released radioactive material into the environment. According to the World Nuclear Association, the damage took 12 years to clean up and cost $973 million. That doesn’t include any third-party liability claims. |

| Kingston Fossil Plant dam failure & coal fly ash slurry spill | $2-5 Billion | $2-5 Billion | In 2008, a dike ruptured at a coal ash pond at the Tennessee Valley Authority (TVA)’s Kingston Fossil Plant (a coal plant), releasing 1.1 billion gallons (4.2 million cubic meters) of coal fly ash slurry. It is still the largest industrial spill in U.S. history as of 2023. The volume of coal slurry was roughly 5-times larger than the volume of oil released in the BP oil spill in the Gulf of Mexico. The spill released the slurry into the the Clinch River, Emory River, its Swan Pond embayment, and the nearby shore, covering up to 300 acres of the surrounding land. The TVA was found liable and spent over $1 billion to clean up the mess. Additionally, employees at the engineering firm (Jacobs Engineering) hired by TVA to clean up the spill developed illnesses including brain cancer, lung cancer, and leukemia as a result of exposure to the toxic coal ash (which contained radium, heavy metals, and other carcinogens), and within 10 years of the spill, more than 30 had died. A class action case of more than 300 former workers against the TVA and Jacobs is now pending in the Tennessee Supreme Court. When taken through court, the average mesothelioma case generates a verdict award of $5-11 million. When settled, the amount per case is usually $1-2 million. Using $3 million per individual as an estimate for 300 workers, we estimate a final verdict around $1 billion (although the final result may be anywhere from $300 million on the low end to $3 billion or more on the high end). Possible additional punitive damages and additional cases could increase that number several billion higher. |

| Graniteville train collission & toxic chemical spill | $260 Million | $359 Million | In 2005, two Norfolk Southern trains collided in Graniteville, SC, spilling chlorine and diesel fuel into the waterways. Nine people died in the crash, 1 died later from chlorine exposure, and over 250 people were injured from the cloud of toxic chlorine gas that spread over Graniteville. The accident was caused by a misaligned railroad switch. The collision released about 60 tons of chlorine gas from one train car. Norfolk Southern paid approximately $41 million ($63 million in 2023) to clean up the area, evacuate 5,400 residents for nearly 2 weeks while they did so, and pay for miscellaneous property damage and personal injury claims. Avondale Mills (a textile mill near the site of the derailment) shut down and left over 4,000 workers without a job, siting the derailment as the primary cause. Norfolk Southern eventually settled with Avondale Mills for $215 million in 2008 (equivalent to $290 million in 2023). In 2010, Norfolk Southern agreed to pay $4 million (~$5.5 million in 2023) to resolve alleged violations of the Clean Water Act and hazardous materials laws for the chlorine spill that happened as part of the Graniteville crash. |

What was the most deadly train crash in U.S. history?

The deadliest U.S. train accident was in Brooklyn, New York in 1918 when a passenger train derailed in a curved tunnel, killing 102 people.