“69% of companies that bought 2022 Super Bowl ads underperformed the S&P 500 over the next year, so why are companies like Google, Amazon, and DraftKings willing to shell out $7 million for a 30-second ad slot in 2023?”

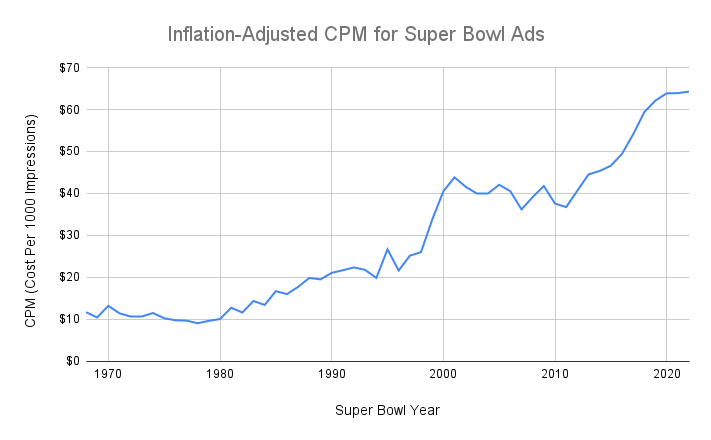

FTX, Quiznos, Blockbuster, Pets.com, Ameriquest — These are just a few of the dead or dying Super Bowl advertisers from the last two decades. Much like stadium naming rights, Super Bowl ads tend to be a low-ROI use of marketing dollars. That hasn’t always been the case, however, as evidenced by the chart below which shows how the average cost per thousand impressions (CPM) for Super Bowl ads has grown 6-fold from 1968 to 2022 (that’s AFTER adjusting for inflation).

For reference, YouTube pre-roll ads (the ads that play before a YouTube video begins) have an average CPM around $3-8 which is TEN TIMES CHEAPER than modern Super Bowl ads on a cost-per-view basis.

Alternatively, you can buy 60-second podcast ad slots for around $23 CPM which is one third the cost and double the length of a Super Bowl ad slot while also arguably being more effective since the ad is delivered to a narrower audience. If you really think you need to reach a general audience across the U.S. (most businesses don’t), you can can run a low cost digital display ad campaign with a CPM around $5 or less. You could even run normal cable TV ads with CPMs of $20-30. There are SO MANY better, more cost-effective options than Super Bowl ads.

However, perhaps one Super Bowl ad view actually is 10x more valuable than one YouTube ad view because the person watching the Super Bowl ad is paying more attention to it. It’s reasonable to question whether Super Bowl ads might actually be worth a 5-10x higher CPM just because of higher audience engagement.

To address that question, we will forget about CPMs altogether and just look at how well the the stock of publicly-traded companies that advertise on the Super Bowl have performed relative to the overall stock market. If expensive Super Bowl ads are not a rip-off, then we should expect the stock of Super Bowl advertisers to perform at least as well as an average stock on the NYSE or NASDAQ.

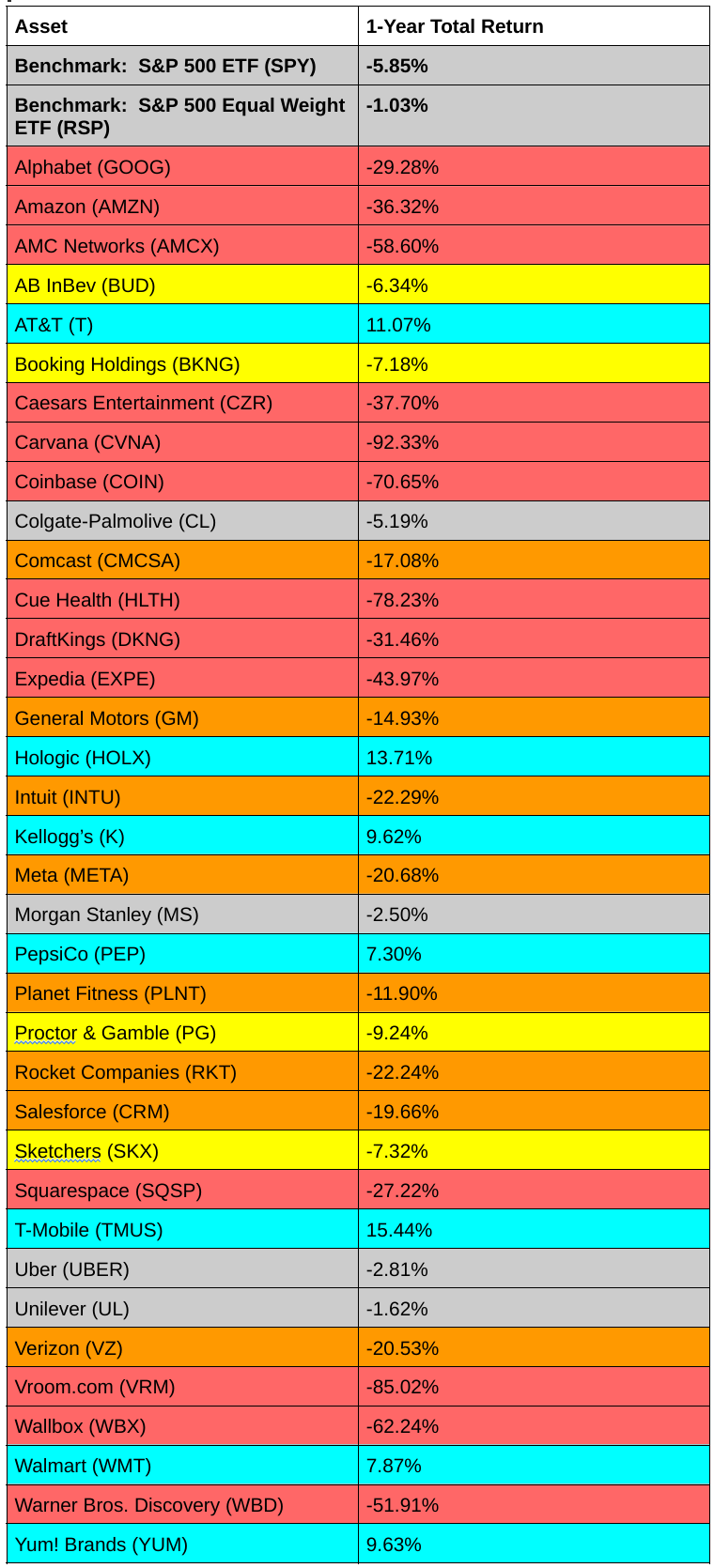

The table below summarizes the 1-year total return (from February 11, 2022 until February 10, 2023) of the 36 publicly-traded (in the U.S.) companies that advertised during the 2022 Super Bowl. For reference, the table also lists the total returns of the market-cap-weighted S&P 500 (SPY) and an equal-weighted version of the S&P 500 (RSP).

The carnage is clear. Of the 36 Super Bowl advertisers, 25 underperformed the S&P 500 over the 1-year period that followed the 2022 Super Bowl. That means 69% of Super Bowl advertisers underperformed the market. If we use RSP rather than SPY as our benchmark, then 29 Super Bowl advertisers (81%) underperformed the market.

Over that 1-year period, the S&P 500 returned -5.85%. The median performance of a Super Bowl advertiser was -18.37%. If we constructed a portfolio by buying an equal amount of stock of each Super Bowl advertiser, our portfolio would have returned -22.83% over that period.

Still, one year is a relatively short time in the stock market. It’s possible that the underperformance we are looking at is just a statistical anomaly (perhaps due to the once-in-four-decades macroeconomic conditions that affected the economy in 2022). To determine if Super Bowl ads really are a bad investment of marketing dollars in more normal economic conditions, we need to look at how Super Bowl advertiser stocks perform over longer time spans. (By the way, if you are enjoying this article, consider subscribing to my free newsletter to get more like it.)

How do Super Bowl advertiser stocks perform over 10 years?

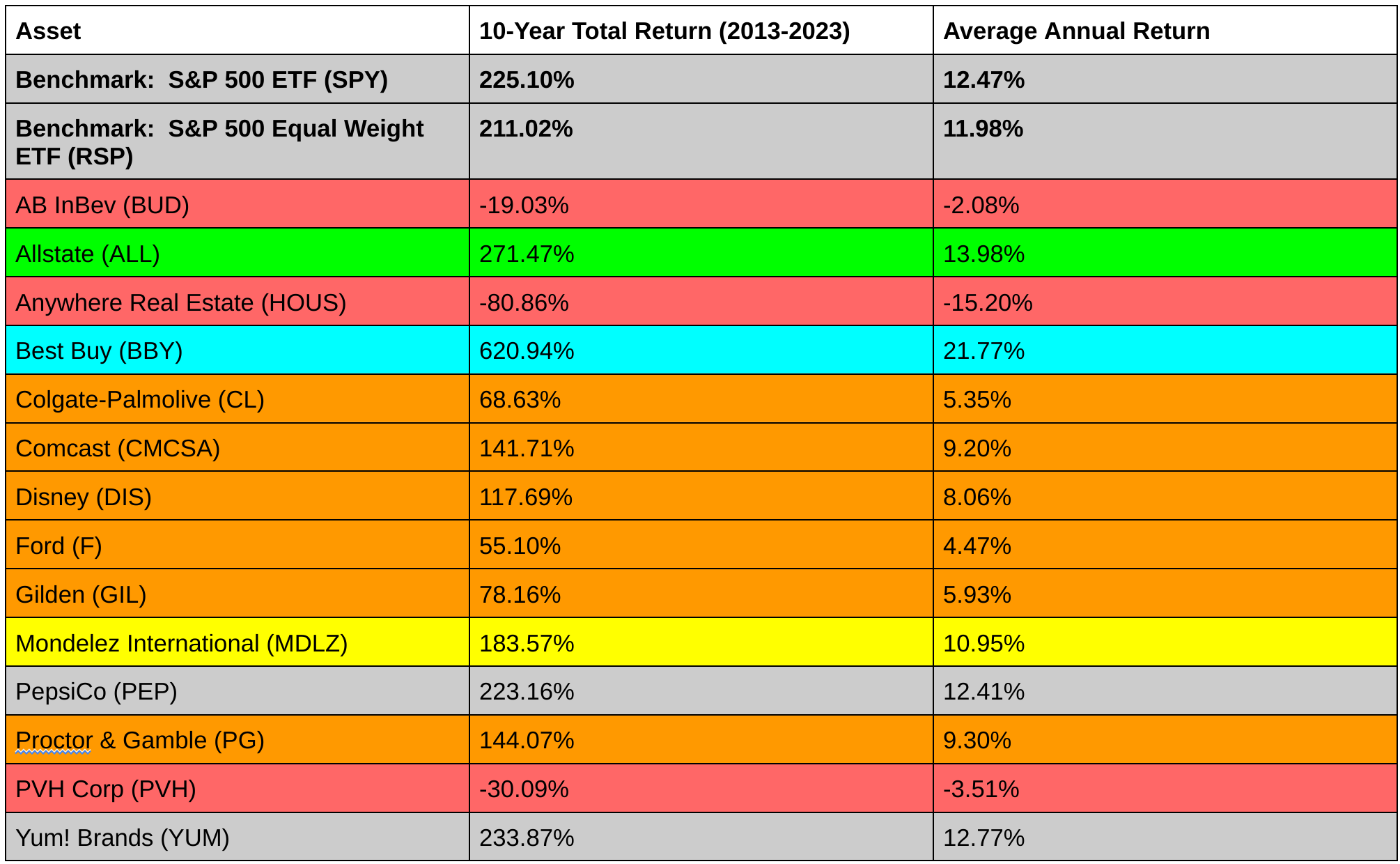

Using this archive of past Super Bowl ads, I determined there were 14 companies that both (1) advertised in the 2013 Super Bowl and (2) have been publicly listed in the U.S. for the entire period of time from February 1, 2013 (just before the 2013 Super Bowl) until February 10, 2023 (the last trading day before the 2023 Super Bowl). The 10-year total returns and annualized returns for each stock (as well as for the S&P 500 and RSP benchmark ETFs) are summarized in the table below.

Of the 14 Super Bowl advertisers from 2013, 11 underperformed the S&P 500 over the next 10 years (79%), and the average annualized return of all 14 Super Bowl advertisers over that decade was a pitiful 6.67% (versus 12.47% for the S&P 500). That consistent underperformance over a decade is even more impressive when you consider that when advertisers bought Super Bowl ads in 2013, the average inflation-adjusted CPM for those ads was only $44.52 versus $64.29 in 2022. That means companies that bought Super Bowl ads in 2013 were making bad decisions, and companies that bought Super Bowl ads in 2022 made decisions that were 44% worse.

Moral of the Story: If you are an executive or director of a company, don’t buy Super Bowl ads unless you have VERY good data suggesting that your company will actually get a good ROI on that marketing spend. And if you are an investor, then stay clear of companies that buy Super Bowl ads unless you have a very specific reason not to. If you are a sophisticated investor, consider a long-short portfolio strategy that involves shorting Super Bowl advertisers while going long ETFs of peer groups of those stocks. I will be sharing more detailed models & data for how to implement such strategies in this month’s Axiom Alpha Market Intelligence newsletter on February 28, 2023.