The rate of new mortgages taken out in 2022 dropped more than 80% from its 2021 peak. Real estate sales and mortgages, personal vehicle sales & financing, and marketing are all examples of industries that are VERY vulnerable to recessions. However, some industries see little to no drop in revenue during recessions (and some even benefit from recessions). Below is a list of 13 industries that are very recession-resistant.

1. Deathcare

Deathcare includes funeral services, burial services, cemetery plot sales, cremation services, body transportation services, urn sales, casket sales, etc. Since recessions don’t decrease the death rate, the deathcare industry tends to be recession-resistant.

However, within the deathcare industry, there are some large secular trends to watch out for. The decline of religion and rise of environmentalism have caused burials to lose market share to cremations almost every year for the past 30 years. That means a cemetery may not be the best business. Additionally, people are opting more and more for home “wakes” rather than traditional funeral home mourning events. That means traditional funeral homes with large event spaces may not be the best businesses to own either. However, cremation and aquamation facilities are great deathcare business opportunities.

2. Healthcare

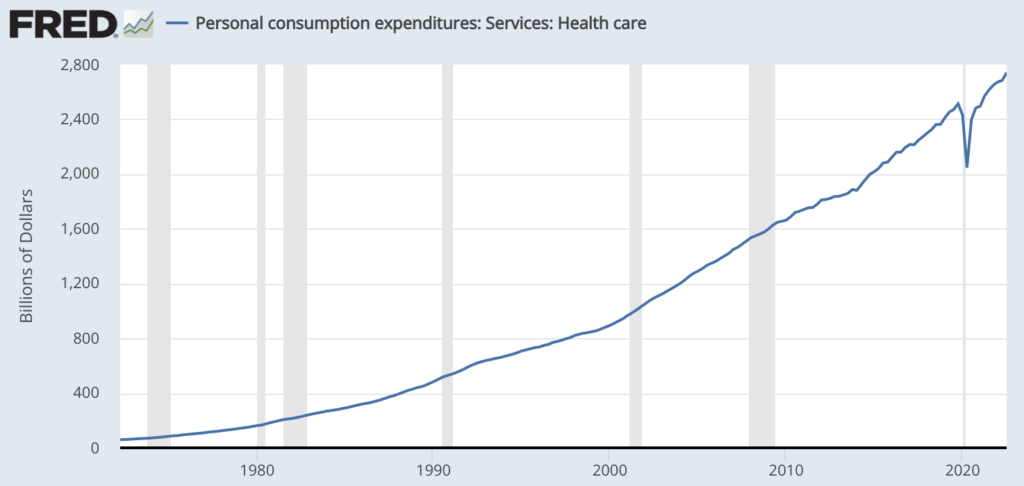

People pay for medicine even if they have to go into debt to do so. People won’t stop taking their prescription even if they do stop buying expensive foods at the grocery store. Additionally, a lot of healthcare is actually paid for by the government and by insurance companies. All of those factors together mean that spending on healthcare is very inelastic. This is apparent in the chart below during the 1980 recession, the 1981-1982 recession, the 1990-1991 recession, the 2001 recession, and the 2007-2009 Great Recession.

The most surprising thing about the health spending chart above is that consumer spending on healthcare actually decreased during the beginning of the Covid pandemic in 2020. That seems especially odd because we think of the Covid recession as being caused by a pandemic (a health issue).

However, in reality, the recession was actually caused by government lockdowns which severely limited people’s ability to engage in any social or commercial activity. That, together with significant fear of getting sick, meant most people did not go to the doctor for checkups, didn’t go to the dentist, and possibly even cancelled their mammograms or other non-urgent procedures.

As a result, 2020 was the first year in recorded history when U.S. spending on healthcare fell. However, healthcare spending fell by only about 2.7% in 2020 versus U.S. GDP which fell by 3.5%. If we add in spending on prescription drugs, then healthcare spending was only down by 1.5%. That means that healthcare was still a stronger than average industry even during that historic year.

If you want to start a healthcare business that is maximally recession-resistant, I would stay out of areas that people can easily put off for years (e.g. dentistry and orthodontics).

3. Pets

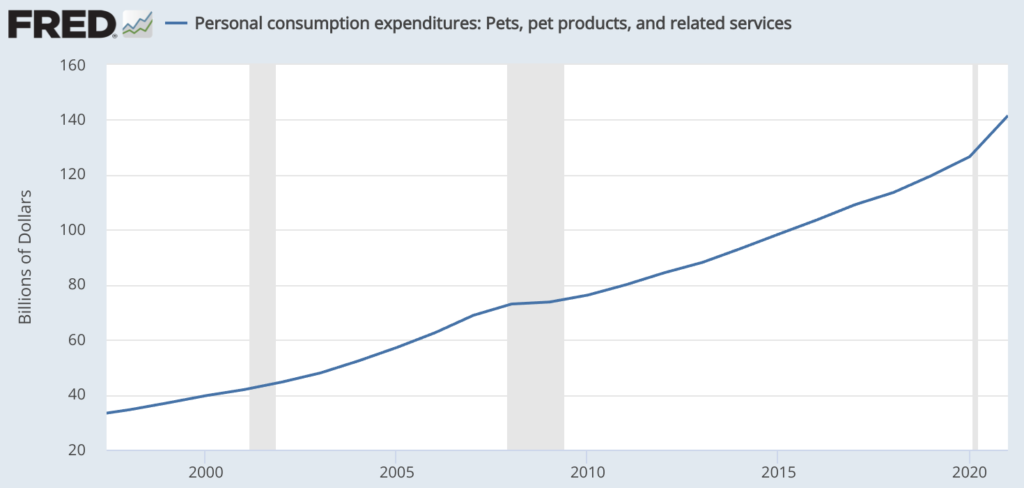

People spend money to buy pets, pet products, and pet services even during a recession. In the chart below, you can see that pet spending continued to grow at the same pace through the dot com bust recession, stagnated but didn’t decline during the Great Recession, and actually significantly increased during the Covid pandemic.

Word of Caution: One hypothesis for why pet industry spending is so robust during recessions is that people don’t buy many luxury goods for their pets. However, if the trend towards people substituting pets for kids continues, it’s possible that people might start spending a lot more on their pets. If we reach a point in the future where a large percentage of pet industry spending is going towards things like “premium organic non GMO, gluten-free, ethically-sourced, environmentally-friendly, carbon neutral, vegetarian-fed, human-grade dog nootropic supplements”, then the industry may not be nearly as recession-resistant as it has been historically.

4. Lipstick

In her 1998 book The Overspent American, economics and sociology professor Juliet Schor found that when money is tight, women would splurge on luxury brand lipsticks that are used in public (e.g. in semipublic restrooms or after dinner in a restaurant) and forego higher-priced beauty products that are applied in the privacy of their homes (e.g. facial cleansers and eye makeup). This phenomenon became known as the “lipstick effect”.

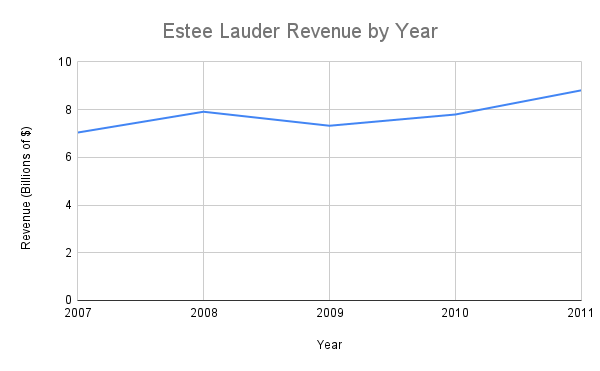

In 2001, Chairman Leonard Lauder of cosmetics company Estee Lauder supplied anecdotal evidence in support of the lipstick effect when he reported his company saw a spike in lipstick sales after the 9/11 terrorist attacks. After the recession of 2008, he again reported a rise in company lipstick sales. Compare that with Estee Lauder sales overall which dropped by 7.4% from 2008 to 2009.

In 2012, an article in the Journal of Personality and Social Psychology found that recessionary cues decreased women’s desire for most products but consistently increased desire for products that increase attractiveness to mates with resources, with the level of desire depending on the perceived mate attraction function served by those products. These researchers also suggested that the reason behind choosing luxury products (e.g. luxury lipstick) was because luxury products do a better job of advertising their attractiveness-enhancing benefits. If true, that suggest that during a recession, advertising your product or service as something that enhances female attractiveness should be a good strategy.

According to a 2022 NPD article, this phenomenon is so deeply rooted in human psychology that make up sales even increased between 1929 and 1933 during the Great Depression.

Word of Caution: Not all recessions are the same. During the early onset of Covid-19 in 2020, lipstick and lip gloss were the hardest hit of all cosmetics because faces were being covered by masks.

5. Chocolate Candy

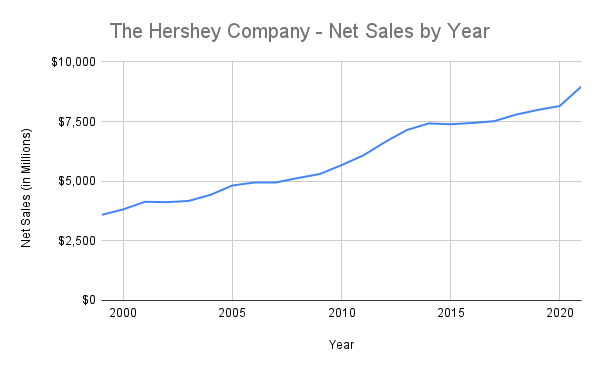

When people get stressed (such as during a recession), they stress eat. In particular, many people stress eat small comfort snacks such as chocolate. Just look at the Hershey Company’s net sales by year in the graph below. Sales don’t slow at all during the 2001 recession, the Great Recession, or the Covid-19 lockdown recession.

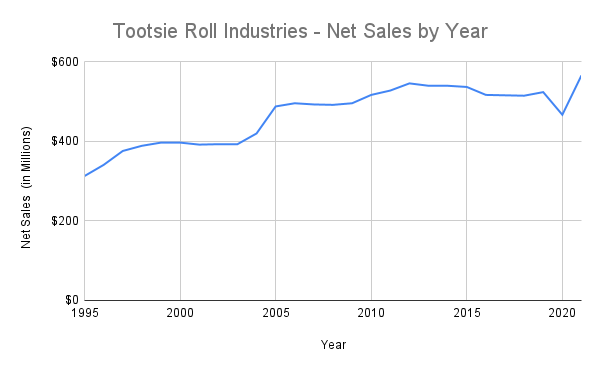

If we look a the sales of Tootsie Roll Industries over the same period, we see that sales did take a hit during the 2020 pandemic but did not notably decline during either the dot com bubble recession or the Great Financial Crisis.

6. Alcohol

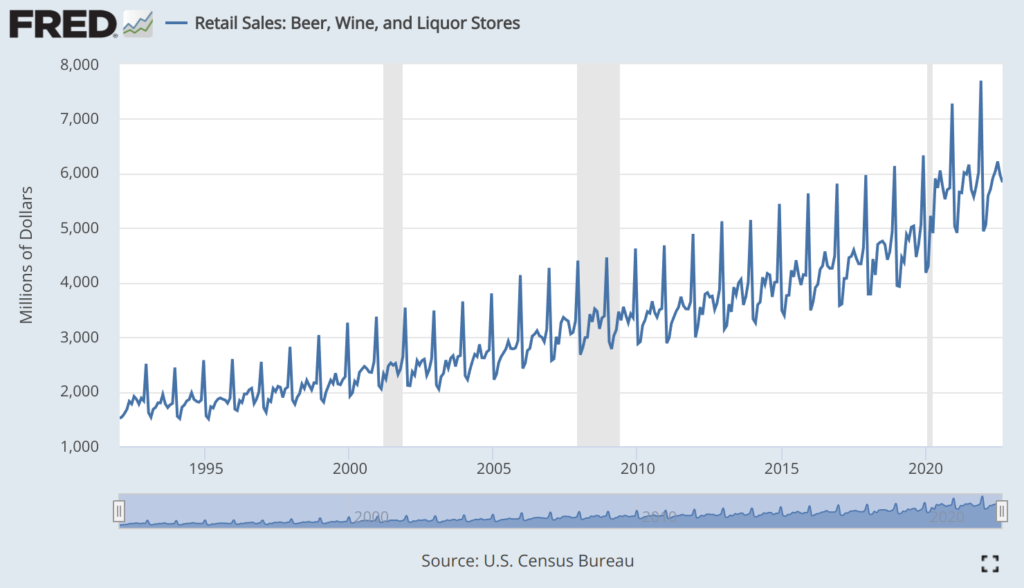

Like chocolate, alcohol is a product which people consume more of when they are stressed. That means Alcohol sales don’t really suffer during a recession.

7. Internet & Wireless Service

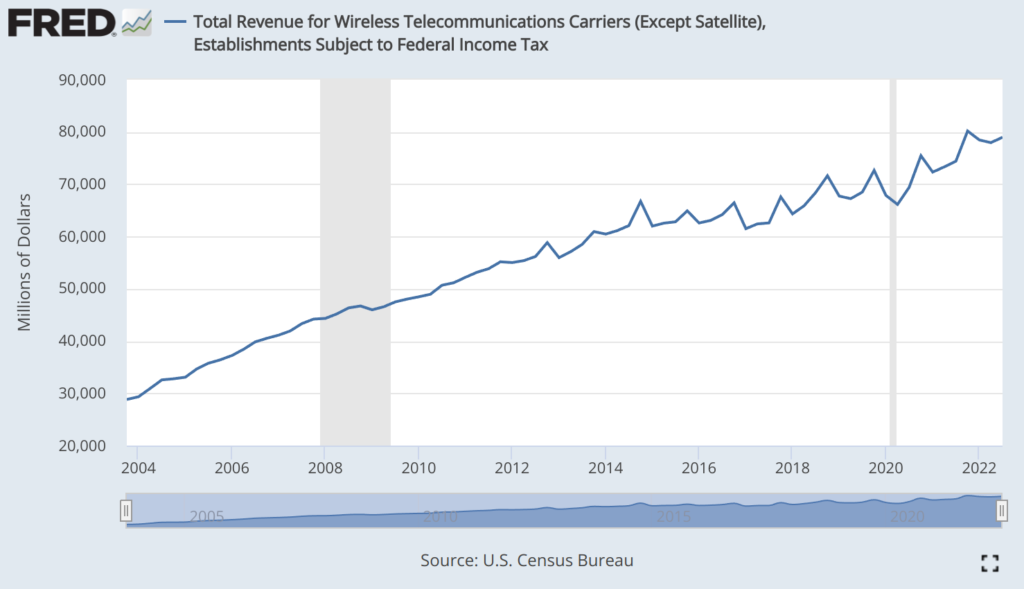

Internet and wireless phone services are regulated utilities that people depend on for nearly all aspects of their lives, from work to relaxation. Almost no one stops subscribing to internet or wireless services during a recession which makes the industry extremely recession-resistant.

8. Energy & Water Utilities

Like internet and wireless services, energy and water services are core utilities that people depend on and are unlikely to consume substantially less of even during a recession.

9. Government Contracting

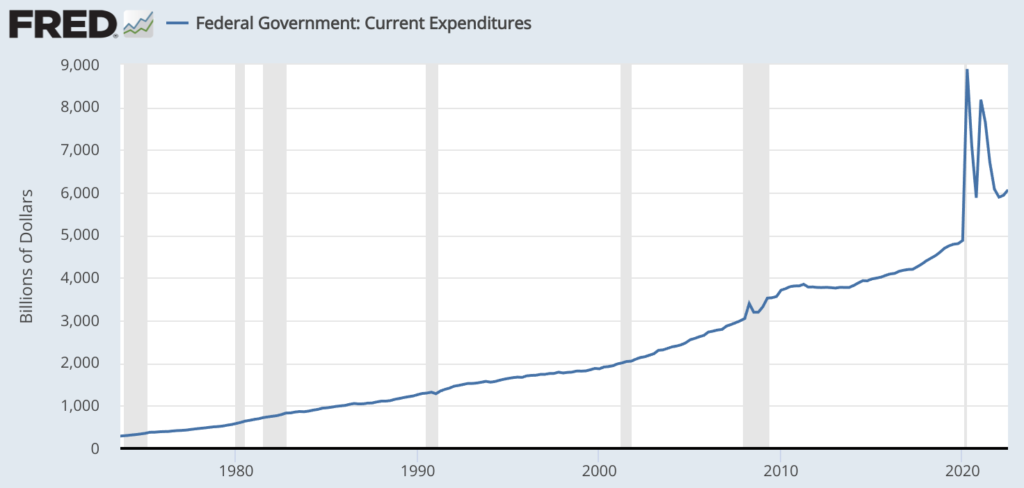

The federal government does not really cut spending during recessions. In fact, often the federal government increases spending during recessions as a form of economic stimulus. That means that federal government contracting is a very recession-resistant piece of the economy.

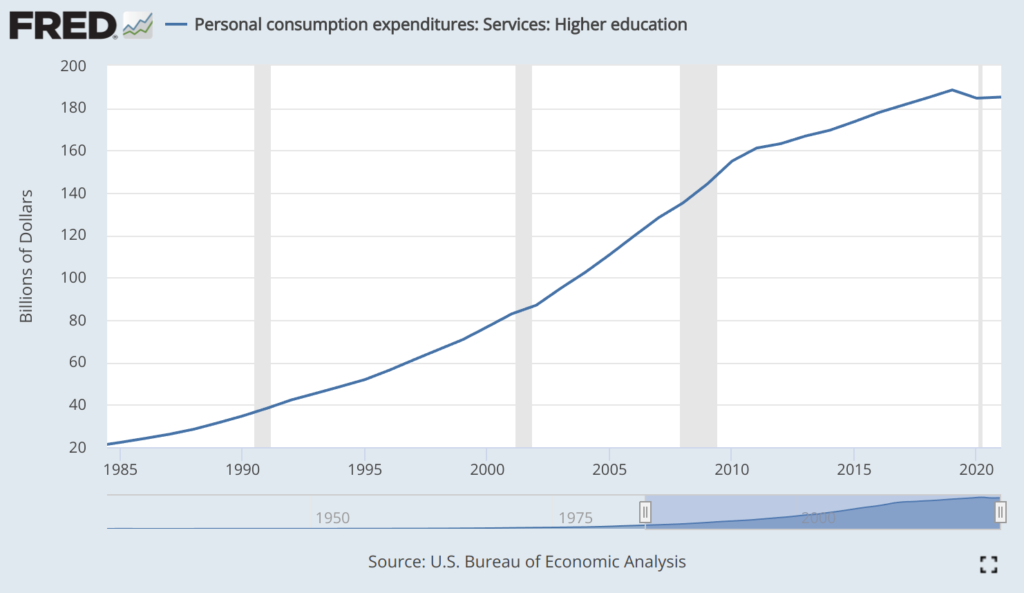

10. Higher Education

During recessions, people still go to grad school. In fact, many young adults who feel like they don’t have great job prospects during recessions choose to go to grad school to avoid blemishing their resume. With the exception of the covid 2020 recession during which lockdowns made attending universities difficult, higher education spending has always continued to grow during recessions.

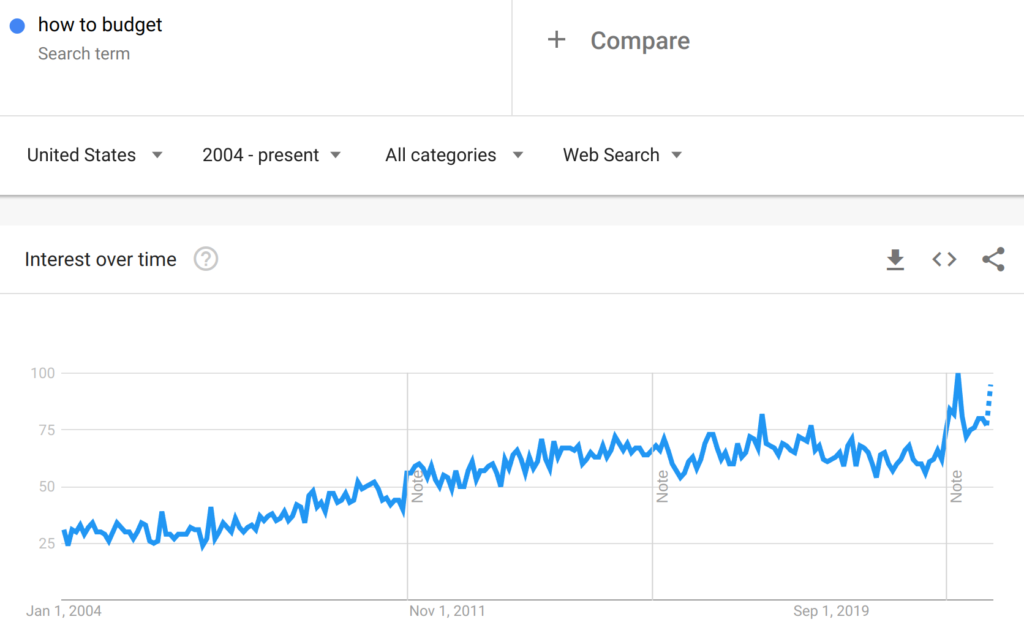

11. Budgeting Tools

Products and services that help people budget increase in demand during recessions. To monetize this demand, you need to ensure you don’t charge too much money for your offering, but if you offer a useful and affordable option, there is opportunity here.

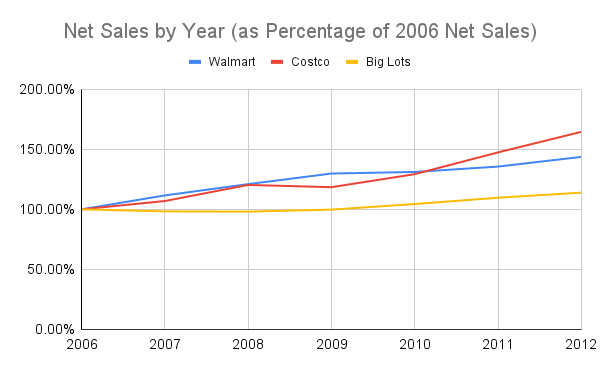

12. Diversified Discount Retail

When times are tough, people still need food, clothing, and other essential items, and they turn to the cheapest stores to buy those items. That means discount retail companies like Walmart and Costco tend to have revenue that is very recession-resistant.

13. Legal Services

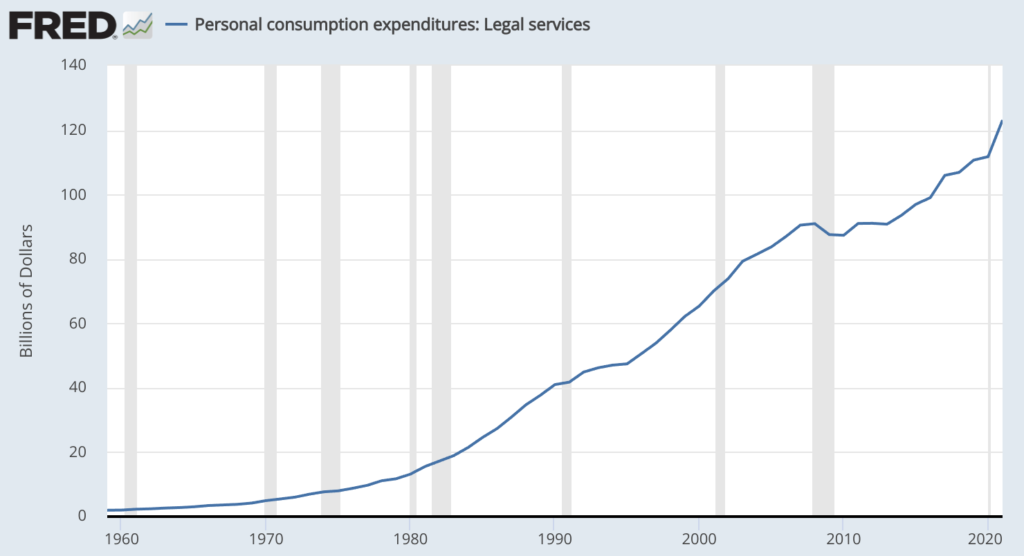

Since 1959, there have been 9 recessions, and only one (2009) saw annual personal consumption expenditures on legal services decrease (and even then, only 4.0% down from 2008 peak to 2010 trough).

During the 1990 recession, the growth rate of spending on legal services slowed notably, but spending on legal services did still grow.

During the 1960, 1970, 1974, 1980, 1982, 2001, and 2020 recessions, personal expenditures on legal services continued to grow at more or less the same rate as pre-recession.