Three years ago, I designed a trading algorithm that predicted market moves based on the propagation of information & sentiment from niche communities in Twitter and Reddit to niche media sites to mainstream media sites. It was relatively accurate. I pity anyone trying to trade on such data today when the truth-to-fiction ratio is at an all-time low.

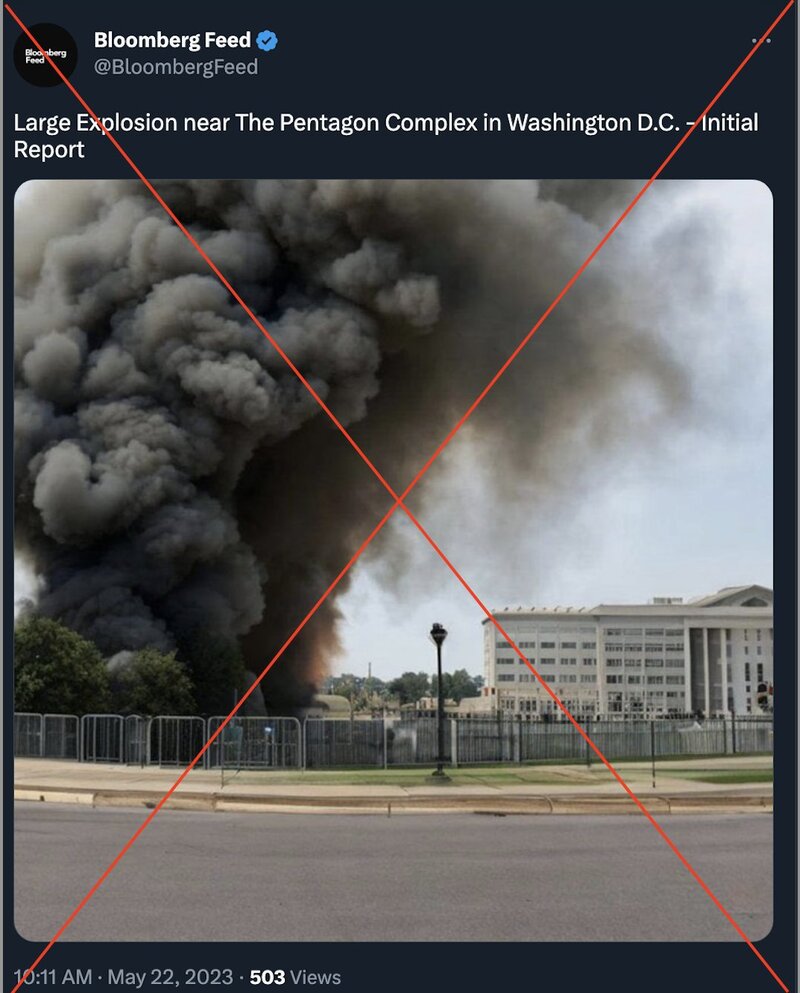

At 10:11 AM Monday morning, a verified Twitter account named “BloombergFeed” posted an image of a smoke plume near the Pentagon along with a message saying that a nearby explosion had been reported. In reality, the account was unaffiliated with Bloomberg, the image was AI generated, and the headline about an explosion was 100% fake.

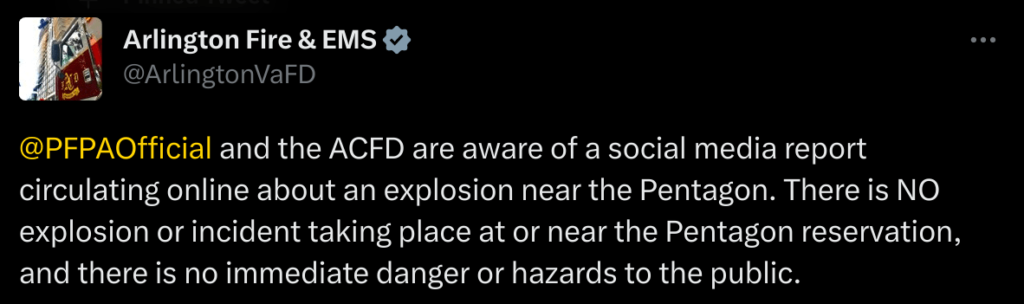

It took about 20 minutes for media & government sources to release statements debunking the story. Arlington Fire & EMS released a statement on Twitter at 10:27 AM.

Unfortunately, the stock market had already reacted to the fake news with the S&P 500 taking a dive. At least, that’s what every large media outlet posted articles claiming.

- NY Times: “An A.I.-Generated Picture Stokes a Stock Market Plunge“

- AP News: “FACT FOCUS: Fake image of Pentagon explosion briefly sends jitters through stock market”

- Barron’s: “An AI-Generated Pentagon Image Caused a Brief Panic in the Stock Market”

- Fox Business: “Image believed to be generated by AI showed fake explosion at Pentagon, sending stock market into brief nosedise“

- Cointelegraph: “AI-generated image of Pentagon explosion causes stock market stutter“

Yesterday, I started researching the timeline of events, including the viral path of the fake image through social media, in order to write my own article on AI market manipulation. But instead, I discovered that all the mainstream media articles I just quoted were actually false. The AP’s “FACT FOCUS” article contained fake news–oh the irony.

The S&P 500 price chart below has 1-minute granularity. The first black dot shows exactly when BloombergFeed tweeted the fake image, and the second dot shows when Arlington Fire & EMS tweeted to debunk the fake image.

The S&P 500 declined from 9:42 AM to 10:10 AM, and then reversed within 1 minute of when BloombergFeed tweeted the fake image at 10:11 AM. Other “distributor” Twitter accounts such as @UKR_Report independently shared the fake image at almost the same moment. Yet immediately afterwards, the S&P 500 did not drop. It rose.

Social media data suggests 10:10-10:11 AM was the temporal epicenter of virality for the fake image, yet that is the same time when the stock market reversed its 28 minute decline into a roughly 20 minute recovery which only started to dip again AFTER the fake image had already been debunked.

That means there is no positive correlation between the viral spread of the fake image and any price decline in the S&P 500. Furthermore, even if the timing of the fake image virality and stock market drop DID line up, the correlation with price would be so insignificant as to be indistinguishable from noise! That’s because the largest intraday swing in the stock market on Monday was about 0.7%. For comparison, during the first 8 months of 2022, 87.3% of all trading days had intraday swings of at least 1%. In other words, the stock market drop being attributed to the fake image is indistinguishable from everyday random stock market fluctuations.

If you are an unashamed capitalist, you can read more articles like this by subscribing to my email newsletter (it’s free!).