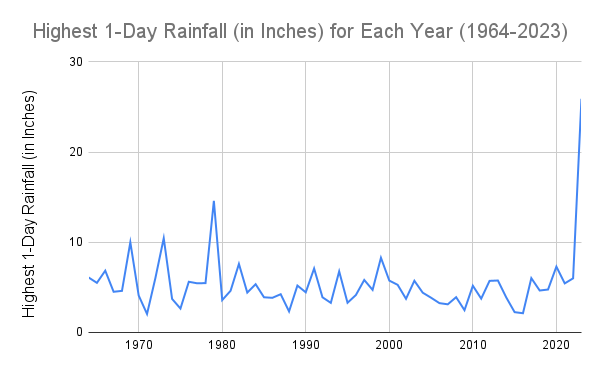

On April 12, 2023, an isolated storm unleashed 25.91 inches of rain on Fort Lauderdale within a single 24-hour period. Runways and aircraft at Fort Lauderdale airport were submerged in several feet of water, and the airport had to shut down for 40 hours, resulting in over 1,000 cancelled flights. Days after the airport reopened, many sections of taxiway were still underwater.

Fort Lauderdale’s flash storm broke multiple records:

- The most rainfall in Fort Lauderdale in a single day (14.59 inches on April 25, 1979)

- The most rainfall for anywhere in Florida in a single day (23.28 inches in Key West on November 11, 1980 during a hurricane)

And this isn’t even the first time that Fort Lauderdale has flooded in the past year. Less than 7 months ago in September 2022, a king tide lifted Fort Lauderdale’s sea level 16 inches higher than predicted, which flooded streets throughout the city.

As someone who has looked at lots of investment properties for sale in Broward County over the last 12 months, these back-to-back floods made me seriously wonder:

Will the frequency and/or severity of floods and other natural disasters eventually make investing in Fort Lauderdale unprofitable?

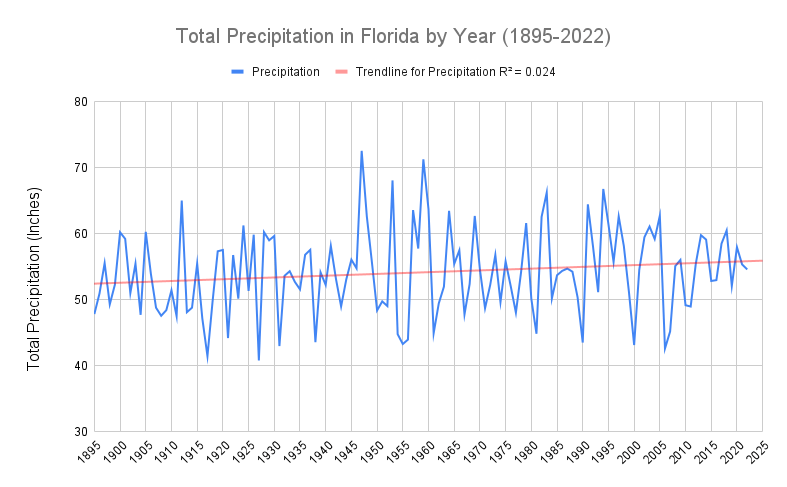

I’m interested in data, not sensationalized climate change claims, so I started by looking at the total amount of precipitation in Florida each year, from 1895 to 2022. Both the data and a trendline for that data are graphed in the chart below.

As you can see, there is a definite upward trend in total rainfall in Florida over the last 127 years. On it’s own, that doesn’t necessarily mean that flooding will become more common. In principle, if the ocean level does not rise significantly, then the government could engineer better water drainage systems to quickly remove large amounts of rainfall. However, it will take time (years if not decades) for the government to fully upgrade those waste water & drainage systems even if they have the money and willpower to do so. In the meantime, flooding will continue to be an increasing risk.

However, the upward trend in rainfall is not occurring in isolation. Historical records also show that the sea level in Broward County has risen by 8-10 inches over the last century. Optimistically, this rate of sea level rise will continue at the same pace. However, NASA satellite measurements from 1993 to 2023 show that the pace of global sea level rise has increased by 30% in 30 years. Pessimistically, the Southeast Florida Regional Climate Change Compact predicts up to 2 feet of sea level rise by 2060 and potentially over 4 feet of sea level rise by 2100.

The GIF below shows a map of Fort Lauderdale with 0, 1, 2, 3, and 4 feet of sea level rise. The blue areas are under ocean water. The green areas are below sea level but are isolated from the ocean. Green areas would be at serious risk of flooding during every storm but wouldn’t necessarily be continuously underwater like the blue areas.

According to a report by the City of Fort Lauderdale, a 2 foot increase in sea level would partially flood every “Regional Activity Center” (a high foot traffic, multi-purpose commercial & residential area) in the city.

Takeaways

- The flood risk in Fort Lauderdale is high and will continue to get higher due to both increasing rainfall and rising sea levels.

- If you DO decide to invest in Fort Lauderdale, buy property that is not in any of the blue or green areas from the “2 feet of sea level rise” scenario from the GIF shown above.

- Fort Lauderdale will need to add sea walls and seriously upgrade its water drainage systems to avoid large portions of the city being either permanently submerged in the ocean or at least subject to severe flooding during storms.

- Even if sea level increases by 4 feet, the city is not doomed. Sea walls and better drainage systems can keep the majority of properties above water. However, if the local government is slow to adopt these changes, real estate investors could be at serious risk. Flood insurance companies will be quick to either price in the higher levels of risk from government inaction OR to withdraw coverage from the area entirely so that investors cannot get insurance except through the state-run Citizens Insurance program (which comes with its own unique risks). Such government inaction would significantly increase the risk-to-reward ratio of Fort Lauderdale real estate investments.

How much is flood insurance in Florida?

Most home insurance policies do not cover flood damage so if you own property in a high flood risk area like Fort Lauderdale, you need to get flood insurance.

Most people who get flood insurance do so through the National Flood Insurance Program (NFIP) which is managed by FEMA and delivered by either one of the 50+ private NFIP insurance providers or by the government-run NFIP Direct. NFIP flood insurance is available to anyone with property in one of the 23,000 participating NFIP communities in high-flood-risk areas.

As of 2023, the average cost of flood insurance in Florida is $655 per year. However, the actual rate will depend on what flood zone you are in.

| Flood Zone | Average Annual Flood Insurance Cost |

| AO | $343 |

| AH | $439 |

| X | $506 |

| A | $674 |

| AE | $757 |

| VE | $1,044 |

| D | $1,273 |

| V | $3,516 |

What is a Special Flood Hazard Area in real estate?

A Special Flood Hazard Area (SFHA) is a high-risk flood area designation used by FEMA and the government-run National Flood Insurance Program (NFIP). Properties in Special Flood Hazard Areas are usually designated as “A” or “V” flood zones. In 2023, the average annual cost of flood insurance in Florida through NFIP was $655, but the average annual cost of the same flood insurance in “V” flood zones was $3,516. That means if you are a real estate investor with property in a Special Flood Hazard Area, you may need to budget several times the normal amount for flood insurance.

What is flood zone X in Florida?

A shaded zone X area is a moderate flood risk area, and an unshaded zone X area is a minimal flood risk area. The average cost of flood insurance in zone X areas is below the overall average cost of flood insurance in Florida.

Is flood insurance required in Florida?

Not everyone who owns property in Florida is required to have flood insurance. However, some property owners are required to have flood insurance.

The federal government requires you to have flood insurance if you both (1) own property in a Special Flood Hazard Area and (2) have a federally backed mortgage on that property.

Additionally, Florida law requires that all homeowners with Citizens insurance must have flood insurance by March 1, 2027. That requirement will be phased in over time until then:

- April 1, 2023: Flood insurance must be purchased for any new Citizens insurance policyholders living in SFHA areas.

- July 1, 2023: Current Citizens policyholders living in SFHA areas will be required to purchase flood insurance.

- March 1, 2024: All Citizens policyholders who have a property value of $600,000 or more must purchase flood insurance (whether or not the property is in an SFHA).

- March 1, 2025: All Citizens policyholders who have a property value of $500,000 or more must purchase flood insurance (whether or not the property is in an SFHA).

- March 1, 2026: All Citizens policyholders who have a property value of $400,000 or more must purchase flood insurance (whether or not the property is in an SFHA).

- March 1, 2027: All Citizens policyholders must have flood insurance.

Is Fort Lauderdale worth investing in?

Both Fort Lauderdale and Hollywood, Florida are at high risk of flooding. That risk of flooding is likely to increase significantly in the future due to both increasing rainfall and increasing sea levels. However, the local government can take steps to reduce those risks by building sea walls and better drainage systems.

Approach Fort Lauderdale like a distressed asset — you need to structure your deals the right way to make sure you can get back at least what you put in. That might mean using high leverage taken out through an LLC or other business entity where the leverage does not require a personal guarantee. It might also mean finding deals on flood insurance or finding ways to increase the cash flow from real estate assets (e.g. by doing assisted living rentals rather than normal rentals) so that your payback period is shorter.

Alternatively, you can just speculate on continued growth of the south Florida real estate market. I don’t suggest this however. Just like AI came “all of a sudden” with tools like ChatGPT, a correction to the south Florida housing market may come “all of a sudden” with a single devastating storm that wipes out both houses and demand for new houses as people realize just how vulnerable the area is to severe flooding.

References

[1] Florida Climate Center: Annual precipitation data by year since 1895

[2] EPA Report: What climate change means for Florida. 2016.

[3] How much and how fast will the sea rise? FortLauderdale.gov

[4] Surging Seas Interactive Risk Map

[5] Fort Lauderdale – Extreme daily rainfall for each year

[6] The City of Fort Lauderdale Climate Vulnerability Assessment

[7] Southeast Florida Regional Compact on Climate Change: Sea Level Rise Data

[9] Florida flood insurance rates

Appendix: Trend in Anomalous Rainfall Events

There does not appear to be a significant trend towards increasing frequency of severe 1-day rainfall events, despite what climate change models suggest. This could be because we are not measuring over a long enough time span, because there are confounding variables, or because the climate models that suggest “freak” storms will increase in frequency are just wrong.