If you run a business and want to hire independent contractors (such as freelancers) to do work for your business, then you’ll need to follow some rules to avoid problems with the IRS. In this article, I’ll cover exactly what you need to do to stay compliant.

1. Collect a form W-9 from the contractor

The very first thing you need to do is collect a form W-9 (or W-8 for non U.S. contractors) from your contractor. You don’t have to send this form to the IRS, but you do have to keep it in your records in case you are ever audited. You’ll also need the information on the form to fill out 1099 forms which you *do* have to share with the IRS.

I have another article explaining exactly how an independent contractor is supposed to fill out form W-9.

EXCEPTION: If pay a contractor less than $600 during the entire year, then you don’t need to worry about any of that. In this case, you don’t have to collect a W-9 and you don’t have to provide a form 1099 to either the IRS or the contractor.

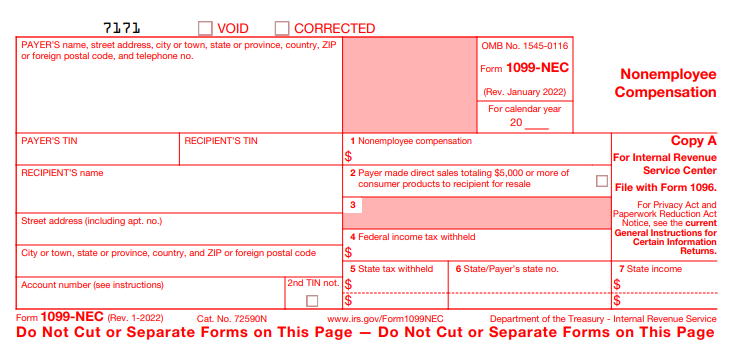

2. File a form 1099-NEC & send a copy to the contractor

Prior to 2020, businesses would use form 1099-MISC to report payments to independent contractors. In 2021 and beyond, businesses must instead use form 1099-NEC.

After the end of each year, you have to file a form 1099-NEC with the IRS by January 31 (or the first business day after that if January 31st is a weekend or federal holiday). You’ll submit the version of the form called “Copy A” (shown above) to the IRS. You’ll also need to send a copy to the independent contractor. This version is called “Copy B”.

EXCEPTION: If the independent contractor is registered as a C corporation or S corporation, then a 1099-NEC is not required. You can find out whether an independent contractor is a C or S corporation by looking at what they entered in section 3 of their form W-9.

NOTE: You can email Copy B of the form 1099-NEC to your contractor, but only if you first get their consent. If you don’t get their consent, you have to (physically) mail it to them.

To obtain consent for email delivery, you have to get their consent via email. According to IRS rules, your email requesting their consent must include the following:

- An affirmation of the fact that, if the recipient does not consent to receiving an electronic copy, they will receive a paper one.

- The scope and duration of their consent. For instance, are they agreeing to receive an electronic copy just this year or every year they work for you?

- Instructions on how to request a paper copy from you (even if they give consent to receive an electronic one).

- Instructions on how to withdraw consent. They may withdraw consent at any time in writing (electronically or on paper).

- The conditions under which 1099-NEC forms would no longer be provided (for instance, if the contractor’s contract is cancelled or if you end up paying them less than $600 for their services).

- Instructions on how they can update their information with you.

- A description of the hardware and software they need to view and print the 1099-NEC form (e.g. a computer capable of running Adobe PDF Reader).

- A date at which the 1099-NEC form will no longer be available. For instance, if you are making it available to download via your company’s website, you must tell them at what point in time the form will be removed from your servers.

3. Comply with state requirements

Every U.S. state has its own requirements. Most states require that you file a copy of 1099-NEC with them as well, but some do not. Additionally, some states impose requirements at the time you hire an independent contractor. This is even true of some states like Florida which doesn’t have any state income tax but still requires an informational filing when you hire an independent contractor (this is a relatively new rule that came into effect only in late 2021).