Texas has no state property tax. However, the Texas Constitution and statutory laws authorize local governments such as cities and counties to set and collect property taxes. Each local government which is authorized to set property taxes is called a “taxing unit”.

As of 2022, there were 4550 distinct taxing units in Texas.

Each taxing unit has a unique 8-digit ID number, but does NOT necessarily have a unique name. For example, there are two taxing units with the name “Valley View ISD”.

| Taxing Unit Number | Taxing Unit Name | Total Tax Rate |

| 049-903-02 | Valley View ISD | 1.0841 |

| 108-916-02 | Valley View ISD | 1.2453 |

Taxing units can correspond to many different types of local governments, including:

- Cities

- Counties

- Independent school districts (ISDs)

- School equalization districts

- Community college districts

- Vocational districts

- Economic development municipal management districts

- Economic development districts (EDDs)

- Hospital districts

- Public utility districts

- Municipal utility districts (MUDs)

- Road utility districts

- County utility districts

- Water authorities

- Watershed authorities

- Water improvement districts

- Water control and improvement districts (WCIDs)

- Fresh water supply districts (FWSDs)

- Water conservation districts (WCDs)

- Groundwater conservation districts

- Drainage districts

- Levee improvement districts (LIDs)

- Emergency services districts (ESDs)

- Navigation districts

- Public improvement districts (PIDs)

Any given property in Texas will typically fall within multiple different taxing units. Each taxing unit can set its own tax rate, but none of these taxing units can specify the property value. Instead, every taxing unit must use the same property value which is determined by the appraisal district which contains the property.

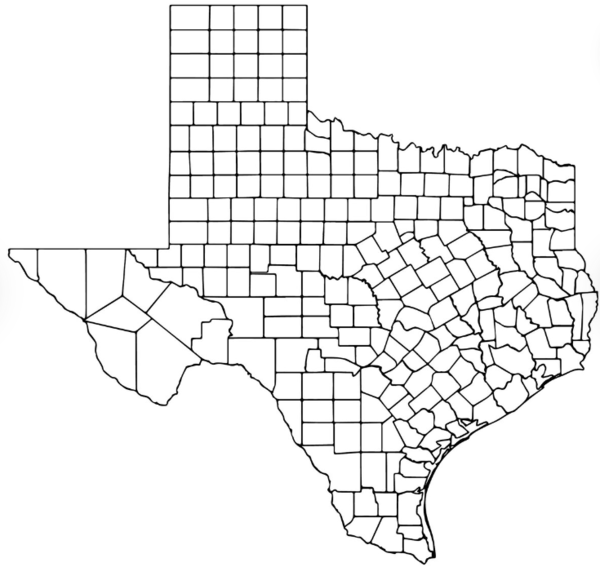

Unlike taxing units, appraisal districts do not overlap. There are a total of 254 appraisal districts in Texas. Each appraisal district has a chief appraiser who is responsible for appraising the value of each property in the district as of January 1st each year. Each appraisal district is governed by a board of directors whose members are elected by the local taxing units subject to the appraisal district’s property valuations.

Appraisal districts also process applications for tax exemptions, special agricultural appraisals, and other tax relief.

If a property owner disagrees with the property value assigned by the appraisal district, then they can appeal to the local appraisal review board (ARB) whose members are local citizens appointed to the board by a local administrative judge.

How High Are Property Taxes in Texas?

Texas ranks among the 5 states with the highest average property tax rates.

The taxing units with the highest total (property) tax rate in Texas are Fort Bend MUD #195 and Fort Bend MUD #198 which both had a total tax rate of 3% in 2022 according to the Texas Comptroller.

How Can Investors Avoid Property Taxes?

There are several strategies that Texas real estate investors can use to reduce their property tax bill, depending on the type of property, the location of the property, how the property was purchased, and what the property is used for. Some of the most useful tax strategies include:

- Historic districts — Many cities and counties offer property tax abatement incentives for properties in designated historic districts. For example, in Austin, if you rehabilitate a “contributing property” in a historic district, investors are eligible for a 10-year, 100% abatement on all city property taxes on the added value of the property that resulted from the rehabilitation.

- Historic landmarks — Some local governments offer tax incentives for investors who own and maintain historic landmarks. For example, the city of Austin, Travis County, and Austin Independent School District offer 100% tax exemptions.

- State and federal historic properties — If you own an income-producing property designated as historic at the federal or state level, you could likely qualify for the Texas Historic Preservation Tax Credit Program and/or the Federal Historic Rehabilitation Tax Credit.

- Agricultural tax break — If you have at least 10 acres (although the exact amount varies by county) of land that has been used for at least 5 of the last 7 years for agricultural purposes (including farming, livestock raising, and beekeeping), then your property is likely eligible for a reduced property valuation for tax purposes.

- Opportunity zones — Opportunity zones don’t affect property taxes, but they do affect capital gains taxes. If you invest in them the right way, you can not only defer capital gains (as you can with a 1031 exchange), but you can actually eliminate your capital gains entirely.

If you’re a real estate investor trying to develop a tax minimization strategy, reach out to me using the form below. I can help you find and structure tax-optimized deals. In fact, I can even help you identify possibilities you probably didn’t know existed, such as using opportunity zones to not only invest in real estate but also software and media businesses. Use the form below to tell me about your situation and what you want to accomplish.

References

[1] Texas Sources of Revenue: A History of State Taxes and Fees 1972-2022

[2] Texas Property Tax System Basics. Texas Comptroller.

[3] Texas Property Tax Rates & Levies Lists by Year. Texas Comptroller.

[4] Texas Property Tax Exemptions. Texas Comptroller.