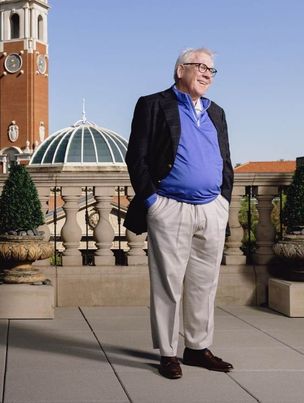

Harlan Crow is a Dallas-based real estate developer who was thrust into the public spotlight after ProPublica uncovered 20 years of previously undisclosed gifts from Harlan to Supreme Court justice Clarence Thomas.

But this article isn’t about that — it’s about how Harlan Crow (and his family) became billionaires in the first place so that they could afford to take private jets to Indonesia and own a private superyacht like this:

Poor Dad, Billionaire Dad

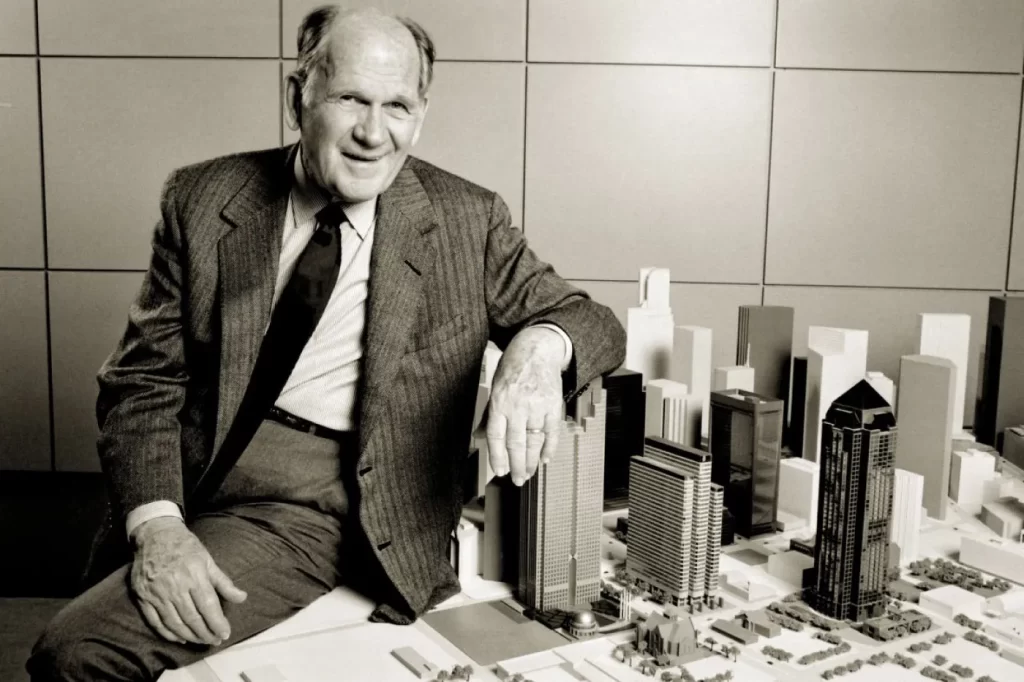

The story starts with Harlan Crow’s father, Fred Trammell Crow, who grew up so poor that he couldn’t go to college after graduating high school, jumped around between different odd jobs and careers until he was 33, and yet eventually controlled more real estate than any other person in America.

Fred Trammell Crow (who just went by his middle name Trammell) graduated high school during the great depression and couldn’t afford to go to college. For years, he worked odd (unglamorous) jobs, from plucking chickens to cleaning bricks to unloading boxcars to delivering messages back and forth between divisions of a bank. Eventually, he saved up enough to attend night school for accounting and several years later, he became a CPA. A couple years after that, he joined the Navy as an auditor at the start of World War 2. Five years later, he left the Navy again struggled to find his footing in business. He worked for a moving company for a brief time and then as a wholesale grain merchant, working for his wife’s family’s business.

When one of the other tenant’s in the grain warehouse needed more space, Trammell was 33 years old and he decided to take a risk. He took out a personal loan to build a warehouse while only having a portion of the building pre-leased. He completed the warehouse in 1948, and successfully leased the remaining portion of it to other tenants. That was the start of his would-be billion dollar career in real estate development.

After that, he was prolific. He started finding and partnering with as many people as he could. By the mid 1950’s, Trammell was the largest warehouse developer in Dallas.

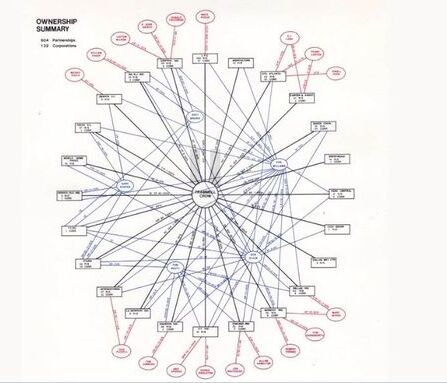

Trammell grew his business by seeking out partners who would provide the land or money that he needed to build. This allowed him to continuously scale his real estate empire without needing to pause to accumulate cash flow from one project to reinvest into the next.

“Genuine partnership is the ideal business form… Sharing the efforts and the fruits, the risks and rewards. When embraced with full and proper spirit, it works magic.”

Fred Trammell Crow

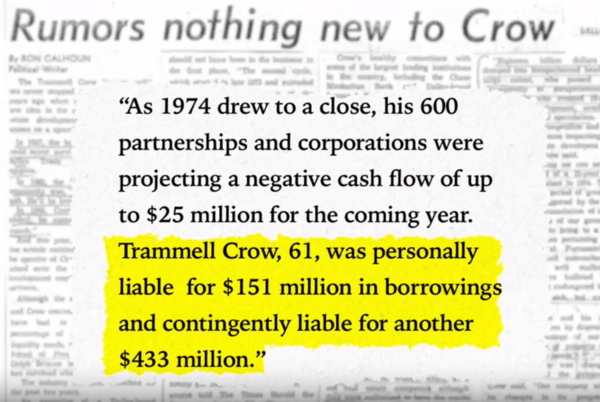

And Trammell embrace the partnering strategy HARD. By 1974, he was personally tied to a web of over 600 partnerships and corporations.

But real estate development has a reputation of being financially risky for a reason. Development is speculative. You guess that if you build something, tenants will come. Sometimes you’re right, sometimes you’re wrong, and sometimes you’re right but you don’t get as much rent as you thought you’d get or it takes longer to find those tenants than you anticipated.

By the end of 1974, Trammell’s real estate empire was cash flowing negative $25 million per year. The real estate market had slowed significantly, interest rates were high, and Trammell’s debt load was huge.

Trammell was forced to sell off some properties, but he continued to develop multiple new projects simultaneously to generate more cash.

In 1977, Trammell reorganized the company, diversified into investment banking and property management, and hired a CEO to replace himself. That helped the company survive and recover from the credit crunch of the mid 1970’s.

In 1984, the comapny completed Dallas’s first post-modern skyscraper: the 50-story Trammell Crow Center. The company had $13 billion of assets (and a lot of debt) and 5,000 employees.

But then another round of problems came as the Southwestern real estate market hit turbulence. Trammell lost many of his commercial real estate partners and the company’s shareholder equity fell from $1.7 billion in 1986 to $1.3 billion in 1988.

By 1991, many more company reorganizations, spin-offs, and mergers had occurred. By 1992, the main company controlled 6,500 properties worth $9 billion. The company was the largest real estate services firm and provided property management, facilities management, construction, development, asset management, brokerage, and leasing/marketing services.

In 1994, Harlan (the son of Trammell who we started this article talking about — the guy who was taking Supreme Court justice Clarence Thomas on luxury vacations) became the majority shareholder of the company.

In 1997, the Trammell Crow Company IPO’d, and its stock had the ticker symbol TCC.

In 2006, TCC was acquired by CBRE Group, a massive real estate and investment conglomerate that is ranked 122nd on the Fortune 500.

Oh, and parallel to all of this, Trammell also founded Wyndham Hotels in 1981, and that also generated a lot of wealth for the Crow family.

Crow Holdings

The Crow family money is now organized into a new structure: Crow Holdings. Harlan previously served as the CEO and now is just the chairman of the company.

The business has two main segments:

- Real estate development (industrial & multifamily only)

- Real estate investment fund management (with a focus on institutional investors)

The company’s real estate funds focus on industrial and multifamily investments. However, the company also pursues a strategy of niche portfolio aggregation. It will curate, buy, and aggregate small assets in a particular niche like convenience and gas stores or manufactured housing. Once it has accumulated a large enough portfolio in that niche, it will sell it to institutional investors.

Business Philosophy

“Mr. Crow changed the landscape of the way the real estate business is done. If you look at all of the people who grew from within his organization and all of the companies they went on to create… It’s a culture that you’ll probably never see again.”

One of the things which worked well for the Trammell Crow Company was its culture. Trammell focused on people. It had an internal university which it used to train its employees, and employees were encouraged to grow professionally and even leave the company if they wanted to. TCC partnered with many real estate companies founded by TCC alumni, and the prospect of participating in that loop was an effective way to attract ambitious talent.

“[I] reported directly to [Trammell Crow] in business for about a year fresh out of college. Accelerated Real Estate 101 on steroids like I never learned in college! … He was quick to make decisions involving dollar amounts above my comprehension at that time. He stressed the importance of always being a ‘man of your word’ and to do business on a handshake… He also made it a point to teach me as we went along. He would always make time for me on a personal level; something I did not abuse but was very appreciative of…[Trammell was] clearly an intense thinker. You could walk into a room and ask him a question and [after] standing there silently [in deep concentration] for about 30 seconds or more, he would look up and answer the question as if no time had passed.”

But Trammell went further. He was eccentric. He was almost hippy in some ways, yet staunchly conservative in his advocacy for taking personal responsibility for one’s life.

At one time, he gave a speech saying that his biggest secret to success was taking complete responsibility for everything in his life:

“Though there are myriads of things which have affected us and have been a part of the cause of our success, one thing stands out in my mind above all… I believe that few persons or companies experience success without knowing and living this matter. The matter is this: Everything that happens to me in my life is my own responsibility–solely and absolutely my own responsibility. I can claim or expect no help from anyone! It’s all up to me! … Now life doesn’t guarantee you everything, no matter how you try, but you’ll only get the best that life has for you when you understand and absolutely observe that it’s all up to you. Let me tell you a secret. Fate is kinder to those who so face life… And people support more those who take the complete responsibility for all and everything in their lives.”

Trammell Crow at the Trammell Crow Company Annual Meeting in 1994

At another time, Trammell gave a speech where he gave a different biggest secret to his success:

“You know what it is? It’s love! It’s the most powerful force in the world, and it will do more for us individually and as a company than anything else we can do.”

So it seems like Trammell really has 3 keys to success:

- Partnership.

- Love.

- Taking complete responsibility for everything that happens to you.

References

[1] Crow Holdings – Detailed Video History of Trammell’s Career

[2] Superyacht Fan: The Michaela Rose

[3] FamilySearch: Fred Trammell Crow (1914-2009)

[4] Texas State Historical Association: Trammell Crow Company