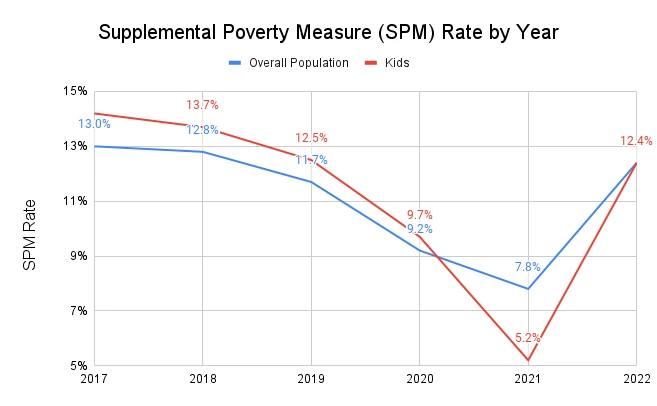

Child poverty in America jumped from 5.2% in 2021 to 12.4% in 2022, as measured by the Supplemental Poverty Measure (SPM).

As you can see from this chart, both overall and child poverty in the U.S. trended down from 2017 to 2021, and there are four big reasons for this:

- In 2017, Republicans passed the Tax Cuts and Jobs Act which doubled the child tax credit from $1,000 to $2,000 per child.

- From 2017 to early 2020, the U.S. unemployment rate dropped by around 20%, AND the labor force participation rate increased at the same time. Wage growth outperformed overall inflation as well, which meant more people took home more money.

- In 2020, the CARES Act and other Covid policies authorized trillions of dollars of government stimulus, from several thousand dollars of stimulus checks given to everyone, to over 10 million PPP loans given to small business owners — loans that were eventually forgiven. Student loan payments were also paused, and many states implemented eviction moratoriums that let some people stop paying rent. At the same time, the Federal Reserve dropped interest rates nearly to zero, which created a financial bubble that helped millions of everyday people make money with stocks and crypto in early 2021.

- In March 2021, Democrats passed the American Rescue Plan which increased the maximum child tax credit from $2,000 to $3,600 per child AND made the credit fully refundable, meaning parents with no income could still claim the full benefit.

Those are the four main reasons why U.S. poverty decreased so much between 2017 and 2021. But why did it shoot back up in 2022? In short, because many of the causes of falling poverty I just mentioned got reversed. From 2021 to 2022:

- Inflation caused the median income to decrease,

- Inflation caused the cost of living (and therefore the poverty threshold) to increase,

- Stimulus programs ended,

- The most popular stocks and cryptocurrencies held by everyday people declined in value by 50% or more (for example, retail investors lost about $700 billion just in Tesla stock value during 2022), and

- The enhanced child tax credit under the American Rescue Plan ended.

In addition, the rate of Hispanic migrant border crossings tripled from the beginning of 2021 to the end of 2022, reaching a record high that is nearly 10 times higher than the number of migrants crossing the border in 2017. The migrants who remain in the U.S. almost always start out in poverty, and they tend to also have large families with lots of kids.

In other words, the expiration of the enhanced child tax credit program is definitely a big reason that child poverty increased, but it is definitely not the only reason. In my estimate, the enhanced child tax credit benefit is likely responsible for less than half of the increase in child poverty from 2021 to 2022.

References

[1] Census Report: Poverty in the United States in 2022

[2] Census Report: Poverty in the United States in 2021

[3] Census Report: The Supplemental Poverty Measure: 2020

[4] Census Research: The Supplemental Poverty Measure 2019

[5] Census Research: The Supplemental Poverty Measure 2018

[6] Census Research: The Supplemental Poverty Measure 2017

[7] Census Research: The Supplemental Poverty Measure 2016

[8] Census Research: The Supplemental Poverty Measure 2015

[9] Census Research: The Supplemental Poverty Measure 2014

[10] Census Research: The Supplemental Poverty Measure 2013

[11] Census Research: Supplemental Poverty Measure: 2012

[13] FRED Real median household income in the U.S.

[14] What are the costs of permanently expanding the CTC and the EITC?