60% of executives expect to replace more full-time employees with independent contractors, according to Mercer’s 2023 global talent trends survey.

The term “gig economy” was coined in 2009 (the same year that both Uber and Freelancer.com were founded), but the trend of replacing W-2 workers with 1099 workers actually predates that by at least 8 years.

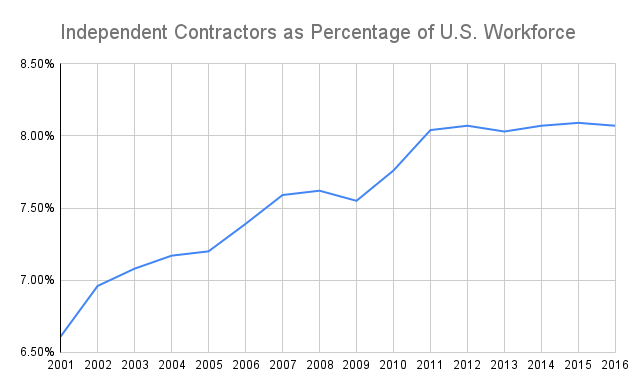

An IRS study found that from 2001 to 2016, independent contractors’ share of the U.S. workforce rose from 6.6 percentage points to 8.1 percentage points (a 22% increase).

That doesn’t include self-employed individuals who operate “true” businesses which have their own employees or over $10k in non-travel deductions.

It also doesn’t include gig workers who misreport their 1099 income (but who, if included, would mean that ICs’ share of the workforce increased roughly 32% instead of 22% from 2001-2016).

Who the IRS study DOES include in the definition of independent contractor are:

- Most travel nurses

- Many cleaners & janitors

- Most tutors

- Most Uber drivers

- Independent medical couriers

- An increasing number of relatively unspecialized backoffice, administrative, and secretarial workers

- Many graphic designers

- Most part-time freelancers who report their 1099 income

- And many others

I even have a friend who was hired as a data scientist for a large utility company in 2021, and she worked in that capacity for over a year as an independent contractor even though her role was essentially the same as the company’s data scientist employees.

Fast forward to 2023. The number of independent contractors is at an all time high, and the trend of replacing W-2 employees with 1099 contractors has been accelerated twice–first by the pandemic and then again by the subsequent economic slow-down which we are still going through.

The software tools and flexible management strategies that companies adopted to enable remote work during the pandemic are exactly the same tools and flexible management strategies needed to work with independent freelancers. And now that the economy is slowing, company executives are thinking about all the costs that come with a W-2 employee that DON’T come with a 1099 freelancer:

- Health insurance

- Dental insurance

- Vision insurance

- Unemployment insurance

- Workers’ compensation insurance

- Payroll taxes

- Paid maternity/paternity leave

- Paid sick leave

- Paid vacation days

- 401k match

- 401k plan administration

- Employee laptop & other equipment

- Employee software subscriptions (e.g. Microsoft 365, Zoom, Slack, Asana)

On top of all the cost savings, contractors can be hired and fired much more elastically than traditional employees, which is very attractive to companies staring at an uncertain economy. And there are several recent studies which support that this trend is not slowing down any time soon:

- In Mercer’s 2022 global talent survey, 60% of executives said they expected more full time workers to be replaced by gig workers.

- A 2022 Forbes survey found that 41% of SMB financial decision-makers were relying more on independent contractors and freelancers than they used to, and that 38% expected to increase their outsourcing in the event of an economic downturn.

- A 2022 MBO Partners survey found that contingent labor (defined as all non-permanent workers, including temp agency workers, internal temp workers, independent contractors, and statement-of-work consultants) constituted 28% of the average large corporation’s workforce. The survey also found that 67% of large corporations expected to increase their use of contingent labor over the next 18 months, and 13% expected to “substantially increase” their use. Interestingly, the survey found that once a company first “tested the waters” of contingent labor, they were much more likely to then double down on the strategy and outsource even more labor.

Business Opportunities Created by This Trend

- Demand for information and recommendations regarding non-employer healthcare and dental insurance will increase over the next several years. That is an opportunity for media companies, content creators, and content marketers.

- Independent contracting comes with personal finance problems that are different from those for people with traditional W-2s. For example, independent contractors will use more IRAs versus 401k’s. That implies growing demand for financial advisers who specialize in helping freelancers, for mortgage brokers who can help people with non-traditional income qualify for mortgages, and for IRA providers (while at the same time, decreasing relative demand for 401k providers).

- Some percentage of freelancers will aspire to build “true” businesses which will increase demand for business formation services, business tax filing services, and other “basic” new business services.

- This trend will degrade traditional worker protections such as paid maternity/paternity leave, paid sick leave, and unemployment insurance. That degradation will eventually (perhaps in 10-20 years) create sufficient political backlash that legislative reform on those topics is enacted.

If you enjoyed this article, subscribe to my free newsletter to get more like it.

Appendix A: The Gig Economy is in Every Sector

- Transportation: Uber, Lyft, Turo

- Delivery & Retail: Grubhub, Instacart, Amazon, Postmates, DoorDash

- Short-Term Housing: Airbnb, VRBO

- Experiences: Airbnb, GetMyBoat

- Media: YouTube

- Education: Cambly, TutorMe

- Home Services: Handy, TaskRabbit, Bark, Angi

- Eldercare: Care.com

- Childcare: Care.com, SitterCity,

- Petcare: Rover, Wag

- Content Creation & Marketing: Fiverr, Upwork, 99designs

- Professional Services: Bark, Lawtrades

- Venture Capital: AngelList

- Construction & Real Estate: These are highly fragmented industries, but they have been independent contractor driven since before the internet became a part of daily life.

Appendix B: 2019 IRS Study

In 2019, an IRS study analyzed labor force trends regarding the relative usage of employees versus independent contractors (ICs) in the U.S. The study attempted to answer the following questions:

- How many people in the U.S. work as independent contractors (excluding self-employed individuals who operate “true” businesses)? This would, for example, include Uber drivers, travel nurses, and lawyers whose only income is derived from 1099 work for a large law firm, but would exclude most doctors, lawyers, and consultants who rent an office space.

- What percentage of the U.S. workforce consists of such independent contractors? And how does that percentage change when we look at the high-income vs low-income ends of the workforce?

- How have those numbers trended over time?

The study distinguishes between two types of Form 1099-MISC/K recipients: (1) individuals and (2) non-sole proprietorship businesses.

Individuals are defined as 1099 recipients whose 1099s are issued to (1) a social security number or (2) a business EIN that is linked to an individual’s Schedule C tax return form. Other 1099 recipients are classified as non-sole proprietorship businesses.

In 2016, 82% of 1099-MISC/K recipients were individuals, according to those definitions.

The study’s “preferred definition of IC” is a 1099 recipient who is (1) an “individual” under the definition above, who (2) filed an individual tax return, (3) is not themselves an employer, and (4) has no more than $10k in annual Schedule C business deductions (in inflation-adjusted 2001 dollars). Notably, if non-filers are counted, then the increase in ICs’ share of the U.S. workforce from 2001 to 2016 would be larger than the increase reported in this study. In that way, the study is conservative.

A few stats from the study:

- The number of people who only received IC income increased from 3.25 million in 2001 to 4.9 million in 2016.

- The number of people who received both IC and W-2 income increased from 6.95 million in 2001 to 8.94 million in 2016.

- The number of people who only received W-2 income (no IC income) increased from 144.30 million in 2001 to 158.08 million in 2016.

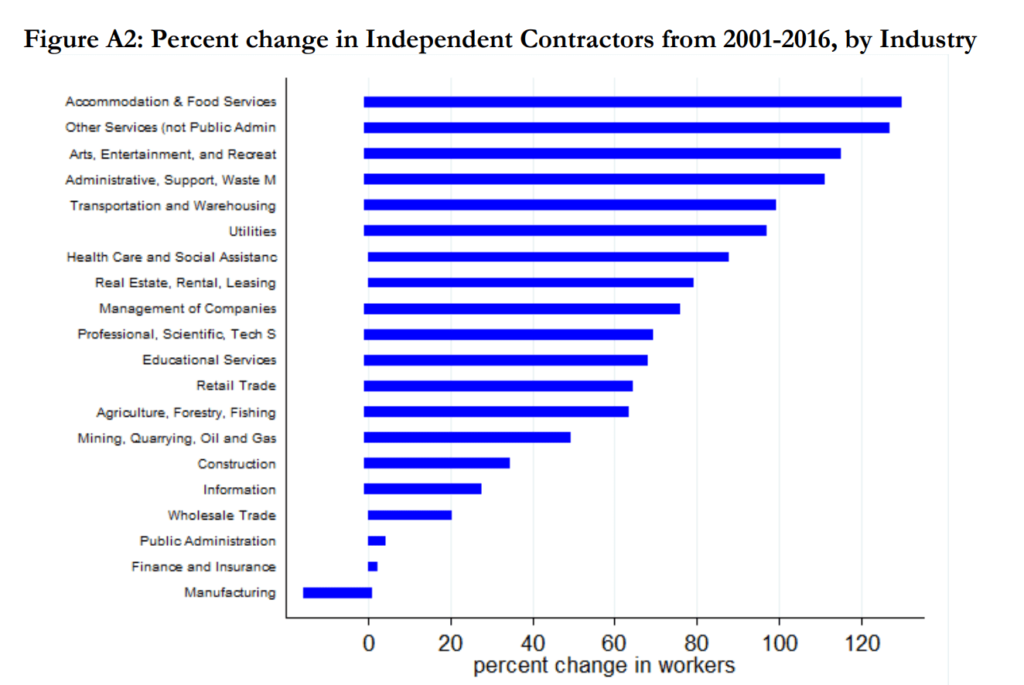

From 2001-2016, there were several industries which saw both an increase in the percentage of firms that hired ICs AND an increase the percentage of workers hired as ICs versus W-2 employees:

- Healthcare and social assistance (NAICS 62)

- Other services (NAICS 81)

- Accommodation and food services (NAICS 72)

- Wholesale trade (NAICS 42)

- Admin, support, waste, and remediation services (NAICS 56)

- Retail trade (NAICS 44)

Appendix C: References

[1] To Cut Costs, Companies Will Hire Contractors Instead of Permanent Employees in 2023. Forbes.

[2] Independent Contractors in the U.S.: New Trends from 15 years of Administrative Tax Data. IRS.

[3] Companies are Contracting Out More Jobs — That’s Not Great for Workers. Ars Technica.

[4] The Evolution of Platform Gig Work, 2012-2021. National Bureau of Economic Research.

- “We find that the number of workers with platform-based gig work payments grew dramatically around the pandemic… with a net increase of 3 million workers (approximately 150% growth).”

[5] 2022-2023 Global Talent Trends Survey. Mercer.

- “Talent attraction and retention are also top of mind for executives… with 50% anticipating that their organization will struggle to meet demand with their current talent model.”

- “In the event of an economic downturn, [57% of] executives would… increase use of AI and automation.”

- “Six in 10 executives [expect] that gig workers will substantially replace full-time employees at their company by 2024 (in Japan, nearly nine in 10 executives make this prediction)…[74% of HR leaders] fear that leadership will have a strong incentive to move remote workers to a freelance model.”

[6] The Legal Industry Enters the Gig Economy Age. ALA Legal Management Magazine.

- “One in seven lawyers said their law firm or legal department planned to outsource more legal matters to attorneys on a contract or project basis in a 2018 [survey].”

- According to another 2018 survey, 58% of law firms currently use part-time lawyers, and 55% employ contract lawyers.

[7] What is a PEO? National Association of Professional Employer Organizations.