Bank balance sheets are filled with lies because the majority of assets on their balance sheet are usually reported at “amortized cost” rather than “fair value”. When interest rates go up, the difference between amortized cost and fair value can grow dramatically. The conversion rate between the balance sheet value of assets and the fair value of assets is usually buried in one or more of the “notes to consolidated financial statements” in a bank’s annual report.

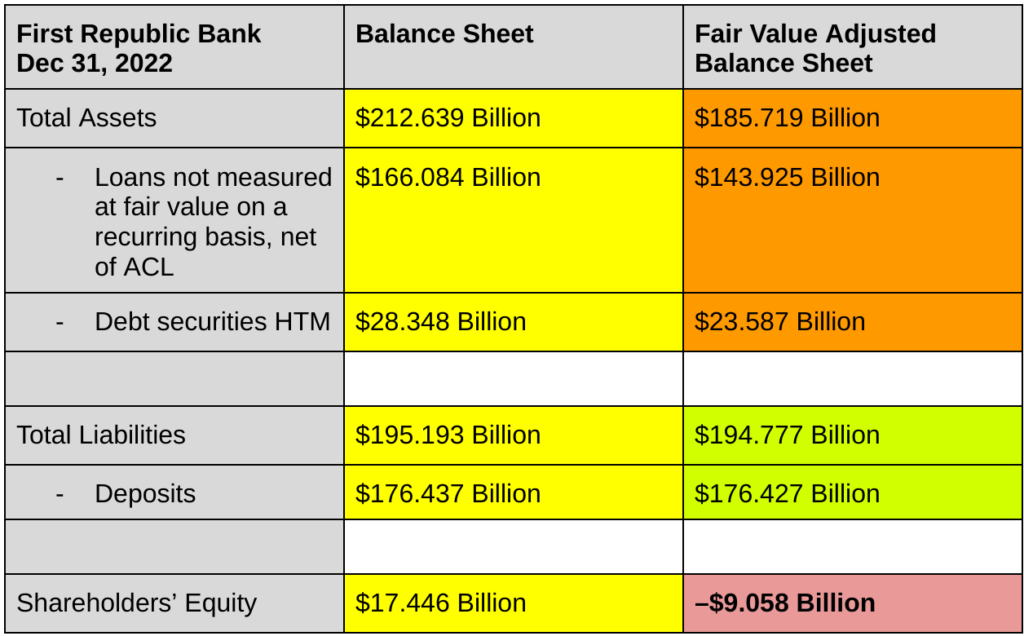

Below is a reconstructed summary of First Republic’s balance sheet, both as originally presented in the company’s 2022 10-K as well as the same balance sheet after revaluing all assets and liabilities at fair value.

See that bottom-right cell in the table? The red one with the negative sign? That’s the gaping hole that appears in First Republic’s balance sheet when you use the bank’s own estimated fair values of their assets and liabilities instead of the made-up accounting values that they report by default.

I’m honestly amazed that the bank has not been shut down yet like Silicon Valley Bank and Signature Bank were last week. At this point, it’s irresponsible for any business to still have more than $250k deposited at First Republic. Also RIP to any investors who are long the stock.