These are the 5 largest companies headquartered in Nebraska, as ranked by total revenue for the 4 quarters ended September 30, 2022.

#1 Berkshire Hathaway ($295.7 Billion)

Berkshire Hathaway (NYSE: BRK.A) is a diversified conglomerate built around a core insurance business that includes Geico as a subsidiary. Berkshire was transformed from a failing textile mill company into the world’s largest conglomerate by Warren Buffett over the course of 57 years. Total revenue over the last 4 quarters was $295.7 billion.

A few impressive stats:

- Berkshire owns about 0.5% of the entire U.S. national debt

- Berkshire owns Geico

- Berkshire owns BNSF, one of the largest freight railroads in North America

- Berkshire owns Dairy Queen

- Berkshire owns the kitchenware company Pampered Chef

- Berkshire owns Fruit of the Loom

| Official Company Name | BERKSHIRE HATHAWAY INC. |

| State of Incorporation | Delaware |

| Headquarters Address | 3555 Farnam Street Omaha, NE 68131 |

| 2021 Annual Report | 10-K |

| Investor Relations Website | Investor Relations |

#2 Union Pacific ($24.4 Billion)

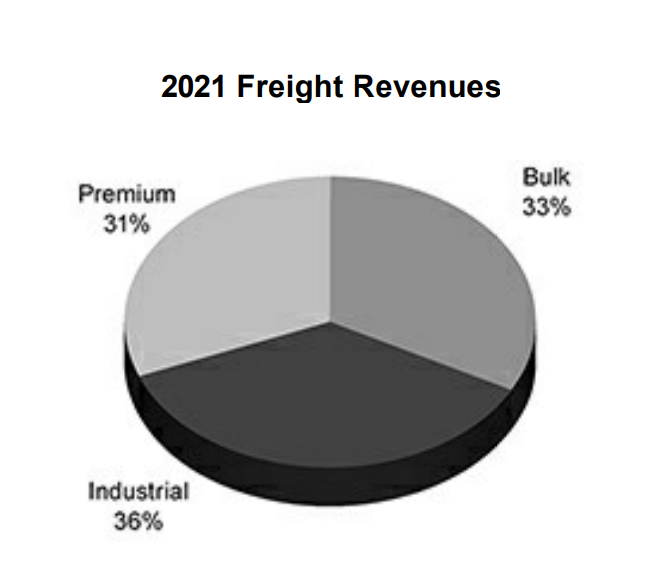

Union Pacific Corporation (NYSE: UNP) is a holding company for the Union Pacific Railroad — one of the largest railroad companies in the U.S. with routes concentrated in the western two thirds of the country. Total revenue was $24.4 billion.

| Official Company Name | UNION PACIFIC CORPORATION |

| State of Incorporation | Utah |

| Headquarters Address | 1400 Douglas Street Omaha, NE 68179 |

| 2021 Annual Report | 10-K |

| Investor Relations Website | Investor Relations |

#3 Kiewit Corporation ($12.5 Billion)

Kiewit is a privately-owned engineering and construction company with industrial, commercial, and infrastructure customers. Total revenue over the last 4 quarters was approximately $12.5 billion.

| Headquarters Address | 1550 Mike Fahey St Omaha, NE 68102 |

| Website | kiewit.com |

#4 Mutual of Omaha Insurance ($11.5 Billion)

Mutual of Omaha is a Fortune 500 mutual insurance and financial services company that owns many subsidiaries with similar names including United of Omaha Life Insurance Company, Omaha Health Insurance Company, Omaha Supplemental Insurance Company, Mutual of Omaha Medicare Advantage Company, Mutual of Omaha Holdings, and others.

Annual revenue is approximately $11.5 billion, although the precise number is not available due to the quirky way its financial accounting is done. For a publicly traded company, majority owned subsidiaries typically have their revenue included in the parent company’s consolidated financial statements. However, Mutual of Omaha does not use GAAP but rather the NAOI SAP (National Association of Insurance Commissioners’ statutory accounting principles).

Under NAOI SAP, there is no consolidated income statement. What we do have though is an income statement for Mutual of Omaha without its subsidiaries (total income of $4.2 billion) and an income statement for one of its largest subsidiaries, United Omaha Life Insurance Company (total income of $6.1 billion). Given the growth in premiums that comes with inflation along with the additional revenue from the other subsidiaries, it seems reasonable that the total consolidated revenue of the company would be at least $11.5-12 billion for the last 4 quarters. That’s consistent with Fortune’s estimate of $11.5 billion in revenue for 2021.

| Headquarters Address | 3300 Mutual of Omaha Plaza Omaha, NE 68175 |

| Website | mutualofomaha.com |

#5 Valmont Industries ($4.2 Billion)

Valmont Industries (NYSE: VMI) offers a diversified portfolio of products to the agriculture and infrastructure industries across the world. Key customers include local and national governments, utility companies, construction companies, farms, and industrial companies.

The company uses four global reporting segments:

- Engineered Support Structures Segment (ESS) — Produces metal and wood poles for road lighting and highway transportation applications. Key customers include construction companies and governments.

- Utility Support Structures Segment (Utility) — Produces concrete and steel hybrid structures used as electrical poles and structures that support power lines. Key customers are electrical utility companies.

- Coatings Segment (Coatings) — Takes unfinished metal products from customers and applies coatings that inhibit corrosion, extend service lives, and enhance aesthetics. Customers of this segment come from a diverse range of industries.

- Irrigation Segment (Irrigation) — Produces mechanical irrigation (water & chemicals) equipment under the “Valley” brand name. Customers are crop growers, sometimes supported by governments.

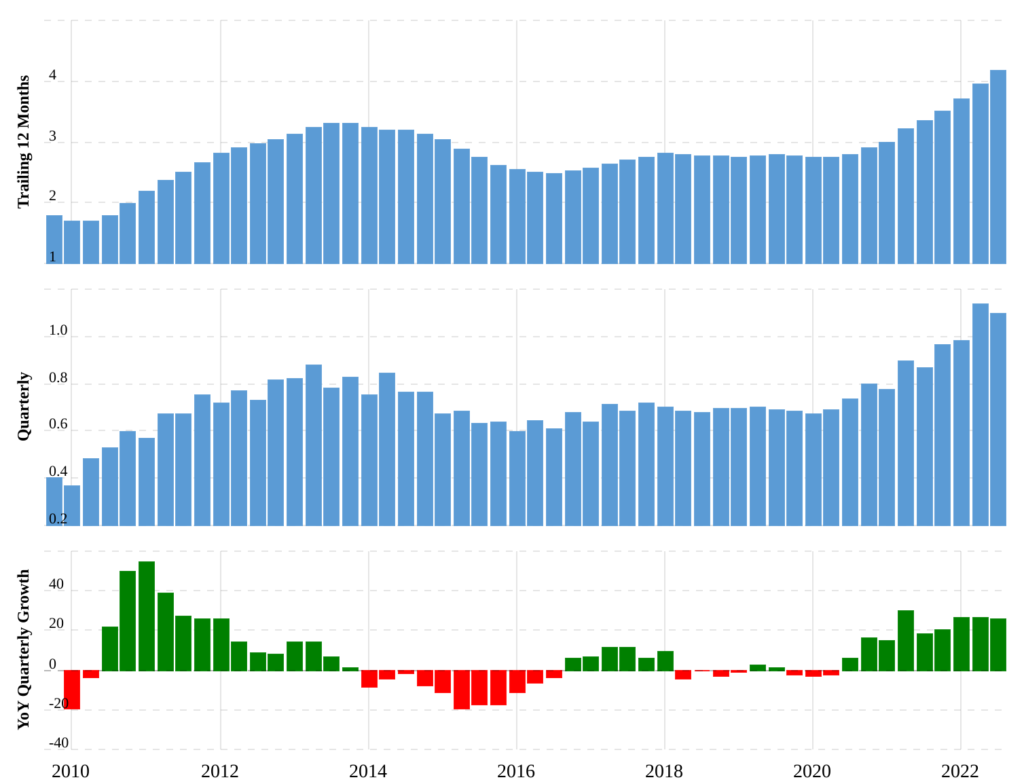

Valmont’s revenue has grown 50% in two years, from $2.781 billion for the 4 quarters ended September 30, 2020 to now $4.177 billion for the 4 quarters ended September 30, 2022. This comes after 5 years of revenue stagnation ($2.748 billion for the 4 quarters ended September 30, 2015) and about 2 years of declining revenue before that ($3.305 billion for 4 quarters ended December 31, 2013).

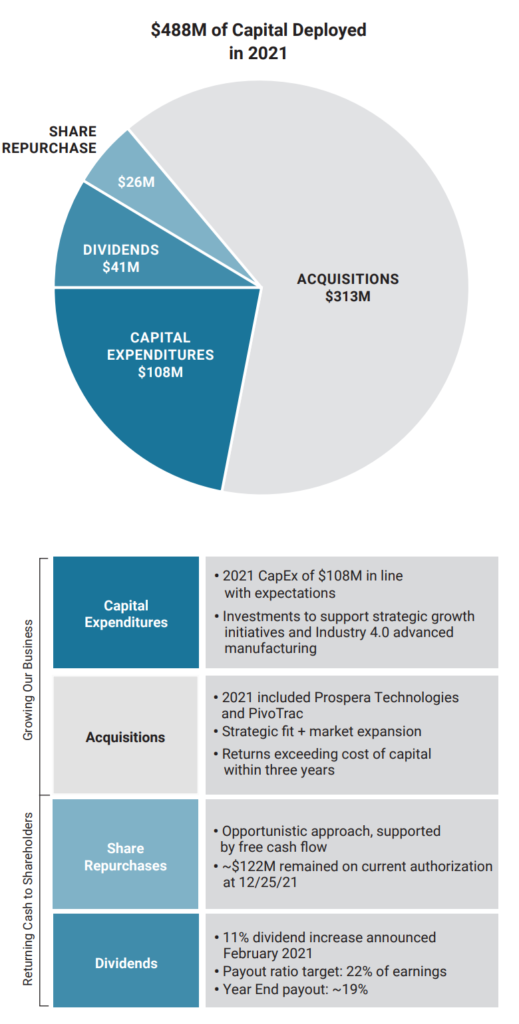

If we look at the company’s capital allocation strategy for 2021, we can start to see what may be driving this high revenue growth: acquisitions.

| Official Company Name | Valmont Industries, Inc. |

| State of Incorporation | Delaware |

| Headquarters Address | 15000 Valmont Plaza Omaha, NE 68154 |

| 2021 Annual Report | 10-K |

| Investor Relations Website | Investor Relations |

Honorable Mentions

TD Ameritrade Holding Corporation is a large company based in Omaha, and it does many billions in revenue each year. However, this list does not consider companies which are majority owned subsidiaries of other companies, and TD Ameritrade is owned by Charles Schwab Corporation which is headquartered in Texas, not Nebraska.

HDR, Inc. is a large, employee-owned engineering, construction, and architecture company headquartered in Omaha with over 11,000 employees globally. However, the company generated only $2.5 billion in 2021 revenue, and hasn’t grown enough in the past 3 quarters to push that number into top 5 territory. This 2020 article is very consistent with that conclusion as it reports $2.5 billion for the total annual revenue in that year as well.