Republicans win both the House and Senate. From market close November 8, 2022 until market close November 8, 2023, the S&P 500 returns at least 5% less than the 80-year average for one-year post-midterm returns. The real (i.e. inflation-adjusted) change in federal spending from 2022 to 2023 is lower than in most post-midterm years.

Axiom Alpha Predictions (Nov 7, 2022)

The 2022 midterm election outcomes will influence many events that investors care about:

- Oil prices

- The probability of future corporate tax hikes

- The probability of future capital gains tax hikes

- Whether or not temporary provisions of the TCJA (Tax Cuts and Jobs Act) get extended or made permanent

- Total federal spending and deficit levels

- The future revenue (and therefore also the stock price) of defense contractors that manufacture the type of weapons currently being sent to Ukraine

- The probability of oil and gas companies getting new government subsidies

- Etc

With that as motivation, let’s make some data-informed predictions about (1) the election outcomes in the House and Senate, (2) how the midterms will affect the stock market, and (3) future legislation that will affect investors.

Which party will control the House of Representatives after 2022 midterms?

On average, the President’s party loses 28 seats in the House and 4 seats in the Senate at midterm elections.

Those are just averages though, and as you can see from the chart above, there have been 3 times since 1934 when the President’s party has actually gained House seats at midterm elections.

However, the data suggests that a large seat loss is much more likely for Democrats. Both statistical polls and election prediction betting markets agree with the historical implication mentioned above that Republicans will control the House after the 2022 midterms.

Current House Composition:

- Democrats: 220

- Republicans: 212

- Third Party: 0

- Vacancies: 3

- Total: 435

Post-midterm House Composition Prediction (Ranges):

- Democrats: 192-217

- Republicans: 218-243

- Third Party: 0-1

Axiom Alpha Final Prediction: There is a more than 80% chance that Republicans will control a majority of House seats after the 2022 midterm elections.

NOTE: Independents or third party members who caucus with Democrats or Republicans are counted as either Democrat or Republican in the breakdowns above.

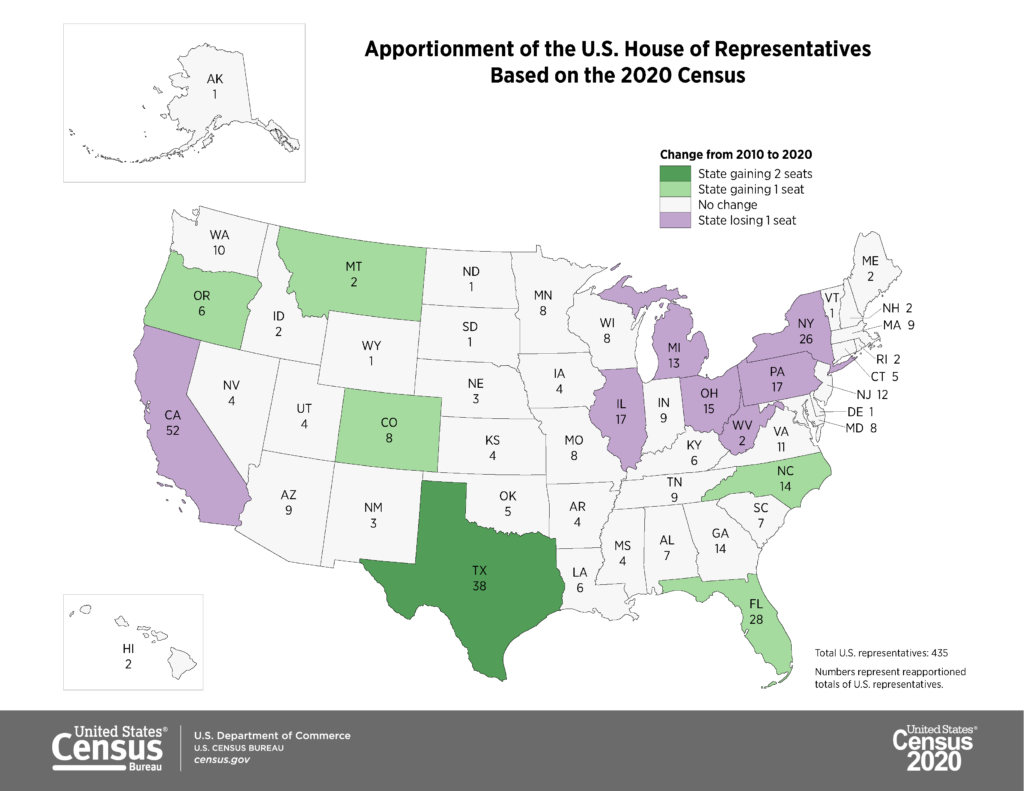

NOTE 2: The 2020 census revealed shifting demographics which removed seats from some historically Democratic states like California, New York, and Michigan, removed seats from some swing states like Ohio and Pennsylvania, and added seats to some historically Republican states like Texas, Florida, and Montana. The map below shows the exact changes to House of Representative seat allocations for each state based on the 2020 census.

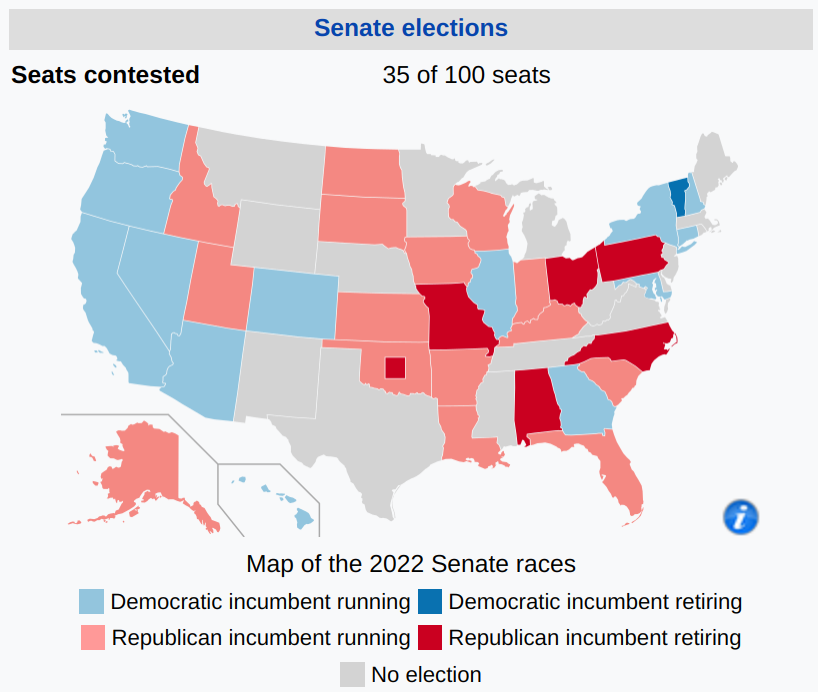

Which party will control the Senate after 2022 midterms?

Currently the Senate’s 100 seats are split 50-50 between Democrats and Republicans. That means the average loss of 4 Senate seats by the President’s party during midterms would place the Republicans firmly in control at 54-46.

However, in several states, the GOP has struggled to find Senate candidates with much centrist appeal. Georgia GOP candidate Herschel Walker, for instance, has been plagued by scandals of hypocrisy and violence including accusations from his own son and ex-wife. And New Hampshire GOP candidate Donald Bolduc has claimed that Trump won the 2020 election, that Bill Gates wants to implant people with microchips, and that the state’s Republican governor is a “Chinese communist sympathizer” — claims that are alienating some swing voters as well as some more traditional, non-Trump-loyal Republicans. Will the number of non-centrist, questionable-character GOP candidates in swing states allow Democrats to retain control of the Senate?

Probably not. There are 6 main battleground Senate races that will determine who ultimately controls the Senate:

- Georgia (probably will require a run-off election)

- Pennsylvania

- Nevada

- Wisconsin

- New Hampshire

- Arizona

Without these seats, Republicans have 48 seats and Democrats 46 seats.

Pennsylvania is leaning red according to the most recent polls. Since Pennsylvania polls are historically slightly biased towards blue, a red edge in the polls most likely means a real red edge (although the margin of error is still large).

Wisconsin also appears to have a slight reddish tinge. That leaves four states which are incredibly close races. Democrats would have to win all 4 just to maintain the 50-50 composition of the current Senate. Anything less and Republicans would have control.

FiveThirtyEight (a poll aggregator and political prediction organization) used three separate models to predict who will control the Senate after midterms:

- The Deluxe forecast (combining polls and human “expert” forecasters) estimates a 59% chance that Republicans control at least 51 Senate seats (a majority) after midterms.

- The Classic forecast (comprised of polls plus other objective indicators without human “experts”) estimates a 51% chance that Republicans will control at least 51 Senate seats.

- The Lite forecast (based purely on poll averaging) estimates only a 50% chance that Republicans will control the Senate.

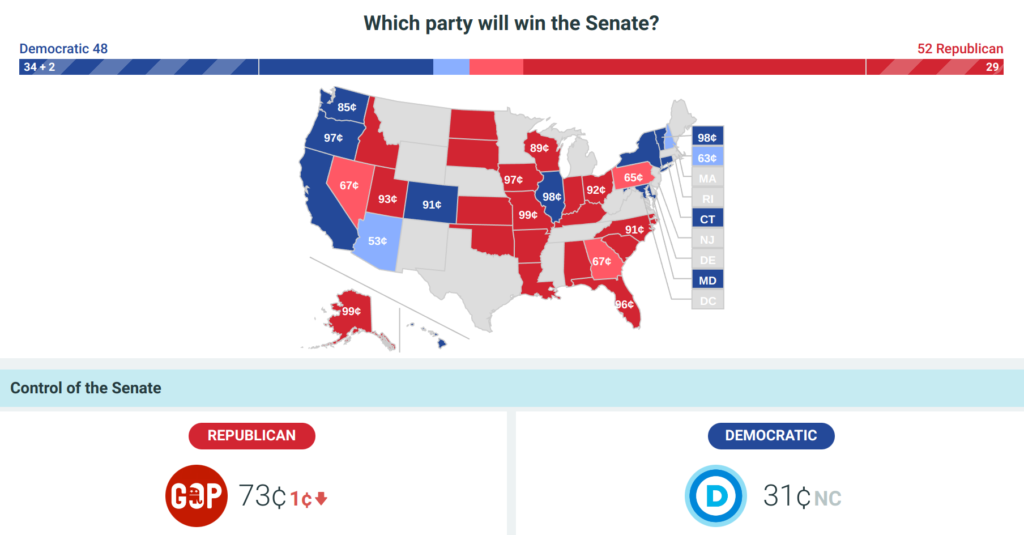

We can also check election prediction betting markets which are historically more accurate than polls. The PredictIt markets are betting that a Republican controlled Senate is more than twice as likely as a Democrat controlled Senate, as shown in the image below.

The 73 cents quantity means that it costs 73 cents to buy a contract that pays out $1 if Republicans win at least 51 Senate seats. The 31 cents means that it costs only 31 cents to buy a contract that pays out $1 if Democrats win at least 50 seats.

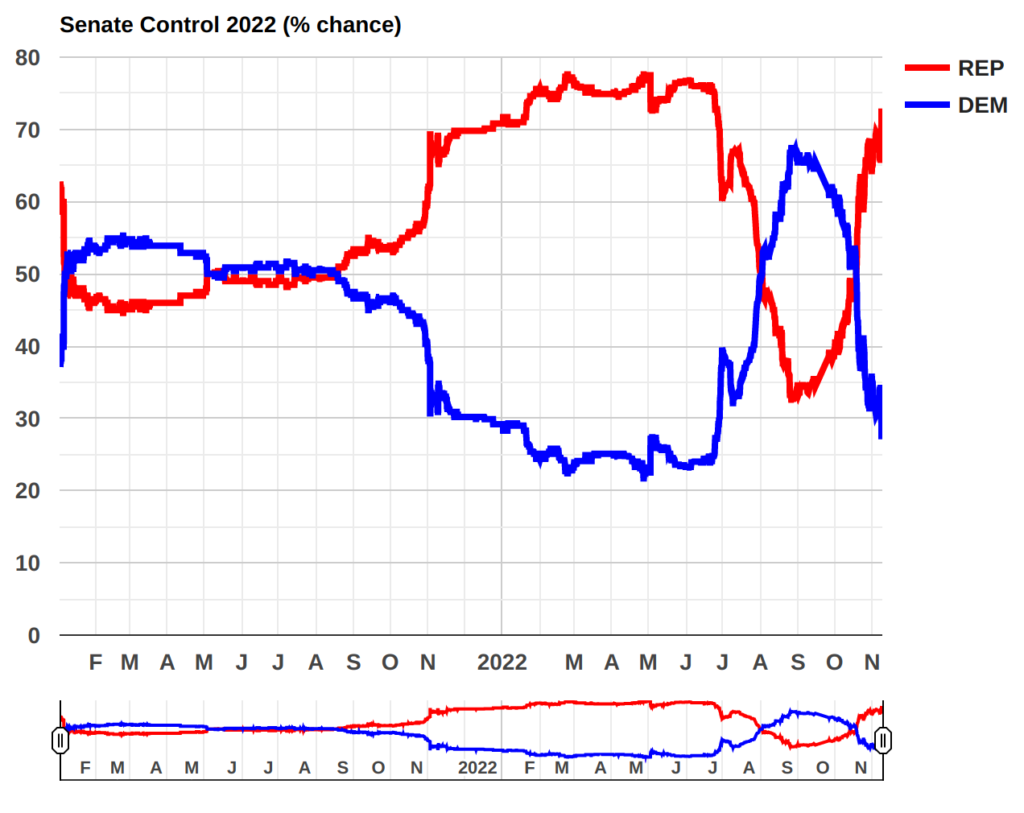

The Iowa Electronic Markets is another exchange for legally betting on the outcome of U.S. elections. Forgive their terrible coloring (red is Democrat and black is Republican) in the price chart below for the “Senate22” market.

There was a low liquidity spike that briefly pushed the Democrat controlled Senate (red line) above the Republican controlled Senate (black line), but overall it’s clear that the market is predicting Republican control.

The betting market aggregation predictor on electionbettingodds.com also predicts that a Republican controlled Senate is more than twice as likely as a Democrat controlled Senate.

Finally, there is a basic fundamental to consider: when the economy is doing poorly (e.g. inflation is high), people are unhappy and tend to vote against the President’s party.

Current Senate Composition:

- Democrats: 50

- Republicans: 50

Post-midterm Senate Composition Prediction (Ranges):

- Democrats: 46-50

- Republicans: 50-54

Axiom Alpha Final Prediction: There is a more than 60% chance that Republicans will control a majority of Senate seats after the 2022 midterm elections.

Will the stock market rally after the midterm elections?

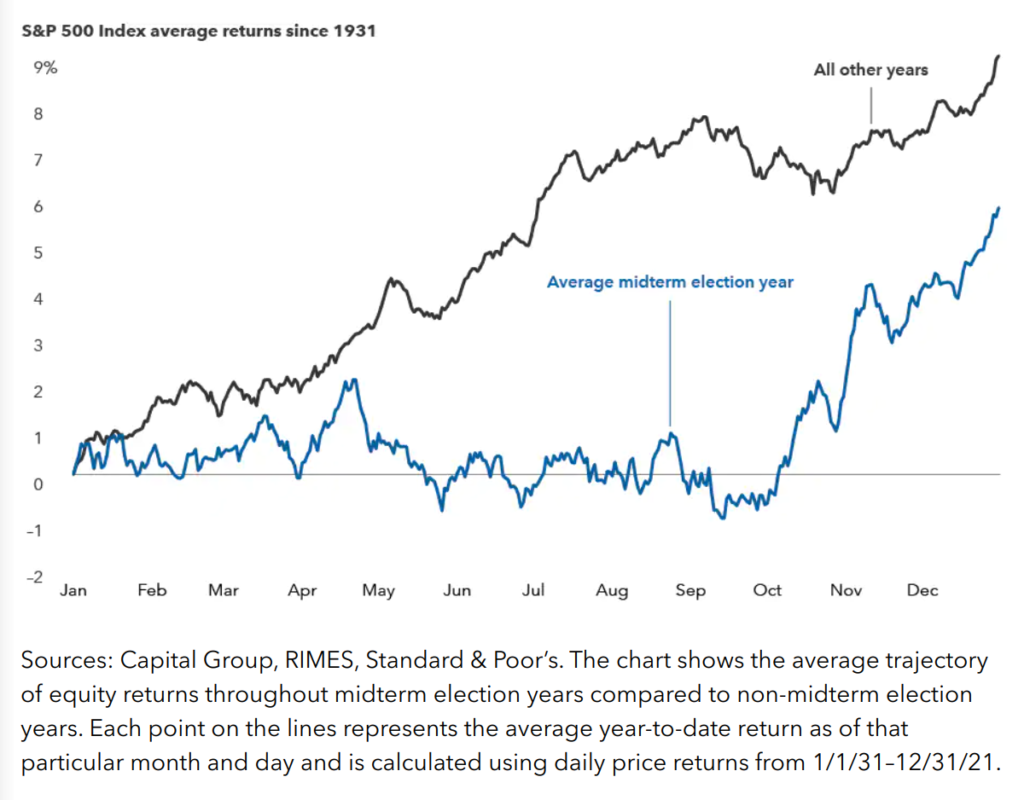

Historically, the average stock market performance from the day of midterm elections until the end of the year has been far above the stock market’s average rate of return (see the chart below).

The average one-year S&P 500 total return after midterm elections is also more than twice the average one-year return of the S&P 500 in other years (15.1% vs 7.1%) from 1950 to 2019.

Before you go load up on S&P index fund shares though, it’s worth considering the dangerous question of whether this time is different.

From 1950-2019, the average one-year return after a midterm election was 15.1% and the median was 13.9%. However, there were 5 times out of 18 when the total return was less than 7%.

One of those times (1978-79) was during an oil & energy crisis when inflation was high — somewhat similar to what is happening today.

Two of those times (2006-07 and 2010-11) were during the Great Recession, a period that some investors think will be similar to where we are headed if the Russia-Ukraine war escalates and/or if the Fed continues to raise interest rates into 2023.

One of those times (2014-15) was during a period when the Fed was attempting to end quantitative easing, bond yields were rising, and globalization was perceived to be at risk — somewhat similar to, but less extreme than, what is happening today.

There is not enough data here to make an exact comparison, but it seems more likely than not that the next 12 months of S&P returns are going to be somewhere in the lower half of the distribution of post-midterm returns.

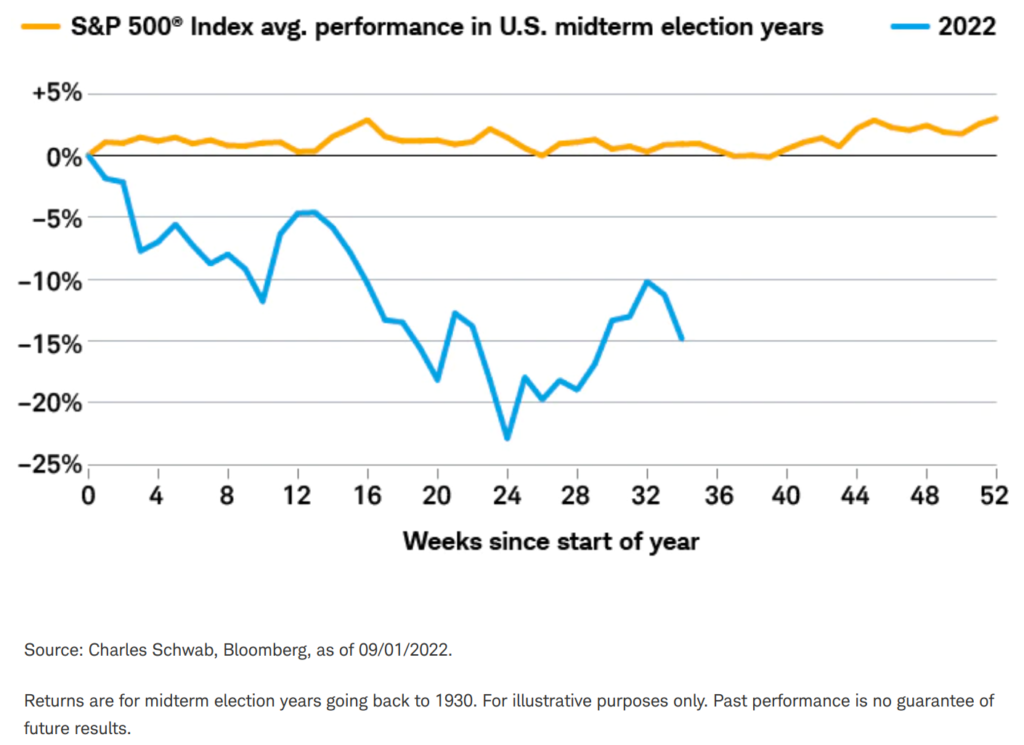

We can also compare the S&P 500’s average performance in U.S. midterm election years with its performance during the first 9 months of 2022:

We see a huge deviation from the average. Given that the variance of midterm year investment returns is larger than the variance of returns in most years, it’s not that unusual for the deviation between any given midterm year and the average of midterm years to be large. However, this is larger than most deviations by quite a bit. This indicates a macroeconomic environment which is much more complex than we’ve seen in most midterm years (war, inflation, rapidly increasing interest rates, pandemic-caused supply chain issues, etc).

Interestingly though, none of the post-midterm year returns since 1950 have been negative — not even the midterm years during the financial crisis or during the oil crisis in the 70’s. That suggests a possible stock market trade: selling put spreads on the S&P 500. For a more in depth analysis of the probabilities and risks of that trade, subscribe to my Axiom Alpha Market Intelligence newsletter where that model will be presented in this week’s issue in much more detail.

What federal legislation should we expect (or not expect) during the next 2 years after the midterm elections?

If our prediction of a Republican-controlled Senate and House are realized, then there are a few likely legislative consequences for investors:

- No increases to the corporate tax rate

- No increases to the individual or capital gains tax rates

- No windfall profits taxes of any kind (on oil companies or otherwise)

- Likely extension of some or all of the TCJA tax changes that are currently scheduled for expiration within the next few years

- No elimination of the 1031 exchange tax loophole

- No “billionaire minimum tax” or wealth tax will be introduced

- New oil and gas industry subsidies may be introduced (the argument will be that it will stimulate new production and therefore help reduce gasoline & energy inflation, even if those inflation types have already come down)

- No future student loan cancellations will occur

None of those are certainties, but it’s my strong guess that a red wave congress would produce all of those consequences, at least until 2024 elections.

Will federal spending be reduced?

Probably not. Not only is inflation high enough to make spending a smaller amount of dollars next year almost impossible for the government, but history shows that even real (i.e. inflation-adjusted) total federal spending increases almost every year.

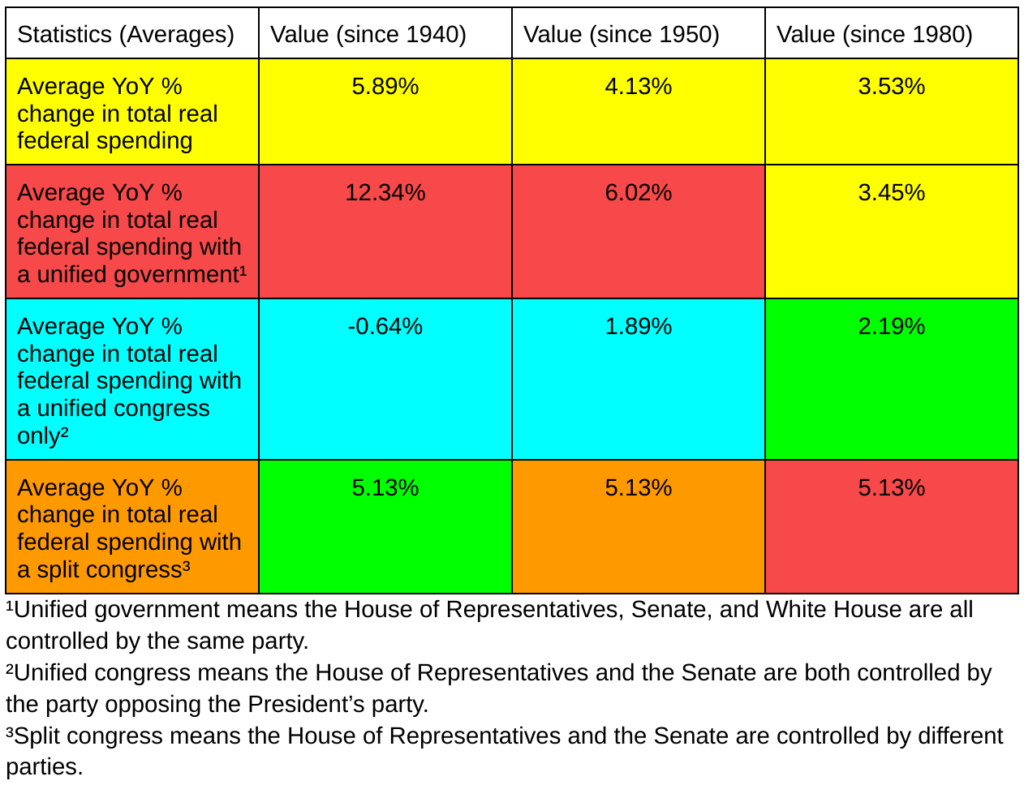

Below is a table showing the average year-on-year (YoY) percent change in real (inflation-adjusted) total federal spending for different government configurations.

The data shows that unified governments (i.e. when the House, Senate, and White House are all controlled by the same party) tend to increase federal spending at a MUCH faster rate than non-unified governments.

The data also shows that governments with a unified congress only (i.e. when the House and Senate are both controlled the party opposing the President’s party) create the SMALLEST average yearly increases in federal spending. That means if Republicans win control of both the Senate and the House this year, we will probably have minimal increases in federal spending in 2023 and 2024. That should help control inflation but may also hurt government contracting businesses.

If we look at medians instead of averages, we see the same patterns (unified governments spend the most, unified congresses spend the least, and split congresses are in the middle).

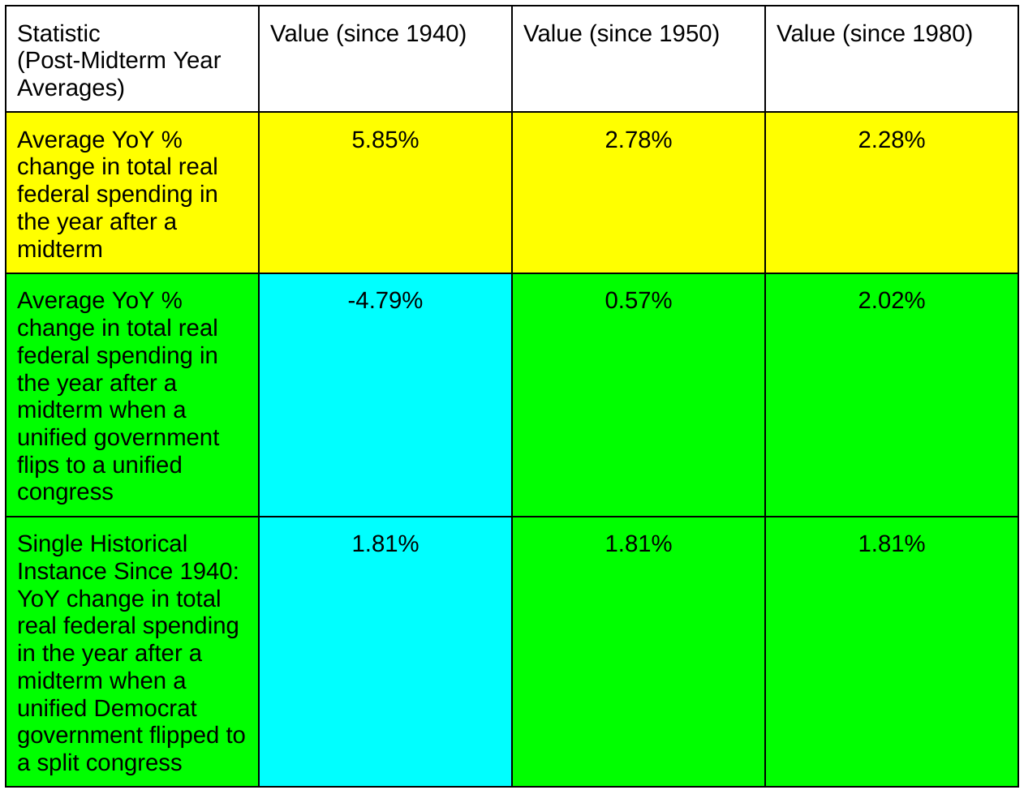

To further confirm our expectations of slower federal spending increases in 2023, let’s look specifically at the average YoY increases of years that immediately followed midterm elections.

As expected, we see a very robust result that in the year following a midterm election, if a unified government flips to a unified congress, federal spending increases at a much slower rate than is typical for years following a midterm election. However, we also see that in the single past instance when a unified Democrat government flipped to a split congress (e.g. like if Republicans only win the House but not the Senate this year), that the spending growth also was much slower than usual.

If we check our results by using medians instead of averages, we again see the same thing:

Axiom Alpha Final Prediction: Real (inflation-adjusted) federal spending will increase slower in 2023 than in a typical year, even a typical year after a midterm. (Note: The slow growth in federal spending supports our earlier hypothesis that the next year will see lower than typical post-midterm stock market performance.)

If you want to read more articles like this, subscribe to my free email newsletter the Axiom Alpha Letter where I talk about money and business from first principles. And if you’re a sophisticated investor interested in more specific & detailed investment strategies, subscribe to my Axiom Alpha Market Intelligence newsletter. It’s one email per month, jam-packed with value, so you don’t have to worry about wasting any time.